A sour month for sugar. From 12-year high to 11-month low, see how sugar’s December selloff followed its Elliott wave script to a T.

While most of us experienced a major blood-sugar boost this holiday season, sugar futures came crashing down for Christmas. On December 26, sugar prices tapped their lowest level in 11 months.

The sweet “soft” commodity market’s selloff was not part of the “market fundamentals” plan. November saw sugar soar 40%-plus for its strongest annual performance in 14 years. Prices stood at a 12-year high. And, according to the mainstream experts, one “fundamental” event constituted a surefire silver bullet for sugar’s continued strength: a massive supply deficit.

From CNBC on November 17:

“Sugar in the global markets clearly have been on fire. We’ve seen 37% gains this year in the global sugar market, and the strength comes on the fact that the markets are looking at deficit this time around.

“That promises to keep the sector in the positive for prices.”

Associated Press on Nov. 19:

“Sugar worldwide is trading at the highest prices since 2011, mainly due to lower global supplies after unusually dry weather damaged harvests in India and Thailand, the world’s second- and third-largest exporters.

“The United Nations Food and Agriculture Organization is predicting a 2% decline in global sugar production in the 2023-24 season, compared with the previous year, translating to a loss of about 3.5 million metric tons (3.8 million U.S. tons).

“The world now has less than 68 days of sugar in stockpiles to meet its needs, compared with 106 days when they began declining in 2020, according to data from the USDA.”

Better Homes & Garden on Nov. 30:

“There’s a Worldwide Sugar Shortage—and It May Impact Your Holiday Baking. The holiday season is feeling a little less sweet this year: There’s a widespread scarcity of sugar, and the impact is being felt across the globe.

“There’s a global deficit of nearly 5.5 million metric tons of sugar, which affects both being able to purchase your favorite sweet treats and the key ingredient to bake them yourself. Your sweet tooth may have to pay a pretty penny to be satisfied.”

Sugar’s upside was all but assured from a “market fundamentals” perspective.

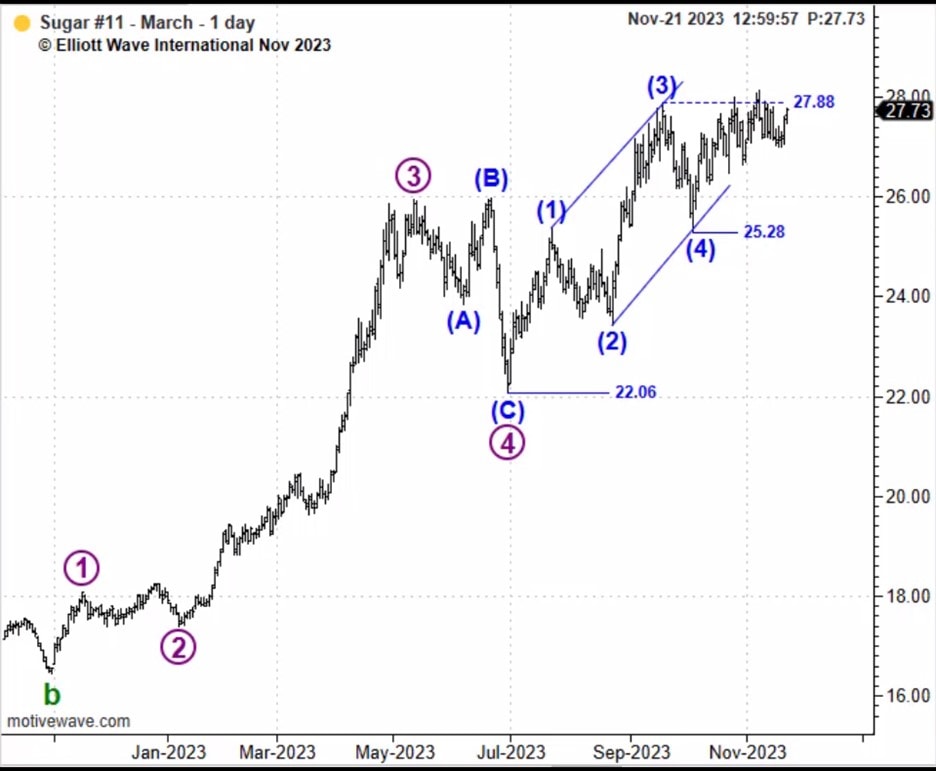

But, on November 21, our Commodity Junctures video service began to see a bearish Elliott wave set-up emerging on sugar’s price chart. There, editor Jim Martens observed that the rally since July had “satisfied minimum expectations” for a complete 5-wave impulse pattern, suggesting the upside was limited. From Commodity Junctures:

“We can count wave 5 and the larger advance from 22.06 complete. What’s missing is an impulsive decline from the existing high at 28.14.”

From there, sugar prices began to weaken, albeit slowly. The labored decline put our immediate bearish count on alert. On November 30, Commodity Junctures offered two possible wave counts. The first, a bullish scenario in which wave 5 was still underway.

Or the original, bearish wave count in which wave 5 was indeed complete. Commodity Junctures explained that, for this bearish scenario to be in effect, prices must fall beneath 25.28. If this occurred, “the end of the line” was in and a significant top was in place.

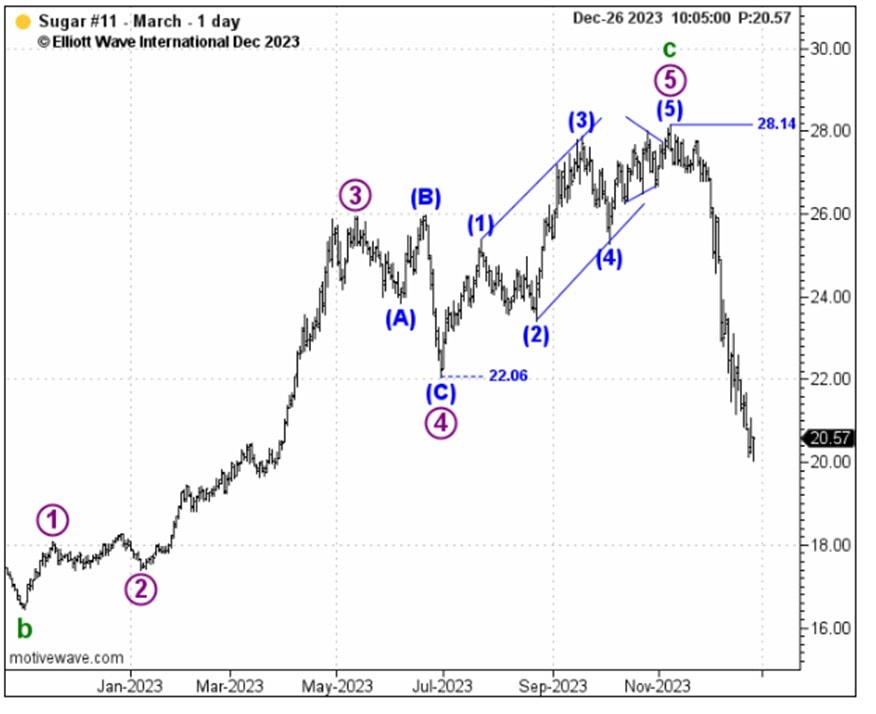

From there, as this final chart shows, sugar held nothing back on the downside, swiftly breaking through the 25.28 level on its way to 11-month lows on December 26.

In the end, there’s no such thing as a perfect forecasting model. We’re no exception to that rule. But what Elliott wave analysis offers is an objective way to analyze commodity market trends in real time while defining critical price levels to minimize risk.

Commodity Opportunities are on Fire

When it comes to knowing the future of commodity prices, there’s no such thing as a silver bullet. Even the most jarring Black Swan events like that of the pandemic can’t accurately determine where prices will go.

The only confident measure of a market’s trend is investor psychology, which unfolds as Elliott wave patterns directly on price charts. Right now, our Commodity Junctures presents high-confident outlooks for the world’s leading names in livestock, grains, softs, foods, and more.

See below to turn a new page in your investment future.