Promotional Videos & Articles

Browse our latest promotional videos & articles.

-

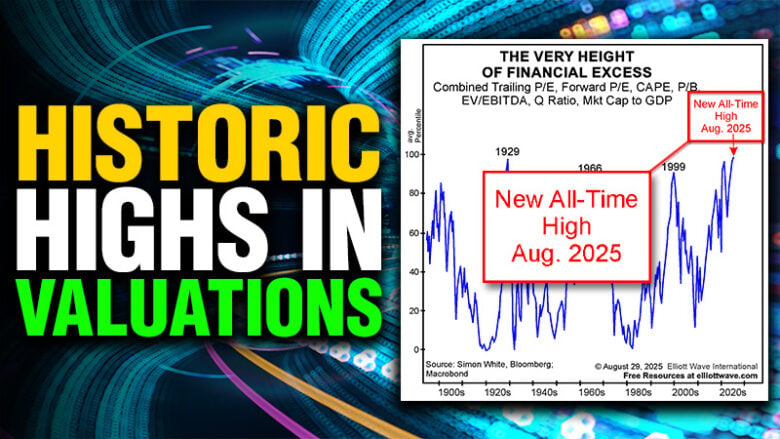

This Chart Should Give Bulls a Fright

The CAPE ratio for U.S. stocks is near its highest level in history — second only to the 2000 peak. History suggests that when optimism runs this hot, markets rarely escape unscathed.

-

Skinny or Bust! The New Body “Ideal” Leaves Few Alternatives

Beauty standards have returned to ultra-thin-only. The November Socionomist is a “shot in the arm” to understanding why.

-

Auto Loan Delinquencies Hit Record Highs—Are Consumers Maxed Out?

Auto loan delinquencies have hit record highs, a worrying sign that consumers are stretched thin and the broader economy may feel the strain.

-

China’s Market Fix Could Spell Trouble

China is loosening market rules after a massive rally, a move that often comes late in a trend. With stocks surging and record leverage, could the Shanghai Composite be in trouble?

-

When Banks Merge, It’s Usually Too Late

Bank mergers don’t signal strength — they reveal strain. See what’s really driving consolidation and how to prepare before the next credit crunch hits.

-

Investors Go ‘All In’ — But History Says That’s Risky

Everyone’s all in — the pros, the institutions, even retail traders. Stock allocations are the highest in years, rivaling levels last seen before major market tops. Here’s why this kind of optimism can be dangerous.

-

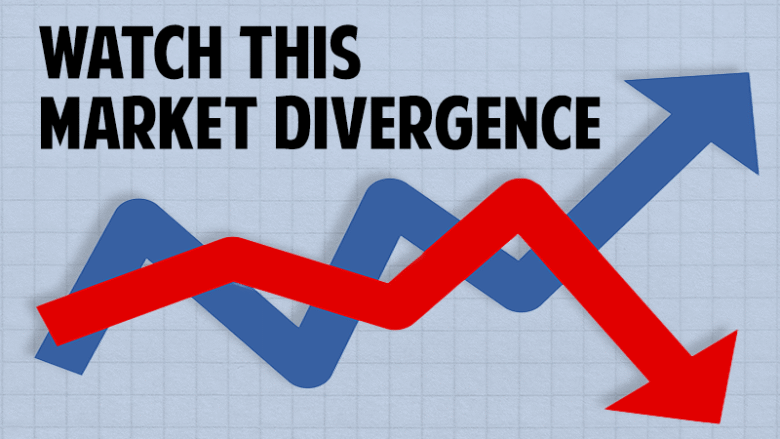

Major Dow Theory Signal Remains in Play

A key Dow Theory non-confirmation is still active. This pattern deserves close attention.

-

When (Beyond) Meat Goes Bad

Remember 2019, when Beyond Meat IPO’d at $25 and then soared almost tenfold to $239.71—making it the biggest IPO gainer of the year? Our Elliott Wave Financial Forecast flagged that exuberance early…

-

The Fed Follows the Market – AGAIN

Why Are We Paying These Guys? When it comes to interest rates, the Fed is NOT in control. The Fed does not lead; it follows the market. Need proof? Check […]

-

Foreign Investment in U.S. Equities Hits a Record

Foreign investment in U.S. equities just hit a record $163 billion. History shows that foreign investors tend to arrive late in a bull market – so what might this signal about the market’s trend ahead?

-

Bond Vigilantes Are Back: What Rising Yields Mean

Yields are climbing across global bond markets. The move could have big implications for stocks and the economy.

-

Are Job Numbers Hinting at a Looming Recession?

Non-farm payrolls are slowing, layoffs are rising and building permits are falling. These trends suggest economic troubles may be building behind the scenes.

-

Valuations Are at Record Highs

Valuations have reached historic extremes, led by tech. Could euphoria be setting in?

-

Debunking the Reigning Theory of Stock Market Pricing

Contrary to widespread belief, exogenous cause is absent from the stock market. Here’s our take on the dominant theory of stock market pricing.