Market in Focus: soybean meal. Anticipating the selloff to 1-plus year lows was “like shooting fish in a barrel.” Wish all forecasting was that easy!

2023 saw the global commodities sector face more setbacks and disruptions than the production of the famously cursed film Fitzcarraldo. And, as 2024 begins, the list of “fundamental” challenges at commodities’ doorstep hasn’t abated, to wit:

- The near 2-year long Russian war with Ukraine continues to impede the global grain supply chain

- Ballistic missile attacks on commercial cargo ships in the Red Sea amidst the ongoing Middle East war

- “The Amazon region’s worst drought in more than a century,” which produces a large share of many global grains such as soy, maize, rice, and wheat. — Dec. 20, 2023 Al Jazeera

- And a January 5 USDA Ag in Drought report showing that “half of U.S. corn and soybean territory is in drought.” Jan. 5 Successful Farming

These “fundamental” targets are constantly moving, making it hard to anticipate how commodity prices will be affected – or will they? From Trade Finance Global, Jan. 17, 2024:

“2024 will see volatility in the commodity market driven by a complex web of market forces, government and intergovernmental policy, unforeseen geopolitical developments, and climate impacts.

“These events are expected to present various credit, political, economic, supply chain, and climate-related risks, testing the ability of many traders and financial institutions to capture available opportunities.”

It’s true that these macroeconomic and climate-related events can’t obscure traders’ ability to capture available opportunities in commodities. But not because they may push prices around; some “fundamentals” seem to do that, others don’t, and yet others seem to do the opposite of what logic suggests.

For a more reliable way to spot commodity opportunities, we know to look at the internal force of investor psychology, which unfolds as Elliott wave patterns directly on price charts.

13. That’s the number of known Elliott wave price patterns. And among those, 5 are “core” Elliott wave patterns: impulse, ending diagonal, zigzag, flat and triangle. In turn, the challenge for every trader isn’t to memorize and anticipate the complex web of “fundamental” market forces. It’s simply to memorize the unique traits and guidelines of each pattern, and then wait for one to appear in real time.

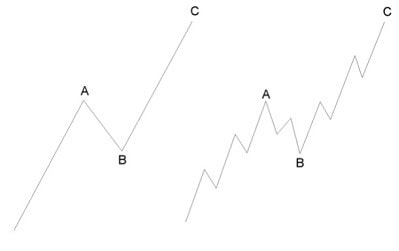

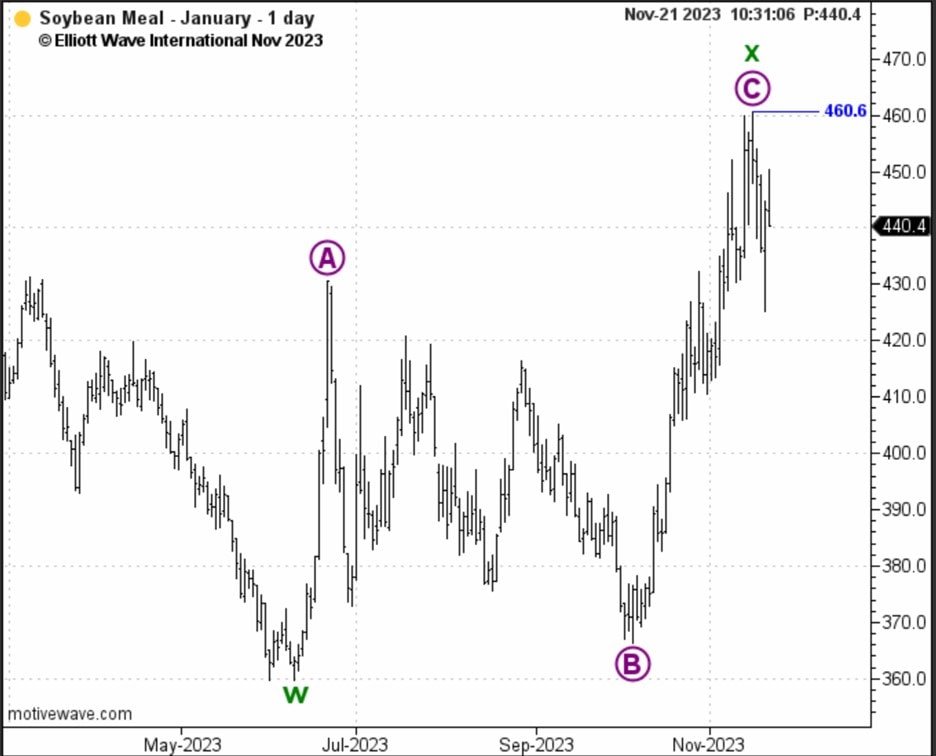

Take, for example, the recent performance in soybean meal. On November 21, our Commodity Pro Service identified a specific Elliott pattern on soymeal’s chart: an Elliott wave zigzag. This is a three-wave correction labeled A-B-C in which wave B terminates before the start of wave A.

The other distinguishing characteristic of zigzags is that wave C travels significantly beyond the end of wave A, like this:

With the zigzag complete, the November 21 Commodity Pro Service set the stage for further decline as the primary downtrend resumed. From Commodity Pro Service:

Despite the push to a new high since our last update, the advance from 359.7 is still in three waves. Three-wave movements represent corrections, so the downturn from Wednesday’s 460.6 high is deep enough to hint that a reversal might be underway.

If the decline continues and it develops to five waves, the decline will represent the first half of a bearish reversal.

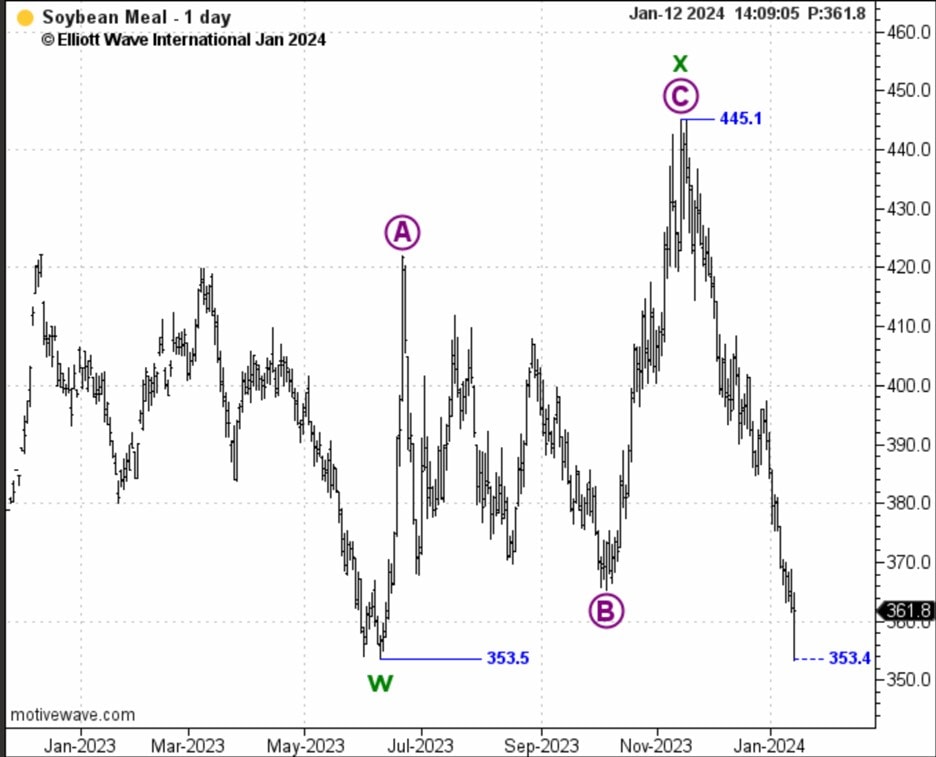

And this next chart, from the January 12 Commodity Pro Service, captures soymeal’s dramatic selloff to one-plus year lows since.

In the words of one of Commodity Pro Service analyst’s Jim Martens – who authored the original Nov. 21 bearish call for soymeal:

“This was a nice, long-term forecast based on the simple three-wave advance. Like shooting fish in a barrel.”

(Editor’s note: The difference in the starting point of the advance is due to rolling from the January contract to the March contract.)

Of course, not all Elliott wave interpretations turn out to be correct. Sometimes, those fish slip away. But because Elliott wave analysis can identify critical price levels of support and resistance, the inherent risk of any trade is managed.

Get instant access to our trader-focused Commodity Pro Service today.

So-y Much Opportunity in Commodities!

When it comes to knowing the future of commodity prices, there’s no such thing as a silver bullet. Even the most jarring Black Swan events like that of the Ukraine war, Middle East conflict, or record global drouth can’t accurately determine where prices will go.

A far more objective measure of a market’s trend is investor psychology, which unfolds as Elliott wave patterns directly on price charts. Right now, our Commodity Pro Service presents high-confident outlooks for the world’s leading names in livestock, grains, softs, foods, and more.

See below to turn a new page in your investment future.