Should You Care About Federal Reserve Meetings?

Does this sound familiar?

Today is a Federal Reserve meeting. You’re glued to the news, stressing over whether they’ll raise or lower rates, and what that might mean for your money.

You’re not alone.

Many investors hang on every utterance from the Federal Reserve, hoping to hear a clue about interest rates.

They’ve been told that declining rates generally means higher stock prices, while rising rates will push stocks lower.

But does this assumption square with the facts?

In short – No.

Let’s look at history.

It’s true there have been times when the stock market rose as the Fed funds rate trended lower (see October 1974 to December 1976 or July 1984 to August 1987).

And, stock prices sometimes falter as interest rates climb higher. This happened from January 1973 to October 1974, and again from December 1976 to February 1978.

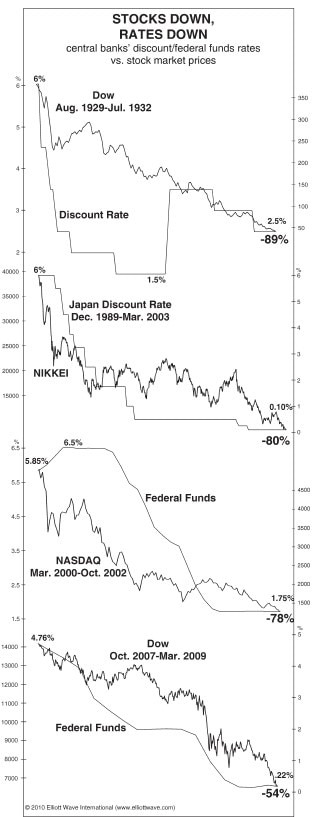

But, there have also been times when interest rates declined and stocks got absolutely smashed! Study this chart and commentary from the February 2010 Elliott Wave Theorist:

[The chart] shows a history of the four biggest stock market declines of the past hundred years. They display routs of 54% to 89. In all these cases, interest rates fell, and in two of those cases they went all the way to zero!

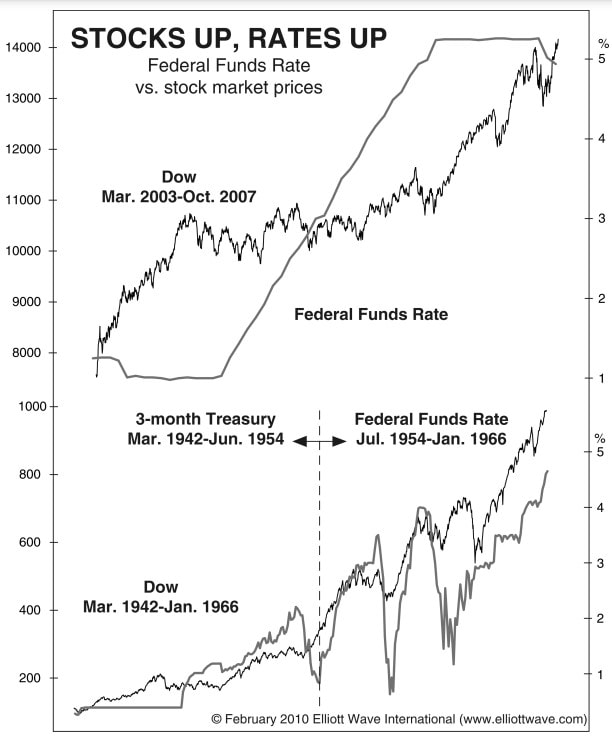

And, it’s also true that stocks rallied nicely during times of rising rates. The Dow Industrials nearly doubled from March 2003 to October 2007 as rates climbed from around 1% to over 5%.

Here’s the point: There is no consistent relationship between interest rates and the stock market.

But that doesn’t stop media pundits and economists from concocting contorted interest-rate explanations for stock market moves and worrying you that they matter!

Check out this video clip from May 2022, which shows the press scrambling to rationalize the market’s explosion higher following the Fed’s half-point rate hike on May 4.

In the months after, as the Fed remained hawkish, the Dow staged a significant rally. Headlines sometimes claimed the rate hikes were bullish, and sometimes claimed they were bearish.

Get off this merry-go-round of nonsense!

Too many investors obsess over Federal Reserve news, wondering whether the Fed will raise or lower interest rates and what it all supposedly means. Don’t be one of them.

The widespread belief that the Fed controls the stock market is just one market myth. You can learn about many others in the first two chapters of Robert Prechter’s Socionomic Theory of Finance, FREE.

Start Reading The Socionomic Theory of Finance Now

Learn About 13 Investor Myths You’re Probably Falling For

- Positive corporate earnings will cause the stock to rally.

- Higher bond yields cause stocks to drop.

- Inflation causes gold and silver prices to rise.

99% of investors hold these irrefutable truths so tightly that they’re willing to invest hundreds-of-thousands of dollars based on these correlations. They never challenge whether they are actually true…

…but Robert Prechter does.

For example, as he states, “Much of the time, GDP and stock prices are allied. But if exogenous causality reigned in this realm, they would always be allied. They aren’t. In fact, they are often diametrically opposed.” This is in contrast to what many market observers believe.

In his groundbreaking text, The Socionomic Theory of Finance, Prechter delves deep into history to study the most popular market cause-and-effects touted by economists, news outlets and brokers.

Read the first two chapters now for free and discover 13 dangerous investor myths.