Diagonals

Key Takeaway: A diagonal is a motive pattern with two corrective characteristics. When you spot an ending diagonal (the most common type of diagonal), be ready for a fast and sharp reversal. A diagonal spotted at the appropriate time is the Wave Principle’s best path to instant gratification!

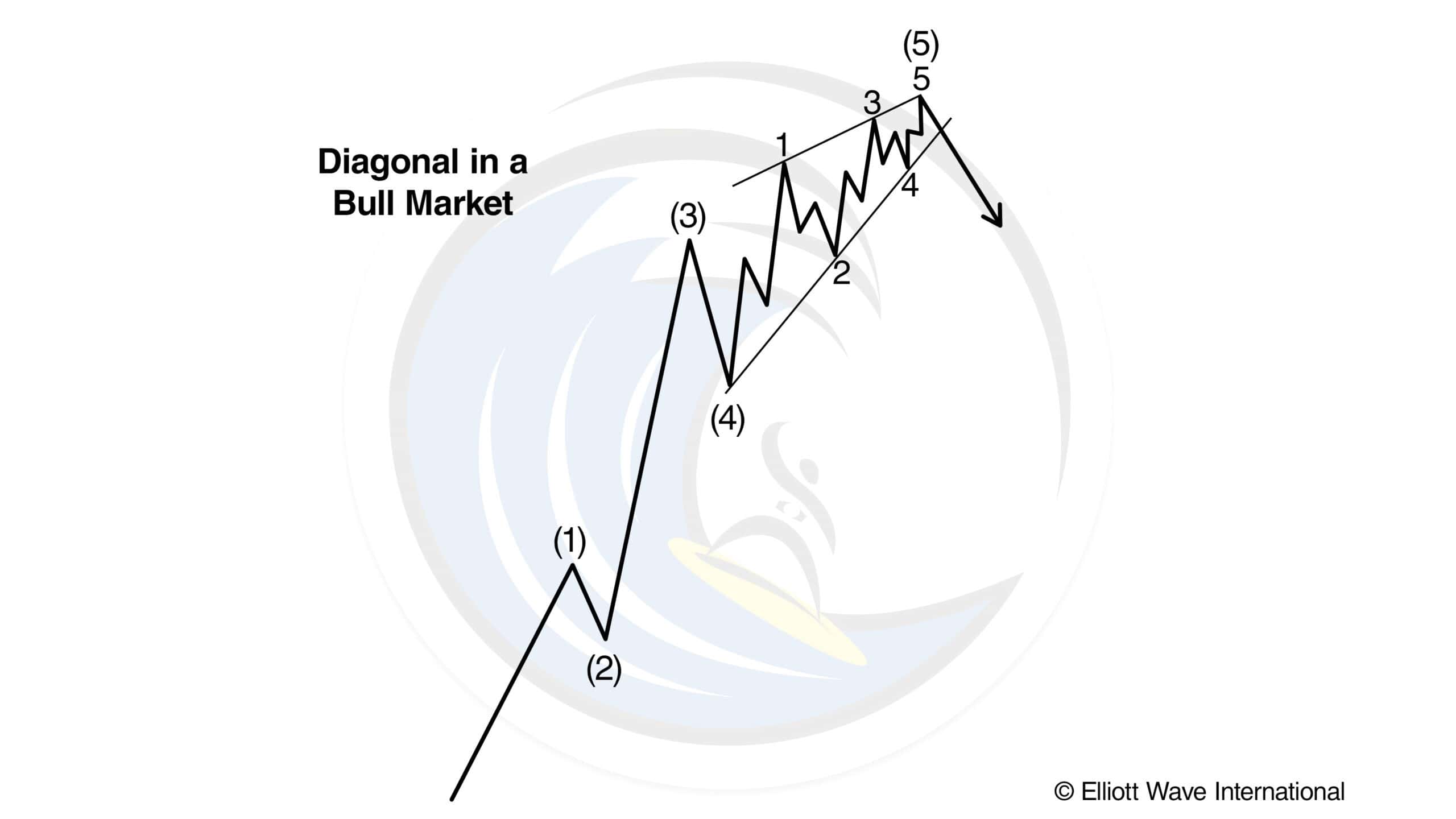

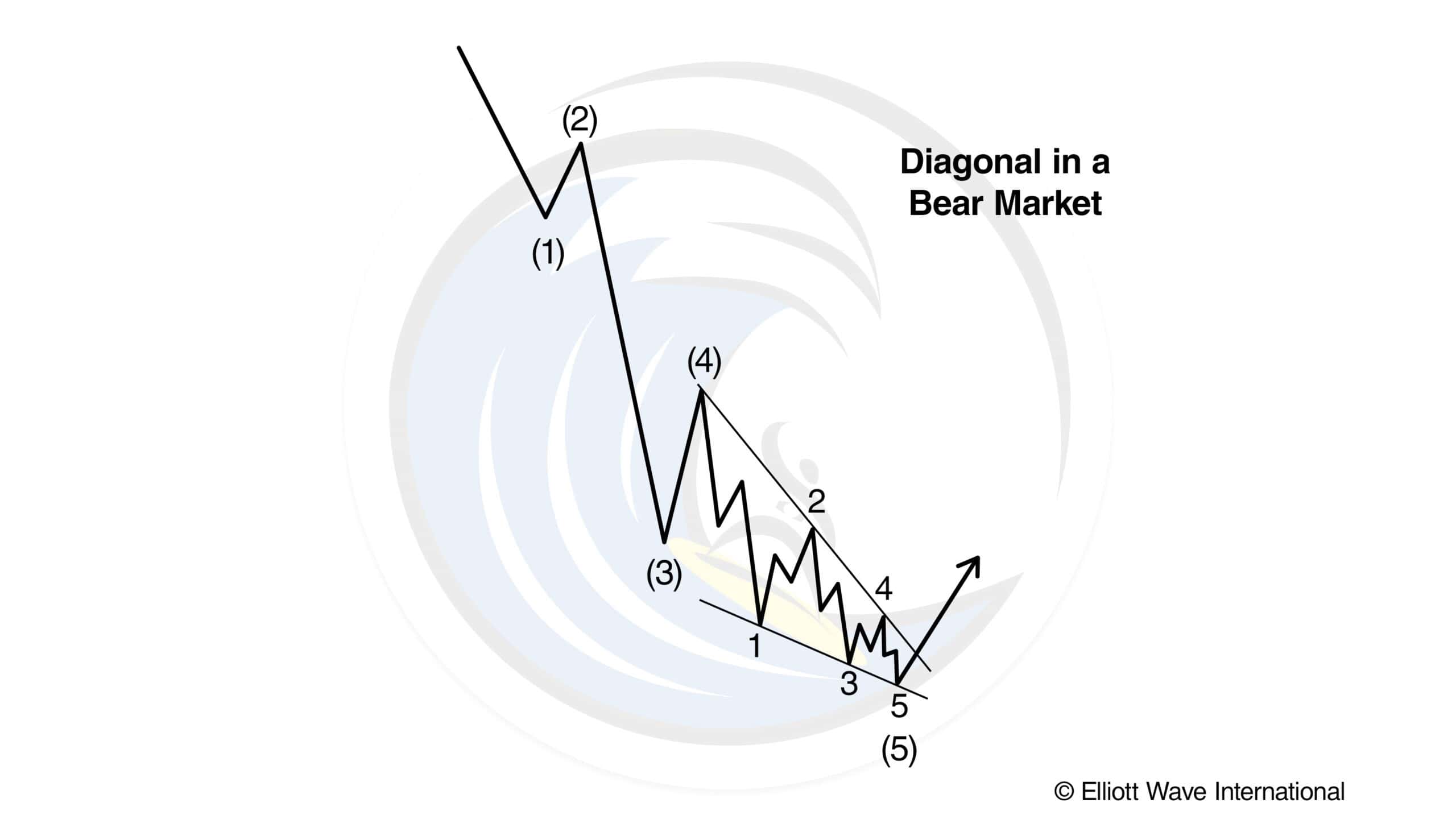

A diagonal is a motive pattern yet not an impulse, as it has two corrective characteristics. As with an impulse, no reactionary subwave fully retraces the preceding actionary subwave, and the third subwave is never the shortest. However, a diagonal is the only five-wave structure in the direction of the main trend within which wave four almost always moves into the price territory of (i.e., overlaps) wave one and within which all the waves are “threes,” producing an overall count of 3-3-3-3-3. On rare occasions, a diagonal may end in a truncation, although in our experience such truncations occur only by the slimmest of margins. This pattern substitutes for an impulse at two specific locations in the wave structure.

Ending Diagonal

An ending diagonal occurs primarily in the fifth wave position at times when the preceding move has gone “too far too fast,” as Elliott put it. A very small percentage of diagonals appear in the C-wave position of A-B-C formations. In double or triple threes, they appear only as the final C wave. In all cases, they are found at the termination points of larger patterns, indicating exhaustion of the larger movement.

A contracting diagonal takes a wedge shape within two converging lines. This most common form for an ending diagonal is illustrated in Figures 1 and 2 and shown in its typical position within a larger impulse wave.

We have found one case in which an ending diagonal’s boundary lines diverged, creating an expanding diagonal rather than a contracting one. However, it is unsatisfying analytically in that its third wave was the shortest actionary wave.

Ending diagonals have occurred recently in Minor degree as in early 1978, in Minute degree as in February-March 1976, and in Subminuette degree as in June 1976. Figures 3 and 4 show two of these periods, illustrating one upward and one downward “real life” formation.

Figure 5 shows our real-life possible expanding diagonal. Notice that in each case, an important change of direction followed.

Although not so illustrated in Figures 1 and 2, the fifth wave of an ending diagonal often ends in a “throw-over,” i.e., a brief break of the trendline connecting the end points of waves one and three. The real-life examples in Figures 3 and 5 show throw-overs. While volume tends to diminish as a diagonal of small degree progresses, the pattern always ends with a spike of relatively high volume when a throw-over occurs. On rare occasions, the fifth subwave falls short of its resistance trendline.

A rising ending diagonal is usually followed by a sharp decline retracing at least back to the level where it began and typically much further. A falling ending diagonal by the same token usually gives rise to an upward thrust.

Fifth wave extensions, truncated fifths and ending diagonals all imply the same thing: dramatic reversal ahead. At some turning points, two of these phenomena have occurred together at different degrees, compounding the violence of the next move in the opposite direction.

Leading Diagonal

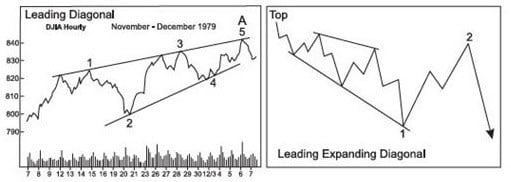

It has recently come to light that a diagonal occasionally appears in the wave 1 position of impulses and in the wave A position of zigzags. In the few examples we have, the subdivisions appear to be the same: 3-3-3-3-3, although in two cases, they can be labeled 5-3-5-3-5, so the jury is out on a strict definition. Analysts must be aware of this pattern to avoid mistaking it for a far more common development, a series of first and second waves. A leading diagonal in the wave one position is typically followed by a deep retracement.

Figure 6 shows a real-life leading diagonal. We have recently observed that a leading diagonal can also take an expanding shape. This form appears to occur primarily at the start of declines in the stock market (see Figure 7).

These patterns were not originally discovered by R.N. Elliott but have appeared enough times and over a long enough period that the authors are convinced of their validity.

“So wait… I can really learn to predict the markets?”

Yes. Markets aren’t rational. For every action, there isn’t always an equal and opposite reaction.

What drives prices isn’t logic, but emotion. Market emotions unfold in predictable patterns called Elliott waves. That’s what makes prices predictable.

What you just read is from the Wall Street bestseller, “Elliott Wave Principle: Key to Market Behavior.” For 40+ years, it’s been a top-shelf book on unbiased market analysis.

Amazon reviewers call it “classic and essential” and “the bible of the theory.” Now, you can get instant, FREE access to the full online version of this book ($29 value).