Corrective Waves

Key Takeaway: Corrective waves are three-wave patterns, or combinations of three-wave patterns, that move in the opposite direction of the trend of one larger degree. Corrections exist to separate rank-and-file trend followers from their money. And while there are more variations than with impulse waves, corrections too are patterned.

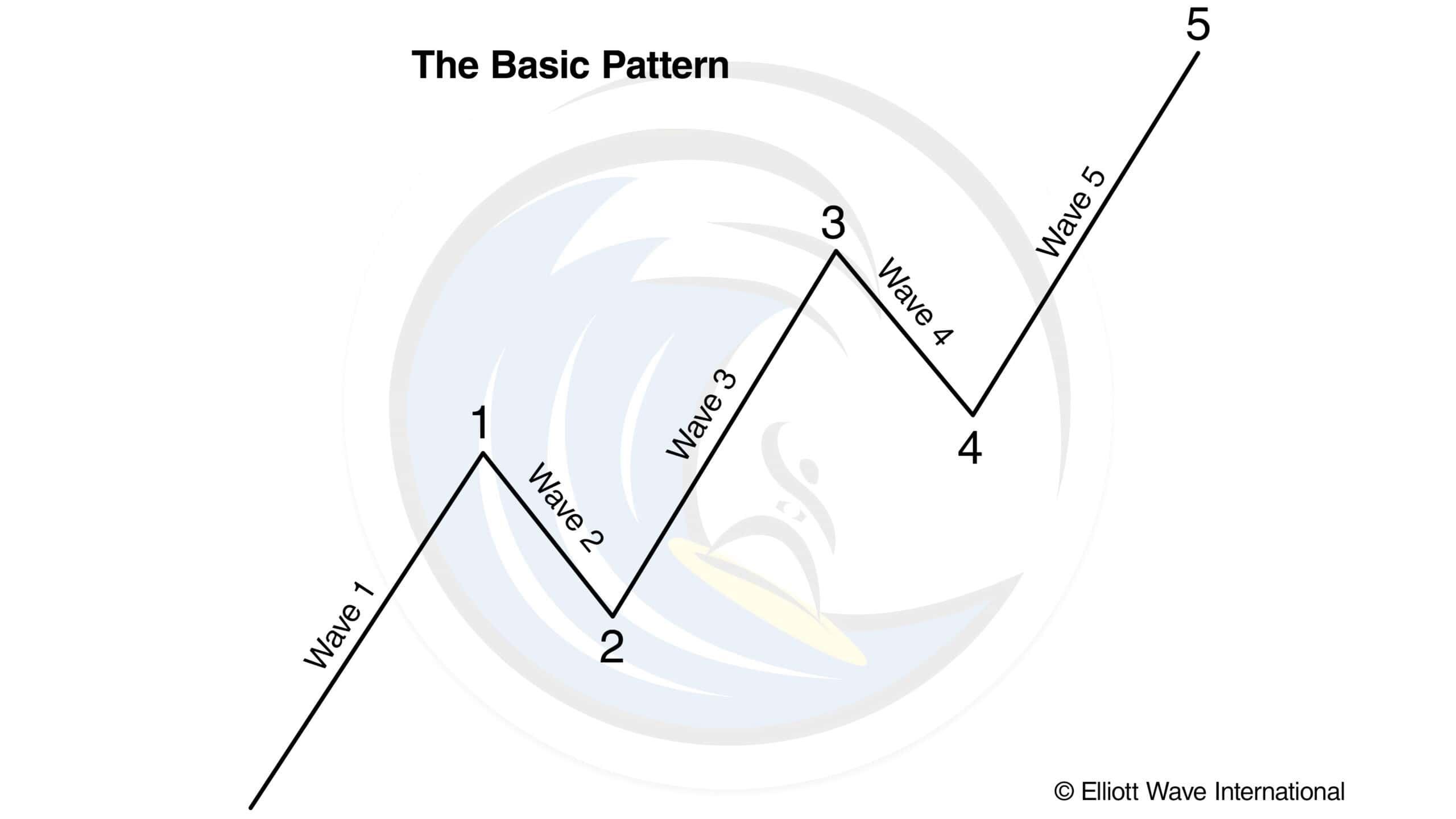

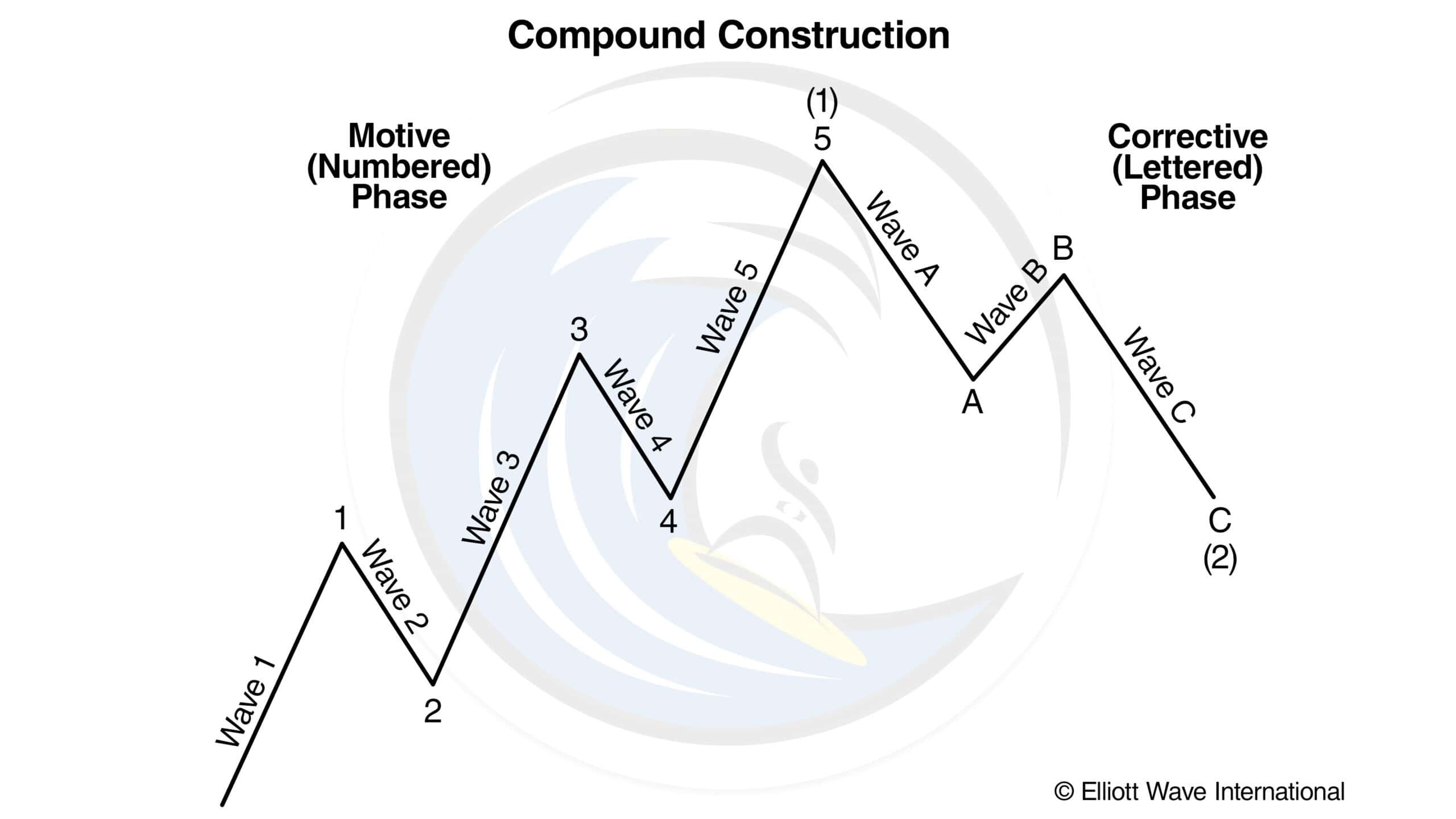

There are two modes of wave development: motive and corrective. Motive waves have a five-wave structure, while corrective waves have a three-wave structure or a variation thereof. Motive mode is employed by both the five-wave pattern of Figure 1 and its same-directional components, i.e., waves 1, 3 and 5. Their structures are called “motive” because they powerfully impel the market. Corrective mode is employed by all countertrend interruptions, which include waves 2 and 4 in Figure 1. Their structures are called “corrective” because each one appears as a response to the preceding motive wave yet accomplishes only a partial retracement, or “correction,” of the progress it achieved.

One complete cycle consisting of eight waves, then, is made up of two distinct phases, the five-wave motive phase (also called a “five”), whose subwaves are denoted by numbers, and the three-wave corrective phase (also called a “three”), whose subwaves are denoted by letters. Just as wave 2 corrects wave 1 in Figure 1, the sequence A, B, C corrects the sequence 1, 2, 3, 4, 5 in Figure 2.

Characteristics of Corrective Waves

Markets move against the trend of one greater degree only with a seeming struggle. Resistance from the larger trend appears to prevent a correction from developing a full motive structure. This struggle between the two oppositely-trending degrees generally makes corrective waves less clearly identifiable than motive waves, which always flow with comparative ease in the direction of the one larger trend. As another result of this conflict between trends, corrective waves are quite a bit more varied than motive waves. Further, they occasionally increase or decrease in complexity as they unfold so that what are technically subwaves of the same degree can by their complexity or time length appear to be of different degree. For all these reasons, it can be difficult at times to fit corrective waves into recognizable patterns until they are completed and behind us. As the terminations of corrective waves are less predictable than those for motive waves, you must exercise more patience and flexibility in your analysis when the market is in a meandering corrective mood than when prices are in a persistent motive trend.

The single most important rule that can be gleaned from a study of the various corrective patterns is that corrections are never fives. Only motive waves are fives. For this reason, an initial five-wave movement against the larger trend is never the end of a correction, only part of it.

Styles of Corrective Waves

Corrective processes come in two styles. Sharp corrections angle steeply against the larger trend. Sideways corrections, while always producing a net retracement of the preceding wave, typically contain a movement that carries back to or beyond its starting level, thus producing an overall sideways appearance.

Categories of Corrective Waves

Specific corrective patterns fall into three main categories:

Zigzag (5-3-5; includes three types: single, double and triple);

Flat (3-3-5; includes three types: regular, expanded and running);

Triangle (3-3-3-3-3; three types: contracting, barrier and expanding; and one variation: running).

A combination of the above forms comes in two types: double three and triple three.

“So wait… I can really learn to predict the markets?”

Yes. Markets aren’t rational. For every action, there isn’t always an equal and opposite reaction.

What drives prices isn’t logic, but emotion. Market emotions unfold in predictable patterns called Elliott waves. That’s what makes prices predictable.

What you just read is from the Wall Street bestseller, “Elliott Wave Principle: Key to Market Behavior.” For 40+ years, it’s been a top-shelf book on unbiased market analysis.

Amazon reviewers call it “classic and essential” and “the bible of the theory.” Now, you can get instant, FREE access to the full online version of this book ($29 value).