We turned bullish on interest rates in September 2020.

It took the Fed 18 months to catch up.

After over a decade of neglect from the “cash is trash” mindset, Treasury bills are back. Today, you can earn 5% a year in a virtually riskless T-bill.

How did we get here? After all, the Fed chairman said it wouldn’t happen.

Fed chairmen have no idea what the future will bring. In 2007, Ben Bernanke opined that all was well, even though the 2008 financial crisis and Great Recession lay dead ahead. When Fed chairmen express an opinion, it’s always a consensus opinion. Consensus is always wrong at the turns.

We do not listen to economists. We have our own forecasting methods. Here’s an example.

What we told subscribers on September 23, 2020:

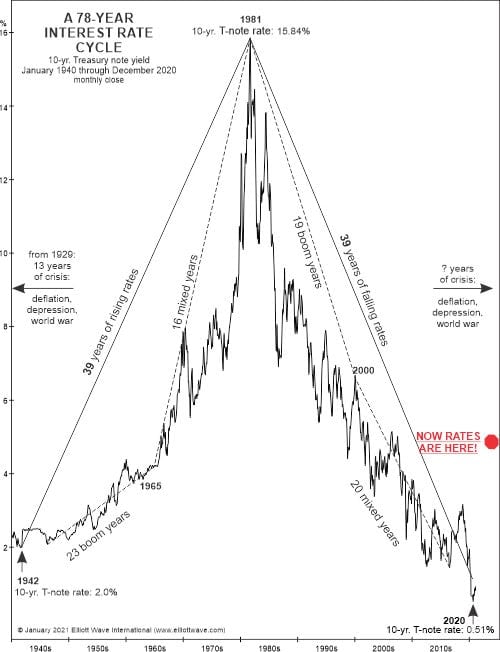

Based on the long-term pattern in the U.S. 10-Year Notes, we said this:

On September 16, Fed Chairman Powell…told reporters that he expected short term interest rates to stay near zero…through “the end of 2023.”

…there is not a chance in the world of that scenario playing out. [T]he probability is high that interest rates have begun a process of rising….

And here’s why we said it:

You know what happened next: Long term interest rates started rising across the board. T-bill rates stayed at zero through 2021 and then soared past 5% in just 18 months.

Imagine if you had read our advance warning of a once-in-a-generation opportunity to refinance your mortgage, get a long term business loan, or pay off a credit card.

Foresights like these are why our subscribers have relied on Elliott Wave International’s unique approach for over 40 years.

How can we stand so apart? The answer is: Our forecasts are based on historical analysis and the Elliott wave model, which are utterly ignored among mainstream economists, institutional analysts and money managers. On Wall Street, independence is as rare as it is valuable.

We may not be right every time, but we always have something to show you that you won’t find elsewhere. Join other smart people. Add us to your investment arsenal.

We have three services that forecast trends in interest rates and bond prices.

Global Market Perspective

($77/mo. – $117/mo.)

Global Market Perspective is a monthly publication that gives you the long-term outlook for global interest rates. It also analyzes and forecasts more than 50 of the world’s most-traded markets: stock indexes in the U.S., Europe, Asia and Australia; forex, precious and industrial metals, oil and gas, cryptocurrencies, interesting opportunities in individual stocks, and more.

In fact, we go beyond forecasting — we also explain how social mood and investor psychology impact the economy, inflation/deflation, culture, politics and beyond. Every issue is a deep dive.

See your Global Market Perspective options now.

Need intensive near-term coverage?

Check out our Interest Rates Pro Service

(As low as $267/mo.)

We have been providing subscribers with professional-grade, intraday forecasts since 1991. Today, the daily and intraday analysis in our Interest Rates Pro Service helps you capitalize on short-term trends in the U.S. 30-Year Treasury Bonds, 10-Year Notes, 5-Year Notes, Eurodollars, as well as in non-U.S. markets like Bunds, Bobl, Gilt, Euribor and the AUS 10-Year Bond.

Learn more about our Pro Service Coverage now.

Need institutional level for coverage of the world money?

Global Rates & Money Flows

($397/mo.)

Our Global Rates & Money Flows brings you unconventional observations and deep analyses of the world of money Monday through Friday, plus a broader perspective each month.

Unlike anything else in your toolbox, Global Rates & Money Flows’ Daily Updates keep you abreast of charts and forecasts, while the Monthly Report provides comprehensive, often contrarian insights into the present conditions and likely future paths of government, corporate and municipal debt. To top it off, editor Murray Gunn conducts live Quarterly Calls to offer his big-picture perspective and answer subscriber questions.

Learn more about Global Rates & Money Flows now.

As you will discover, Murray gives you his all. It’s a bit embarrassing, but we can’t resist quoting a response from one of his readers:

“ – You’re awesome. You’re awesome. You’re awesome. You’re awesome. You’re awesome. You’re awesome. You’re awesome. You’re awesome. You’re awesome. You’re awesome. You’re awesome. You’re awesome. You’re awesome. You’re awesome. You’re awesome. You’re awesome.”

Not ready to subscribe?

Get the latest issue and decide if you like us.

OR:

Join Club Elliott Wave to receive numerous benefits for only $2 a month.