Elliott Wave International Master Theme.

-

Message to Moody’s: ”Thanks, Captain Obvious!”

If you rely on credit ratings agencies for timely financial warnings, you may be woefully disappointed. History provides examples. In one instance, this notorious company’s bond enjoyed an “investment grade” rating just 4 days before the company went bankrupt!

-

Honey, They’re Shrinking the Economy!

The old saying “As GM goes, so goes America” may not be as true as was the case decades ago, yet, there are companies today which can serve as proxies for even the global economy. Let’s look at one of those multinational conglomerates and find out what’s going on.

-

CBS Eye Takes a Hit

An appropriate way to describe the price action of this stock is “skyrocket to air pocket.” Here’s what happened with a well-known company after we gave a 2021 warning.

-

EURUSD: What the News Reported After the Fact — and What Our Subscribers Knew in Advance

Explanations may seem logical in hindsight. But markets rarely move in neat correlation with headlines. A more useful question might be: Who was tracking these moves before they happened?

-

Parallel to the Great Recession

That 0.3% economic contraction in Q1 might be just the first shoe to drop. Historical data speaks loudly and clearly. Review this revealing chart of the Conference Board U.S. Leading Economic Index – and just as importantly, our analysis of it.

-

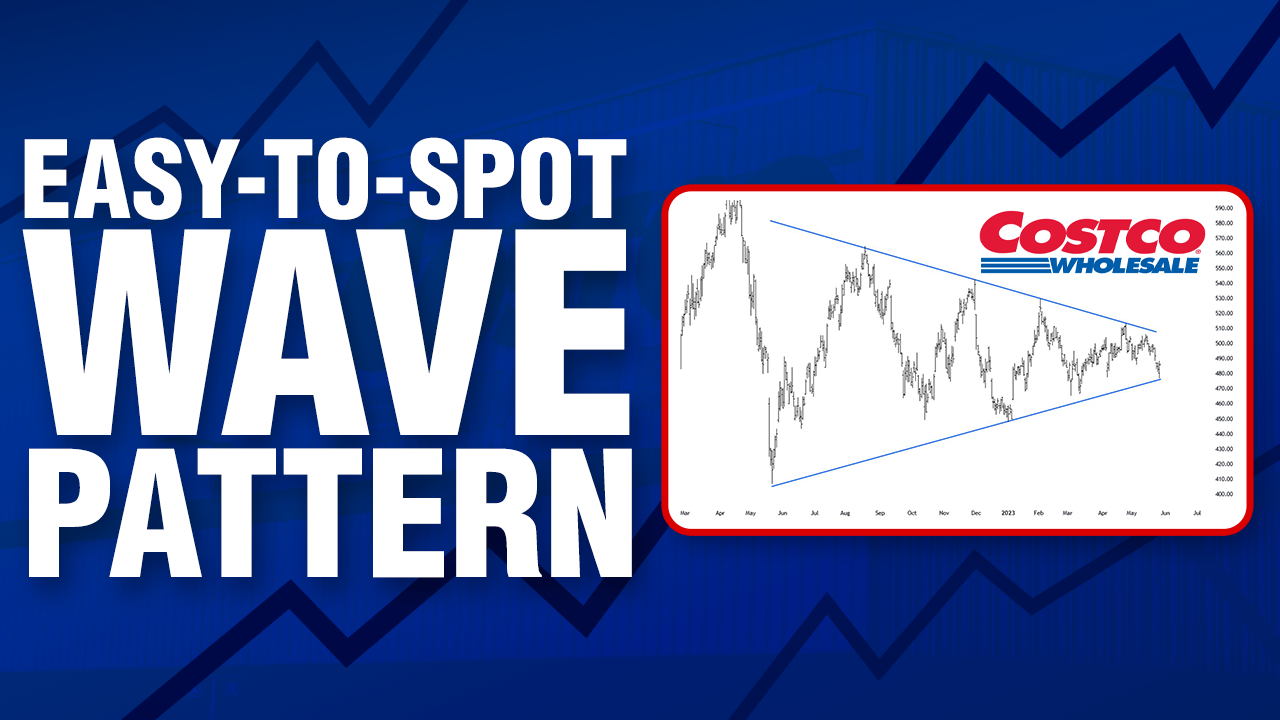

An Elliott Wave Setup You’ll See Again and Again

In his “3 Favorite Trading Setups” course, EWI senior analyst and instructor Robert Kelley teaches you the wave setups he trusts the most — including this Elliott wave triangle setup he called in COST in real time.

-

Debt Collectors Ready to Pounce

The level of debt in the global financial system is unsustainable. A debt implosion may already be underway. Let’s look at student loans.

-

Will Emerging Market Assets Continue to Outperform?

In 2025 so far, our bullish perspective on emerging market stocks have seen gains of 10%, 20%, and even 30%. Asian-Pacific Financial Forecast editor Mark Galasiewski presents the chart showing why this asset outperformance is just getting started.

Got any book recommendations?