Elliott Wave International Master Theme.

-

See Our S&P 500 Chart and Forecast from Before the Big Decline

See for yourself why our subscribers were not surprised when the trend in the S&P 500 turned down.

-

Lovin’ That Leverage: Insights into Current Investor Psychology

Today’s market participants are ramping up their use of leverage. One group of retail investors has already paid dearly. Yet, overall, optimistic psychology has been in charge. This chart shows that many investors are “almost as loaded up for bull as ever.”

-

‘Textbook Pattern’ in XRP: See How We Alerted Crypto Subscribers to a Reversal & Major Rally

This Chart of the Day video breaks down the timely forecasts we showed Crypto Pro Service subscribers ahead of the reversal and rally in XRP. See how it played out in real time.

-

What Lumber Prices Tell Us About U.S. Residential Real Estate

U.S. home construction recently fell to its slowest rate in four years. Learn what this has to do with lumber prices and what lumber prices tell us about the prospects for the U.S. housing market.

-

XRP: We Alerted Crypto Subscribers to a Reversal & Major Rally to Follow

See how our Crypto Pro Service helped subscribers anticipate the turns ahead of –and during — XRP’s powerful advance.

-

This Trend Will Likely Soon Rock the U.S. Financial System

Inflation is a big buzzword these days, yet we see a big change ahead. Learn why the financial system is at major risk.

-

Catching the Eurodollar Low … and the Rally to the Four-month High that Followed

Recently the eurodollar saw a major change in trend, a rally, and a correction – now see for yourself the chart, analysis and forecast that kept subscribers ahead of the volatile action.

-

Secrets of Flat Corrections: Live Elliott Wave Trading with EWAVES

Watch as Elliott Prechter showcases live Elliott wave trading with the EWAVES analysis engine, demonstrating some previously unpublished research on flat corrections.

-

T-Bonds: What Elliott Waves Said at Key Junctures

Our Interest Rates Pro Services team tracks Elliott wave patterns across U.S. & global treasuries of various maturities. And lately, those patterns have been exceptionally clear. See the recent bullish and bearish U.S. Treasury forecasts we showed subscribers.

-

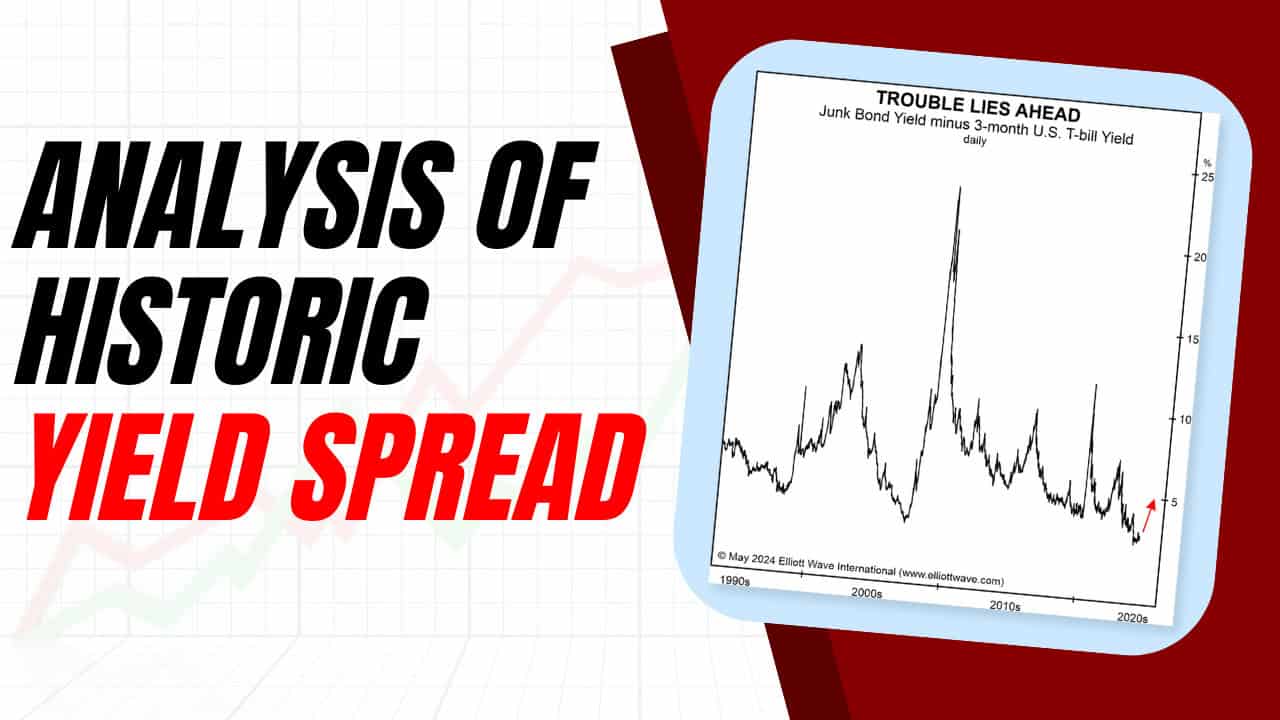

“This chart is stunning in its implications.”

“Junk” bonds are issued by companies with the weakest financial structures. Yet many investors will take on default risk to get a higher yield. Learn why this chart of the junk bond yield minus the 3-month U.S. T-bill yield “is stunning in its implications.”

Got any book recommendations?