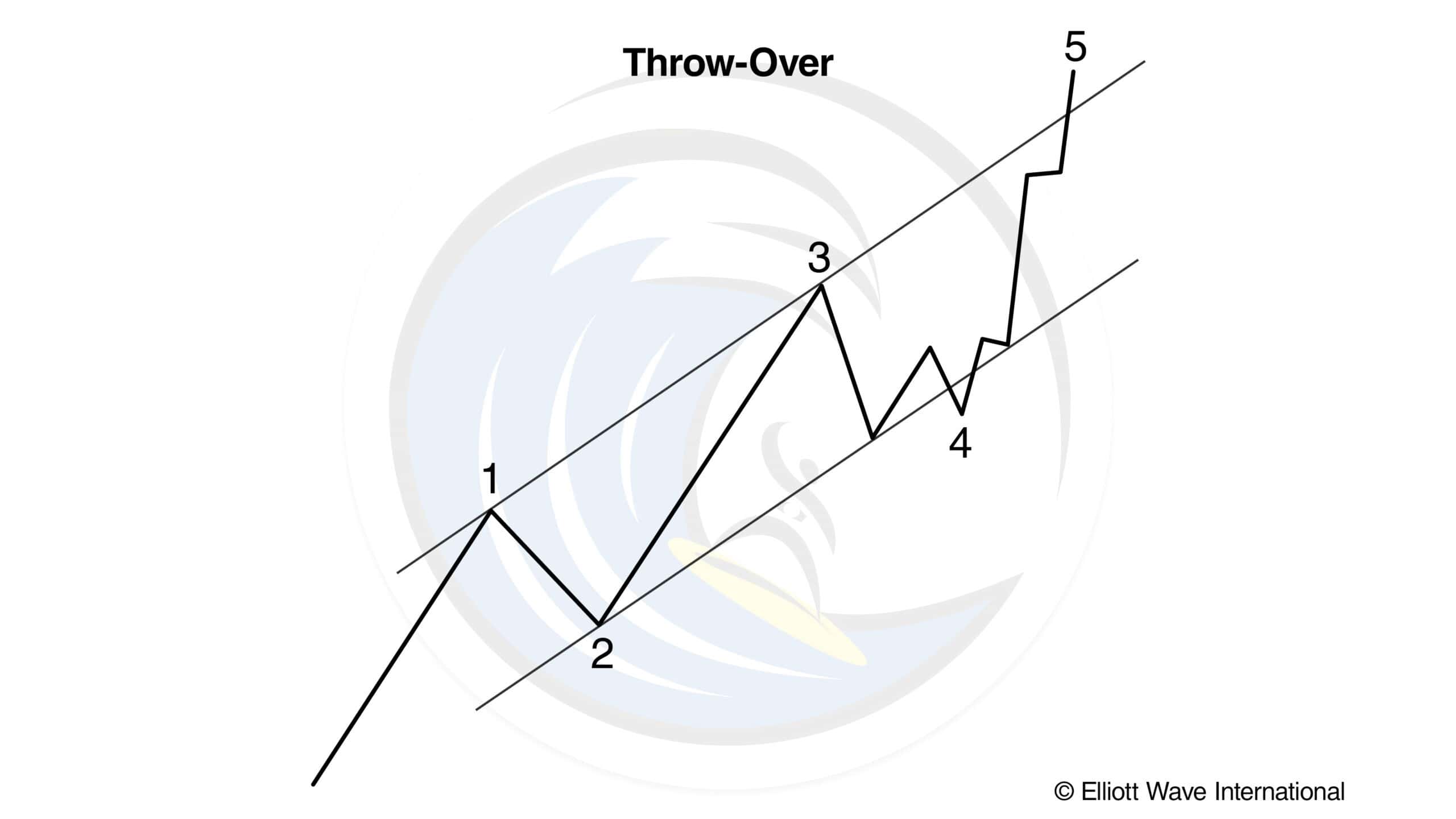

Throw-Over

Key Takeaway: A throw-over occurs when a fifth wave breaks its channel. A throw-over can precede a major reversal.

Within a parallel channel or the converging lines of a diagonal, if a fifth wave approaches its upper trendline on declining volume, it is an indication that the end of the wave will meet or fall short of it. If volume is heavy as the fifth wave approaches its upper trendline, it indicates a possible penetration of the upper line, which Elliott called a “throw-over.”

Throw-overs occur at the end of an advance, when a final burst of optimism carries prices above channel lines and trendlines, to the terminal point in the wave structure.

A throw-over is a reversal pattern. Often, reversals from throw-overs are highly dramatic. The top in 1929, for example, was a throw-over.

“So wait… I can really learn to predict the markets?”

Yes. Markets aren’t rational. For every action, there isn’t always an equal and opposite reaction.

What drives prices isn’t logic, but emotion. Market emotions unfold in predictable patterns called Elliott waves. That’s what makes prices predictable.

What you just read is from the Wall Street bestseller, “Elliott Wave Principle: Key to Market Behavior.” For 40+ years, it’s been a top-shelf book on unbiased market analysis.

Amazon reviewers call it “classic and essential” and “the bible of the theory.” Now, you can get instant, FREE access to the full online version of this book ($29 value).