Should Stock Investors Worry about Crude Oil Prices?

It’s a widespread belief amongst economists, the media, and the public alike that rising oil prices are bearish for stocks.

Check out these headlines:

The logic makes sense: Rising oil prices increase the cost of energy and therefore reduce corporate profits and consumers’ spending power, thus putting drags on stock prices and the economy.

But is it true?

For many economists, the underlying assumption about causality stems from 1973-1974, after the Arab Oil Embargo, when stock prices cratered as oil prices climbed. Since then, the belief has become absolutely entrenched in people’s minds.

Unfortunately, the evidence simply does not support that claim.

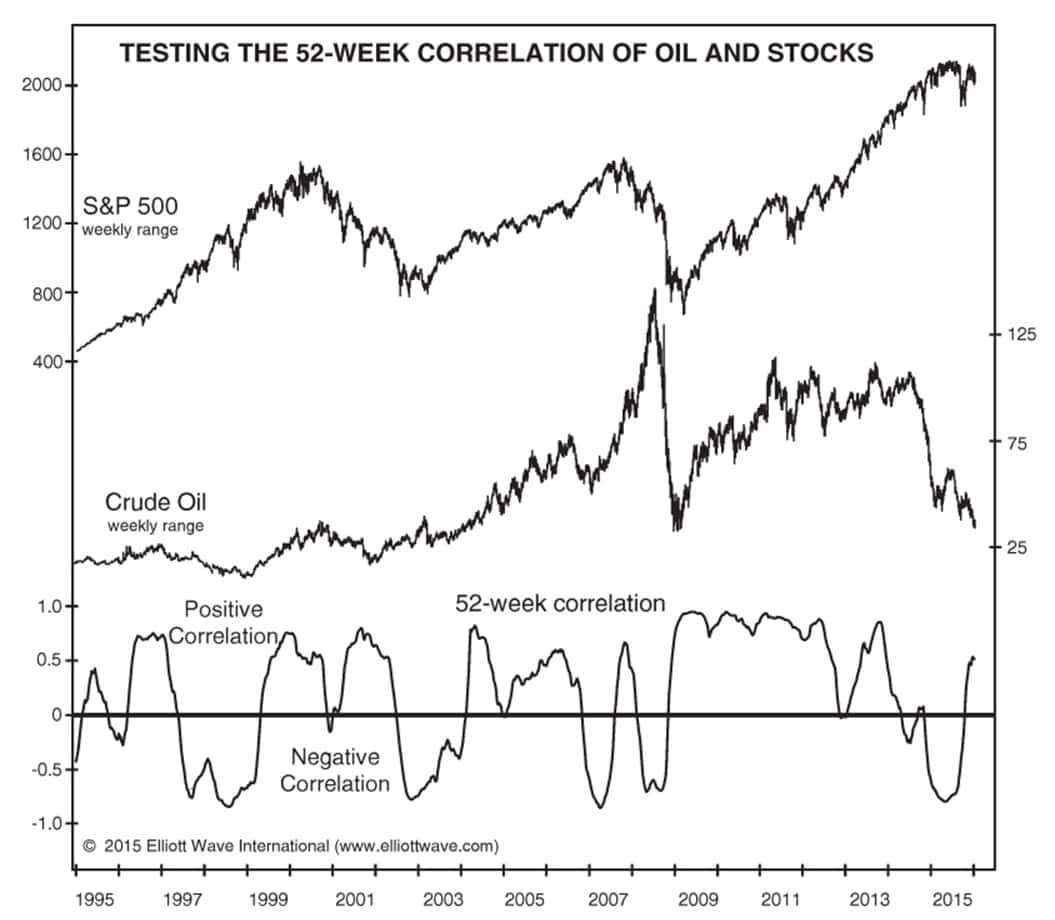

Figure 1 shows that for 21 years, from 1995 to 2016, there was no consistent relationship between the trends of oil prices and stock prices on a 52-week basis. Sometimes it was positive, and sometimes it was negative. (A correlation of 1 indicates that the markets are totally in sync; -1 denotes the opposite.)

During this period, the correlation was positive more often than it was negative – exactly the opposite of what conventional wisdom espouses. In fact, the worst period for the economy and stocks coincided with the oil price collapse of 2008, and then, oil prices doubled and the economy revived.

Realistically, one could wonder if rising oil prices were in fact bullish for stocks.

That’s a reasonable argument. As the economy begins to expand, business picks up, so stock prices rise; and as business picks up, demand for energy rises as businesses gear up and operate at higher capacity. That’s why stocks and oil go up together.

But as Robert Prechter said in his 2017 book The Socionomic Theory of Finance, “One can reverse the causality asserted in any exogenous-cause claim and sound perfectly logical either way… As is typically the case with such dual lines of reasoning, neither causal formulation explains the data.”

Sometimes oil and stocks go up or down together, and sometimes they trend in opposite directions.

The non-correlation has continued in recent years. Watch this video from our Chief Energy Analyst Steven Craig, showing the trends in WTI and the S&P 500 from late-2018 through mid-2020.

The data flies in the face of economists who say that an “oil shock” would hurt the stock market and the economy. It also throws into doubt the very idea that stock prices and oil prices are linked.

Any such link between oil prices and stock prices is simply fiction.

Oil prices, Fed announcements, hurricanes, wars … the stock market is not governed by external news and events — no matter how dramatic. The notion of external “shocks” to stock prices is a myth.

Check out this and other busted myths in the first two chapters of Robert Prechter’s Socionomic Theory of Finance, free.

Start Reading The Socionomic Theory of Finance Now

Learn About 13 Investor Myths You’re Probably Falling For

- Positive corporate earnings will cause the stock to rally.

- Higher bond yields cause stocks to drop.

- Inflation causes gold and silver prices to rise.

99% of investors hold these irrefutable truths so tightly that they’re willing to invest hundreds-of-thousands of dollars based on these correlations. They never challenge whether they are actually true…

…but Robert Prechter does.

For example, as he states, “Much of the time, GDP and stock prices are allied. But if exogenous causality reigned in this realm, they would always be allied. They aren’t. In fact, they are often diametrically opposed.” This is in contrast to what many market observers believe.

In his groundbreaking text, The Socionomic Theory of Finance, Prechter delves deep into history to study the most popular market cause-and-effects touted by economists, news outlets and brokers.

Read the first two chapters now for free and discover 13 dangerous investor myths.