Promotional Videos & Articles

Browse our latest promotional videos & articles.

How the EWAVES Engine Nailed the S&P 500 in 2025

EWAVES has been nailing the S&P 500 this year (2025), calling the Feb top and then the April bottom. Elliott Prechter, creator of EWAVES, explains how the engine was built and how it scans thousands of markets to spot high-confidence Elliott wave patterns.

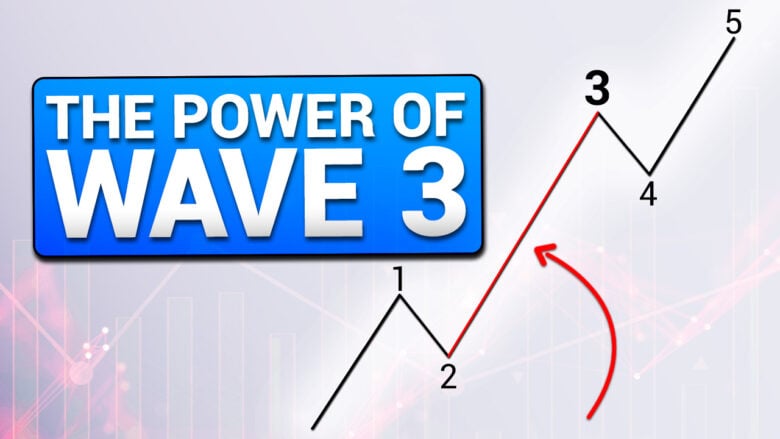

Third Waves Are the Ones You Want to Catch

Of the five waves in an Elliott impulse, the 3rd wave is the one you want to catch. And you definitely don’t want to be on the wrong side of one. Here’s why.

“Wedding of the Century” Where’s My Invitation?

Bezos’ Wedding: New, Borrowed, Blue and… Lampooned!

Deadly Drones: Add to Cart

Deadly drones are becoming easily available, and affordable. Welcome to “belligerence-on-the-cheap.”

One Man’s Trash is Another Man’s Art

What does art made of old trash and debris have to do with a recession? Possibly, a lot!

The “Rules of War” Have Been Rewritten

The “rules of war” have been rewritten. Military might meets “belligerence-on-the-cheap.” The new, July Socionomist explains WHY!

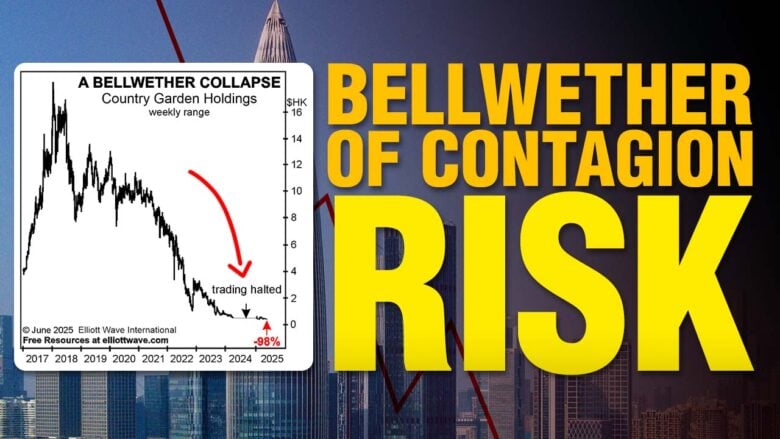

That Can’t Happen Here — Can It?

The world’s second largest economy appears to be on shaky ground. Let’s focus on China’s real estate sector and our analysis of a “bellwether of contagion risk.”

The “No Kings” Protests are Right on Schedule

Mass protests, increasing polarization, fear, anger, xenophobia, and on! Social mood makes sense of the current state of unrest.

Musical (Fed) Chairs

Who will be the new Fed chair? Names are already being floated in the nation’s capital. But does it matter who heads the Fed as far as the trend of interest rates goes? You might be surprised.

Increasingly Authoritarian—and Anti-authoritarian—Impulses

The White House deployment of the National Guard to intervene in L.A. protests has shocked many. But we see it as a powerful sign of negative social mood.

Debt Ceiling Drama

Borrowing and more borrowing. That’s the story of the U.S. government. And, now, Congress wants to raise the “debt ceiling” – again. Here’s what you need to know.

You CAN Survive a Recession – You may Even THRIVE

The mainstream view of the future of the U.S. economy is short on hope. But we see many opportunities to thrive.

Is U.S. Government Debt Risk Free? (Video)

Has U.S. government debt really stopped being “risk-free”? EWI’s Murray Gunn explains why he “doesn’t rule anything out.”

Fundamentals Lag Stocks

Stocks move ahead of fundamentals, which is why Europe’s major defense stock have exploded upward over the past 4 years. EWI’s Brian Whitmer asks, “So … why do pundits say these shares are a buy?”

Long Term Trend Change in China’s Yuan

China’s Yuan currency recently saw a major, long-term trend change. See the chart for yourself, and how it implies a major opportunity.

Ukraine’s “Spider Web” Drone Assault on Russia

The Ukraine drone attack on Russia “caught military strategists off-guard.” But social mood has created the ideal conditions for Operation “Spiderweb.”

Why Do People Buy Shoes at a Discount But Not Stocks?

People’s search for bargains in stores is different from their bargain search in the stock market. Get insights into this striking fact.

Contrary Indicators, Elliott Wave Patterns, and The Dollar Index

What happens when a financial trend is strong enough to make the cover of a major news magazine? Read (and see) the answer for yourself.

Retail Investors Vs. Warren Buffett

Get insights into Warren Buffett’s market behavior and learn how that stacks up with what most investors are doing. Is Buffett right – or is everyone else?

Recessions Stink. Your Financial Wellbeing Doesn’t Have To

Not EVERYONE suffers in a recession. In fact, some businesses and people actually – dare we say it – thrive!

Does the Yield Curve Point to Recession?

This famous indicator is sending a message about recession chances. Get the details now.

Preview: How to Find Opportunities in a Recession — Not Merely Surviving but Thriving in a Downturn

Several key economic indicators suggest that a major downturn could be on the horizon. But here’s the good news: recession doesn’t have to mean retreat. In fact, it can be a time of strategic growth. The cover article in the June 2025 issue of The Socionomist offers a practical guide of how individuals and businesses can turn a challenging economic climate into a field of opportunity.

Corporate Executives Are Part of the Crowd

Financial herding is universal! Even groups like hedge fund managers – who are paid handsomely to think independently – tend to herd. Here’s what’s going on with corporate executives.

Houlihan Lokey (HLI): Riding the Trend with Flash and EWAVES

When Elliott waves develop as expected, it’s a beautiful picture to watch. Here’s how watching wave patterns in Houlihan Lokey (HLI) helped us ride the recent trends.

What Home Sales Tell Us About Recession Chances

The U.S. housing market is showing signs of major weakness. Time-tested indicators reveal what may be next for the sector – as well as for the entire economy.

Recession isn’t Necessarily a Four-Letter Word

The June issue looks at recession opportunities, golfer Rory McIlroy and Art Deco. On Our Radar topics include DEI, airships, and disaster preparation.

In the Mood for… a Trade Crusade

Uncertainty over U.S. trade policy is at a fever pitch. Americans have questions. Listen to our “In the Mood” episode on tariffs for answers.

In the Mood For… A Murderous Musical

The Luigi Mangione story continues to be stranger than fiction. Listen today for our take on why so many are literally singing the praises of an accused murderer.

Message to Moody’s: ”Thanks, Captain Obvious!”

If you rely on credit ratings agencies for timely financial warnings, you may be woefully disappointed. History provides examples. In one instance, this notorious company’s bond enjoyed an “investment grade” rating just 4 days before the company went bankrupt!

What Germany’s Credit Markets Are Saying

Traditional investment playbooks are failing—and the bond market is flashing early warning signs. Discover why a little-known German credit spread may be the market’s next big recession signal, and what it means for investors worldwide.

Already a club member?

Login Now