Forget “market fundamentals” for a second. Sometimes, the market’s technical picture is so clear there’s no question where the price is headed. For Germany’s government bonds (Bunds), that happened… twice!

Generally, bonds get about as much action as Meryl Streep’s understudy.

But between late 2021 and 2023, all that changed when the oft-overlooked global market for long-dated securities stole the limelight in the biggest synchronized crash in prices (and a corresponding rise in yields, a.k.a. interest rates) since at least the 2007 financial crisis. From the 2023 media mill:

- “Buying a Burst Bubble, Bruised Bond Bulls Wince” — Oct. 20, 2023 Reuters

- “Government Bonds are in a Rout Worldwide” — Oct. 4 CNN

- “The Bond Market, a Sleeping Giant Awakes” — Oct. 27 New York Times

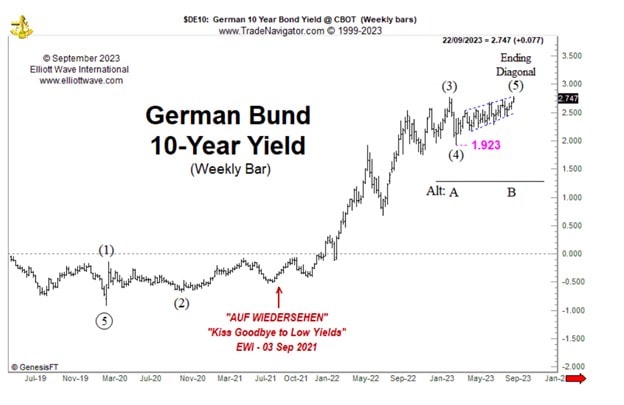

Leading the fore just behind U.S. Treasuries, whose prices also took a generational tumble, was Germany’s 10-year Bond (a.k.a. Bund) which saw its yield rising from (literally) negative territory in September 2021 to a 12-year high two years later in October 2023.

It may still be tempting to shrug this news off with a “meh” – I mean, who’s ever even heard of Bunds! — but tell that to the millions of investors who’s fabled “60% stocks / 40% bonds” asset allocation strategy went up in smoke; or to anyone trying to buy a house lately and squinting at a 300% rise in mortgage rates. They’ll tell you why this global move in bonds has had real, tangible implications.

This dramatic trend change was made even more so by the fact that sleeping-giant-coming-awake was NOT in the mainstream script at the time. Signs of stagflation, recession, and an uncertain post-pandemic future conspired to keep the demand for the “safety” of fixed-income assets high; thus, it was “not the right time” for borrowing costs in Europe’s most important financial instrument to rise.

On December 21, 2021, Bloomberg iterated the popular view:

“Anyone gearing up for bond yields to surge in 2022 should think again. A global glut of saved cash has the potential to restrain an increase in rates, even as central banks dial back their pandemic stimulus.”

It was, however, part of the market’s technical picture, visible through both simple technical analysis tools and the Elliott wave script of market psychology.

On September 30, 2021, our European Short-Term Updatepredicted the most unexpected plot twist for bonds; namely, rising yields. From European Short-Term update:

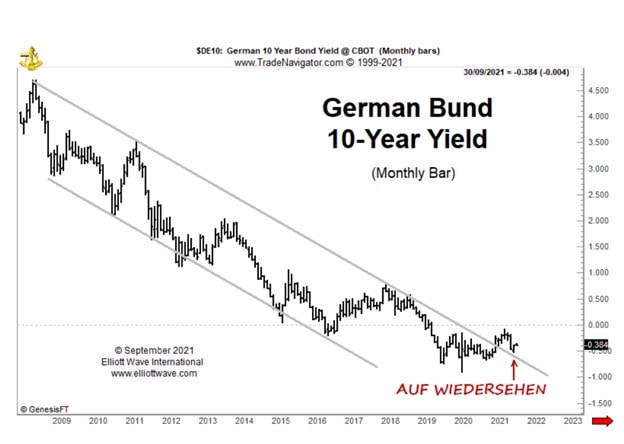

“September 30, 2021: Kiss goodbye to low yields… The incredible era of ultra-low interest rates and bond yields could be in the process of changing, judging by the chart of the German 10-year government bond. The Bund yield fell from 4.70% in 2008 to a low of minus .91% in 2020. As it did so, a distinct trend channel was formed, as shown below. The sideways movement in the yield over the past eighteen months has resulted in the yield moving out of the channel, and in the second quarter of this year, the Bund looked like it might break back above 0%. The subsequent decline might be giving us an excellent clue that the bond environment is changing.

“When bond yields start to rise again, it will become incredibly difficult for heavily indebted nations and corporations to manage their debt burden.”

One month later, the German 10-year bund yield did “kiss” its multi-year trend channel goodbye and was close to breaking back above zero. In our November 2021 Global Market Perspective, we wrote:

“Be prepared for big headlines should [the break above 0] occur. The next few months are set up to be pivotal in the grand scheme of things in financial markets.”

In mid-January 2022, Bund yields penetrated the zero line for the first time since 2019 in route of a history-making rally to 12-year highs and sovereign-debt collapse.

This time, two years later, once again the Elliott wave picture was clear. The rise in yields had unfolded as an ending diagonal pattern, a terminal configuration. The next move of consequence would be a reversal in yields and spike in bond prices. From the September 22, 2023 European Short-Term Update:

“This count anticipates a dramatic decline in the Bund Yield.”

And, this next chart shows what followed: a sell-off in yields to one-year lows as of December 29, 2023.

In the end, the usual blinders of conventional market wisdom – namely, the physics of a “trend in play will stay in play unless acted upon by some outside force” – disabled mainstream experts from both anticipating one of the most dramatic sea changes of the last decade for Europe’s leading bond market and its recent reversal off 12-year highs.

But this change wasn’t impossible to predict. And neither are the other looming shifts in store for the world’s leading financial markets, thanks to our comprehensive, monthly Global Market Perspective and near-term sister service European Short-Term Update.

See below for details on how to read the latest insights from one — or both services — now.

Who Will Kiss Historic Highs Goodbye Next?

Before the yield reversal in German Bund yields unfolded, subscribers to our Global Market Perspective and European Short-Term Update were ready.

Which service is right for you?

If you need our latest big-picture forecasts of global stocks, bonds, currencies, cryptos, energy and more — 50+ markets in total – Global Market Perspective delivers that directly to your screen once a month for just $59.

Small price to pay for being globally prepared. Follow the fast steps below to read the new issue now.

And if your focus is exclusively on near-term changes unfolding in European markets alone, European Short-Term Update may be the better choice.

Global Market Perspective

Monthly Analysis

$77

per month

European Short-Term Update

Weekly Updates

$67

per month