Here’s what happened with stocks after the Fed caused the base money stock to soar nearly 30% annually until it quintupled

In his landmark book, the Socionomic Theory of Finance, Robert Prechter reviews 13 market myths which can harm investors.

Many market participants accept these claims as true, yet they fool investors into making costly decisions. You can read about them by following the link below.

One of these claims is that when a central bank – like the Federal Reserve – initiates quantitative easing (QE), the prices of almost everything will rise.

The claim seems to make sense, given that QE means the amount of money circulating in an economy increases. Hence, as the thinking goes, more money chasing “things” – like stocks — will make the price of those things go up.

However, as Elliott Wave International has posited many times, the prices of financial assets do not respond to the “pulling of levers” or what you might call the “mechanics paradigm” – as so many assume.

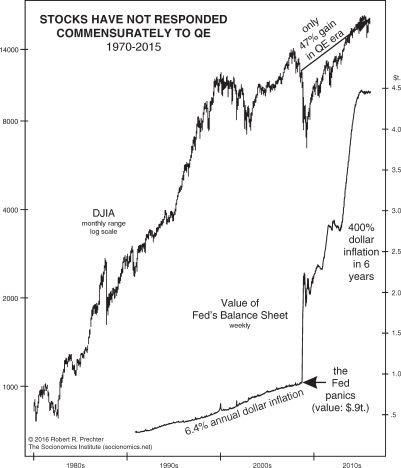

The stock market is indeed a case in point. Here’s a chart and commentary from the Socionomic Theory of Finance:

As a benchmark, [the Fed’s] rate of money creation from 1992 through August 2008 averaged 6.4% annually. Then, over just six years from September 2008 through 2014, the Fed’s “quantitative easing” policies caused the base money stock to soar nearly 30% annually until it quintupled. Surely stock prices should have risen commensurately to reflect this dramatic change. But they didn’t. From July 7, 1932 to September 12, 2008, the DJIA rose 27,609% without a QE policy. From the beginning of the QE policy on September 12, 2008 to its end on October 27, 2014, the DJIA rose only 47%, coming nowhere close to reflecting the Fed’s five-fold inflating of its base money supply.

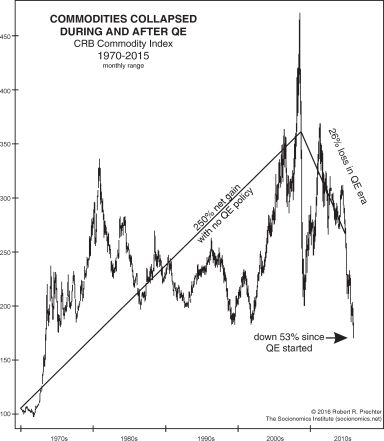

Nor did QE work as advertised regarding commodity prices – as this next chart, along with commentary, make clear:

As with stock prices, commodity prices rose from 1932 to 2008 without a QE program. Then, in July 2008, just two months prior to the onset of QE, commodity prices started their biggest bear market since 1932. … Anyone applying exogenous-cause thinking to these data would have to conclude that QE worsened the collapse in commodity prices.

The bottom line is that the price trends of financial markets are not governed by the actions of central banks or any other exogenous “cause.”

Learn about other market myths by reading Chapters 1 and 2 of the Socionomic Theory of Finance, which you can access by following the link below.

Are You Falling for These 13 Investor Myths?

If so, Your Portfolio is Built on a House of Cards

- Positive corporate earnings will cause the stock to rally.

- Higher bond yields cause stocks to drop.

- Central bank buying and selling moves markets.

- Inflation causes gold and silver prices to rise.

Most investors hold these widely held beliefs so firmly that they’re willing to invest hundreds of thousands of dollars based on these correlations. They rarely – if ever – engage in the research to learn if they’re true …

… but Robert Prechter does.

In his groundbreaking text, The Socionomic Theory of Finance, Prechter delves deep into history to study the most popular market cause-and-effects touted by economists, news outlets and brokers.

Read the first two chapters now – free — and discover 13 dangerous investor myths.