Topics:

Asian Markets (16) Commodities (13) Crypto (6) Currencies (14) Economy (37) Energy (8) ETFs (5) European Markets (21) Futures (1) Interest Rates (33) Investing (104) Metals (12) Social Mood (19) Stocks (93) Trading (84) US Markets (31)

-

Does Quantitative Easing (QE) Make Financial Prices Rise?

-

Is the Sugar Rollercoaster Making You Sick? We Can Help

-

Live Webinar: The Top Commodities to Watch

-

Uranium Miner CCJ: What Helped Us Spot a Major Bottom

-

Commodities: 99 “Fundamental” Problems but Predicting Price Trends Ain’t One

-

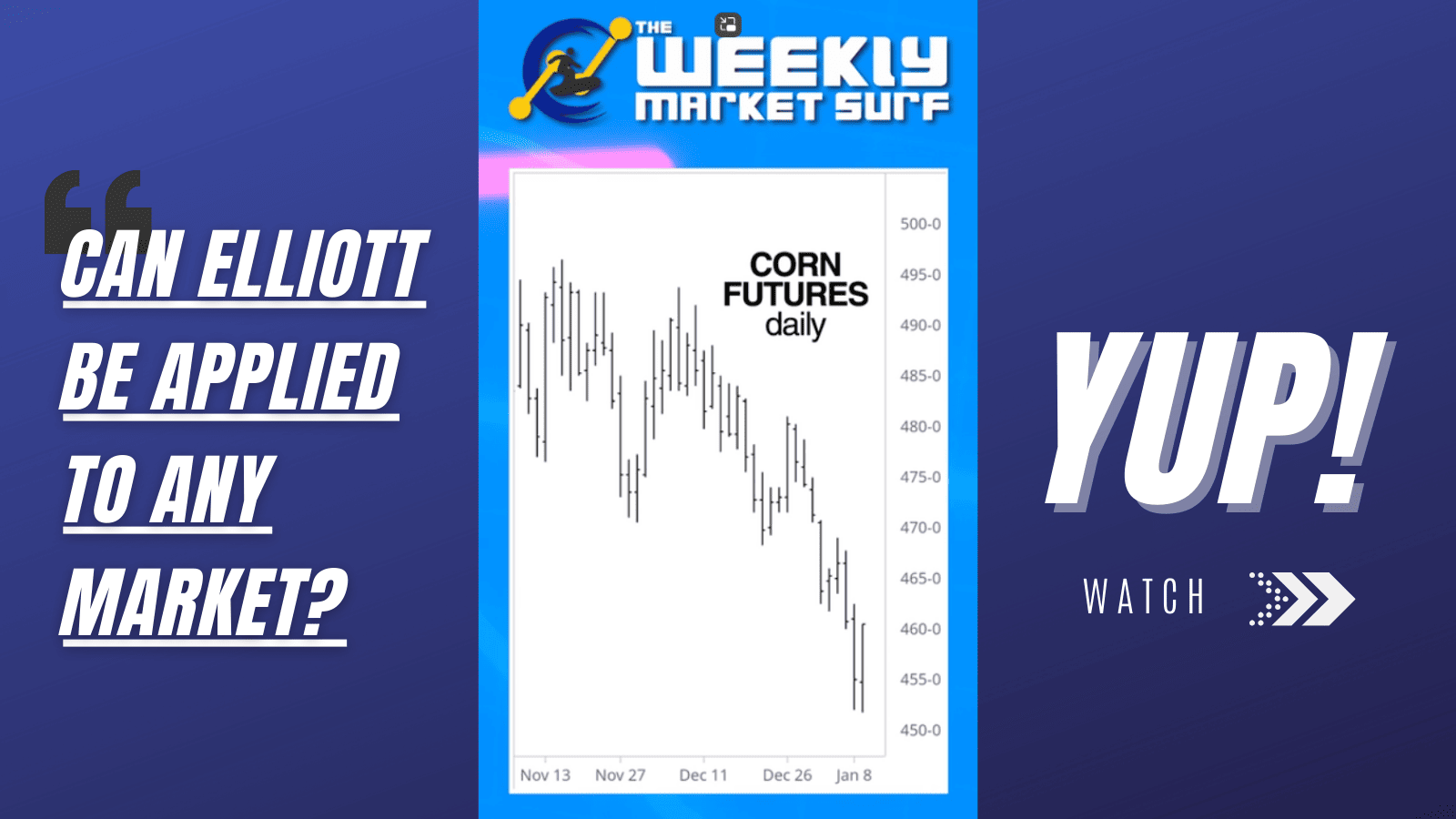

Can Elliott Be Applied to Any Market? Yup!

-

Pattern, Forecast, Outcome: See the Fast Decline in Corn

-

Wheat: How to Forecast Commodities Without Looking at Supply/Demand

-

Commodity Market Update: How to Make Sense of “Senseless” Markets

-

Sugar’s “Market Fundamentals” Stopped Working. Here’s Why…