Elliott Wave International Master Theme.

-

Crypto Traders: See How Elliott Waves Help You Cut Through Ambiguity (AIOZ)

If you’ve never heard of cryptocurrency AIOZ (Aioz Network), don’t fret: With over 20,000 cryptos out there (and counting), it’s easy to miss a few. And that’s exactly the reason our Crypto Junctures service exists: To highlight for you new opportunities you might otherwise miss. Here’s one of our Crypto Junctures editors, Jason Soni, explaining…

-

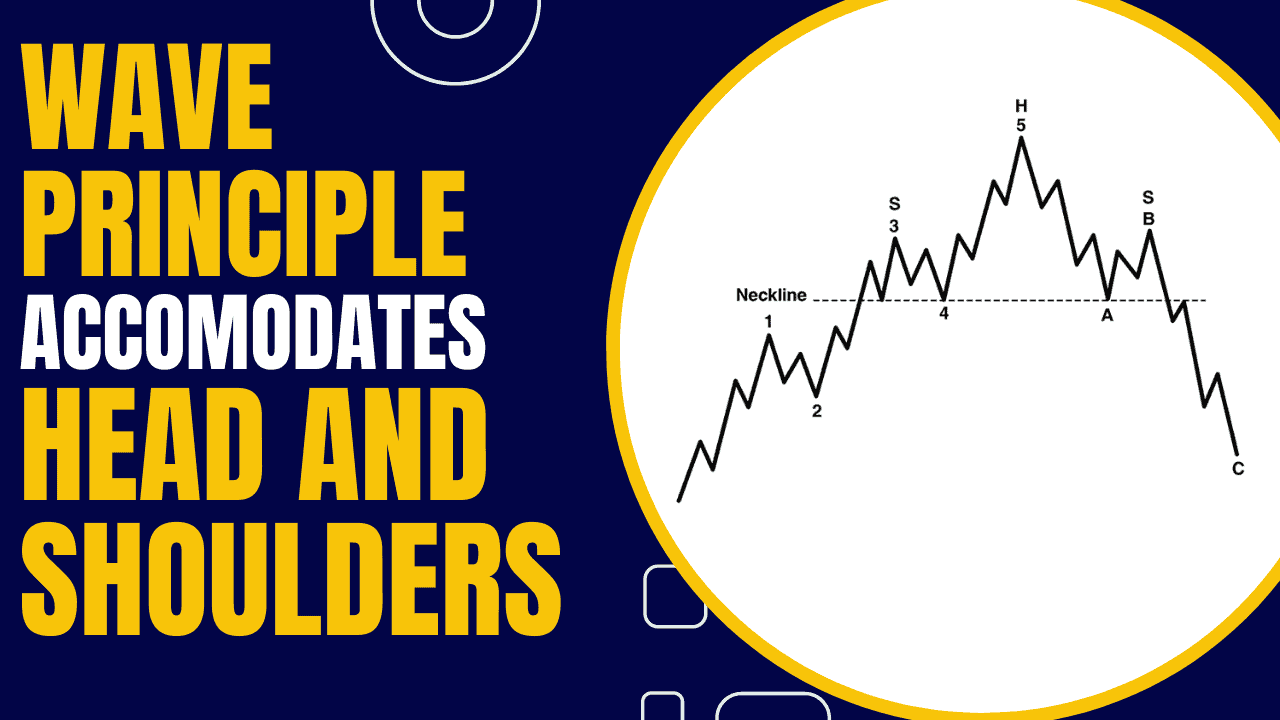

Want to Learn How to “Read” a Price Chart? Start Here.

Investors who study classic chart patterns may be interested in knowing that the Wave Principle subsumes all valid patterns. Here are a couple of examples.

-

Our Forecast Caught the Eurodollar Low & Rally to a 4-Month High that Followed

On June 26, the euro kicked off a powerful rally that propelled it to 4-month highs versus the U.S. dollar. See what we showed subscribers ahead of that move.

-

How to Tell What Central Banks Will Do with Interest Rates (Video)

Many investors like to speculate about future central bank interest rate decisions. These investors often base their interest rates guesses on their views about the economy or inflation. Yet, here’s a better way to determine what central banks will do.

-

AMZN Tops $200: See Why There’s More to the Rally Than Meets the Eye

On July 9, Amazon stock soared above the brain-buzzing $200-a-share mark – a new all-time high. Mainstream media coverage of the retail giant is a wild west of bullish buying and Bezos’ selling. Well… to paraphrase Dr. Seuss, from there to here, and here to there, Elliott wave opportunity is everywhere.

-

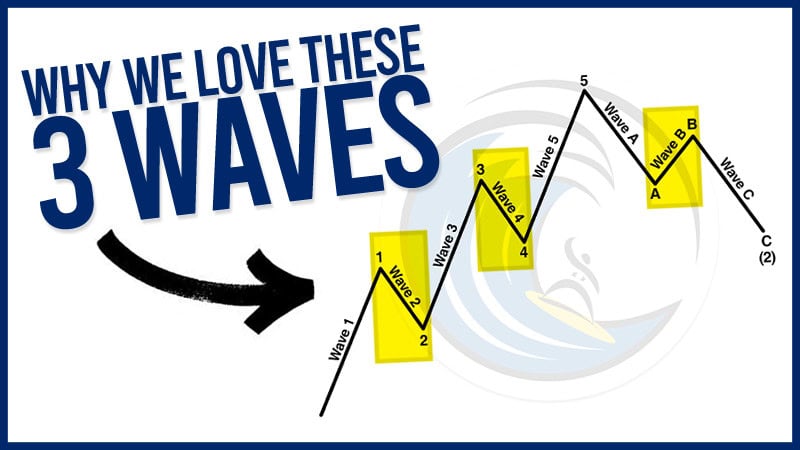

Why We Like Waves 2, 4 and B – And You Should, Too (Video)

Yes, Elliott waves help you identify market opportunities. But before that opportunity starts, there is something our Chief Commodity Analyst and trading instructor, Jim Martens, calls “setup waves.” Watch him explain what they are – and then go see if you can spot them in your own charts!

-

What Happened to All the Stock Market Short Sellers?

Short selling made headlines a few years ago during the GameStop saga. But despite a common misconception, short selling is not “bad” – in fact, it’s meant to serve an important function in a healthy stock market. So, what does it mean when short selling virtually disappears? We’ve seen it before… Here’s Market Trek host…

-

The #1 Struggle Most Traders Experience…

Parallax Founder Imre Gams discusses the number one struggle most traders experience and how the Masterclass helps overcome this challenge.

Got any book recommendations?