Combinations

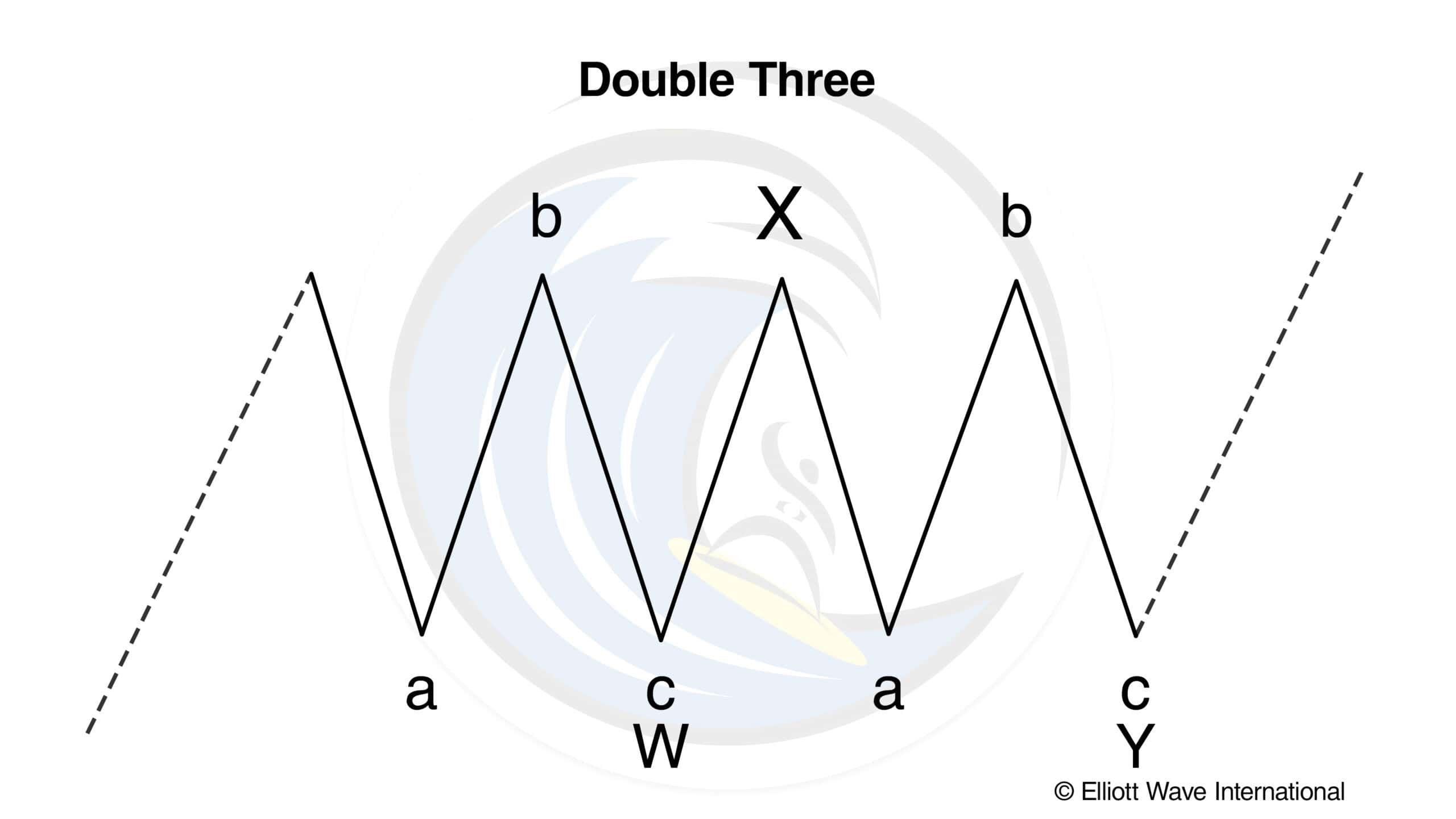

Key Takeaway: Sideways combinations of corrective patterns are called “double threes.”

Elliott called a sideways combination of two corrective patterns a “double three.” While a single three is any zigzag or flat, a triangle is an allowable final component of such combinations and in this context is called a “three.” A combination, then, is composed of simpler types of corrections, including zigzags, flats and triangles. Their occurrence appears to be the flat correction’s way of extending sideways action. As with double zigzags, the simple corrective pattern components are labeled W and Y. Each reactionary wave, labeled X, can take the shape of any corrective pattern but is most commonly a zigzag.

Combinations of threes were labeled differently by Elliott at different times, although the illustrative pattern always took the shape of two juxtaposed flats, as shown in Figure 1.

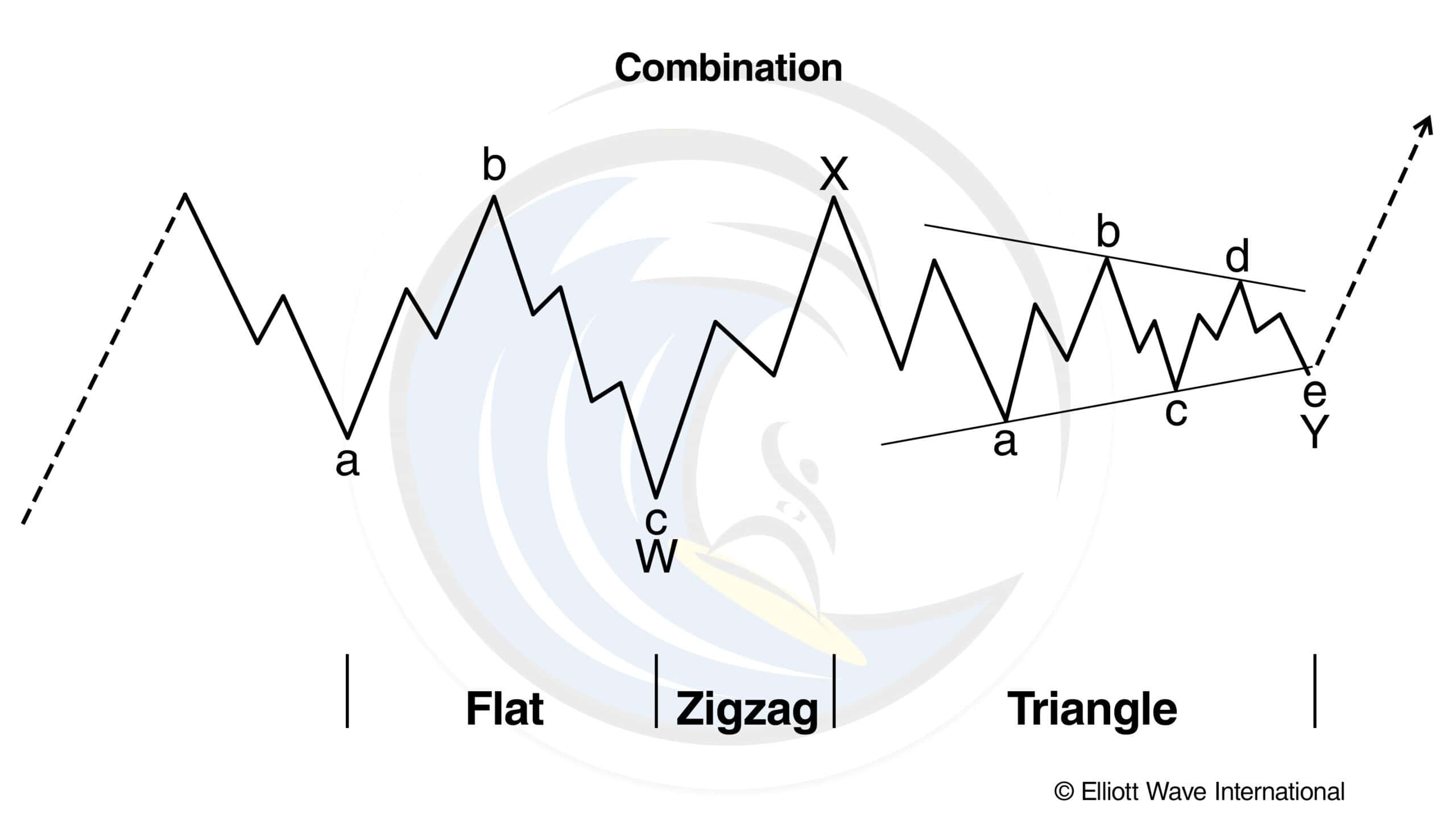

However, the component patterns more commonly alternate in form. For example, a flat followed by a triangle is a more typical type of double three, as illustrated in Figure 2.

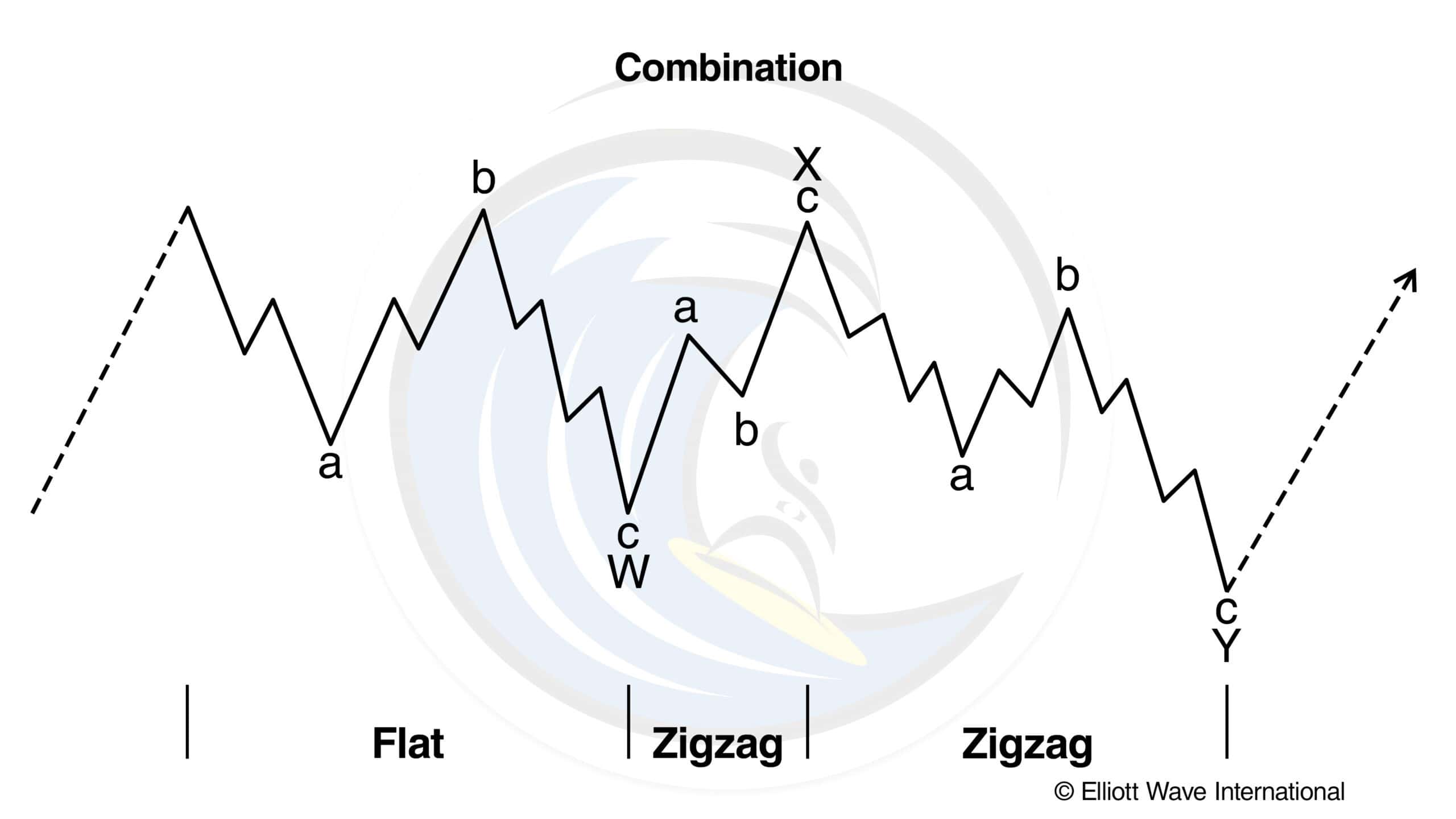

A flat followed by a zigzag is another example, as shown in Figure 3. Naturally, since the figures in this section depict corrections in bull markets, they need only be inverted to observe them as upward corrections in bear markets.

Editor Note: Elliott’s writings include a description of triple threes, which may exist only in theory. In considering tens of thousands of labeled patterns over the years, the authors can only remember one such pattern that could not be labeled in a simpler fashion.

Characteristics of Combinations

For the most part, a combination is horizontal in character. Elliott indicated that the entire formation could slant against the larger trend, although we have never found this to be the case. One reason is that there never appears to be more than one zigzag in a combination. Neither is there more than one triangle. Recall that triangles occurring alone precede the final movement of a larger trend.

Although different in that their angle of trend is sharper than the sideways trend of combinations (see the guideline of alternation), double and triple zigzags can be characterized as non-horizontal combinations, as Elliott seemed to suggest in Nature’s Law. But double threes are different from double and triple zigzags not only in their angle but in their goal. In a double or triple zigzag, the first zigzag is rarely large enough to constitute an adequate price correction of the preceding wave. The doubling or tripling of the initial form is usually necessary to create an adequately sized price retracement. In a combination, however, the first simple pattern often constitutes an adequate price correction. The doubling appears to occur mainly to extend the duration of the corrective process after price targets have been substantially met. Sometimes additional time is needed to reach a channel line or achieve a stronger kinship with the other correction in an impulse. As the consolidation continues, the attendant psychology and fundamentals extend their trends accordingly.

As this section makes clear, there is a qualitative difference between the series 3 + 4 + 4 + 4, etc., and the series 5 + 4 + 4 + 4, etc. Notice that while an impulse wave has a total count of 5, with extensions leading to 9 or 13 waves, and so on, a corrective wave has a count of 3, with combinations leading to 7 or 11 waves, and so on. Thus, if an internal count is unclear, you can sometimes reach a reasonable conclusion merely by counting waves. A count of 9, 13 or 17 with few overlaps, for instance, is likely motive, while a count of 7, 11 or 15 with numerous overlaps is likely corrective. The main exceptions are diagonals of both types, which are hybrids of motive and corrective forces.

“So wait… I can really learn to predict the markets?”

Yes. Markets aren’t rational. For every action, there isn’t always an equal and opposite reaction.

What drives prices isn’t logic, but emotion. Market emotions unfold in predictable patterns called Elliott waves. That’s what makes prices predictable.

What you just read is from the Wall Street bestseller, “Elliott Wave Principle: Key to Market Behavior.” For 40+ years, it’s been a top-shelf book on unbiased market analysis.

Amazon reviewers call it “classic and essential” and “the bible of the theory.” Now, you can get instant, FREE access to the full online version of this book ($29 value).