Promotional Videos & Articles

Browse our latest promotional videos & articles.

Parallel to the Great Recession

That 0.3% economic contraction in Q1 might be just the first shoe to drop. Historical data speaks loudly and clearly. Review this revealing chart of the Conference Board U.S. Leading Economic Index – and just as importantly, our analysis of it.

Never Say Never: When Politics, Debt, and Markets Collide

With global confidence slipping and financial pressure mounting, markets may be speaking louder than the politicians. Read this Daily Update from our Global Rates & Money Flows subscription to learn more.

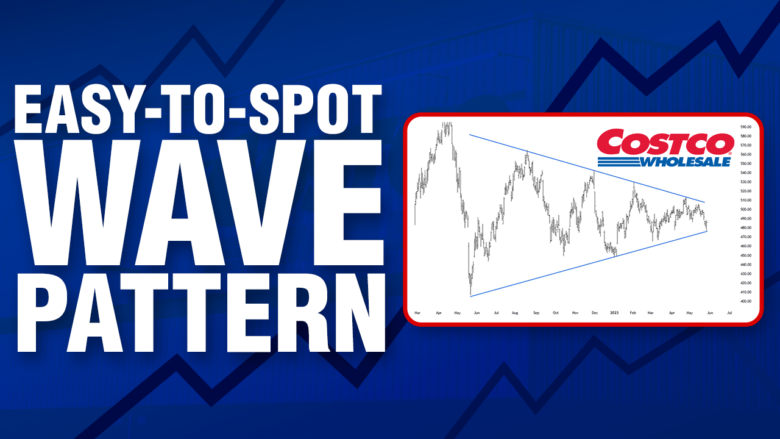

An Elliott Wave Setup You’ll See Again and Again

In his “3 Favorite Trading Setups” course, EWI senior analyst and instructor Robert Kelley teaches you the wave setups he trusts the most — including this Elliott wave triangle setup he called in COST in real time.

Debt Collectors Ready to Pounce

The level of debt in the global financial system is unsustainable. A debt implosion may already be underway. Let’s look at student loans.

Will Emerging Market Assets Continue to Outperform?

In 2025 so far, our bullish perspective on emerging market stocks have seen gains of 10%, 20%, and even 30%. Asian-Pacific Financial Forecast editor Mark Galasiewski presents the chart showing why this asset outperformance is just getting started.

“Recession Ahead?”

EWI’s Head of Global Research Murray Gunn answers the “Recession” question by showing the one indicator that has anticipated every U.S. economic recession since 1969. See the chart for yourself in this 90-second video.

Volatility Spikes and the “Onset of Fear”

EWI’s Global Markets Strategist Brian Whitmer looks at the Euro Stoxx 600 trend in 2025 and sees an “analog” in this market’s pattern to early 2007. As U.S. Dollar spirals against the euro, has sentiment has swung too far?

The Perils of Using Earnings to Forecast Stock Prices

Contrary to widespread belief, “exogenous cause” does not exist in the stock market. Put another way, good news does not necessarily mean stocks will go up and vice versa. With that in mind, consider corporate earnings.

In the Mood for Mangione Mania

We don’t need to tell you who Luigi Mangione is. But in our premier episode of “In the Mood” with Nico Isaac, we do explain how the accused murderer has become an American folk hero.

Elliott Wave Case Study: India’s SENSEX

EWI Senior Analyst Mark Galasiewski walks you through the foundational patterns of Elliott wave analysis—and shows how those patterns helped him forecast India’s bull market from the depths of the 2008 financial crisis.

Pay Attention to Retail Investors’ Actions (Not Their Words)

Actions, not words. Many investors say they’re worried about the stock market, yet this chart reveals their actual behavior. Learn how the “words vs. actions” of investors today compares to past notable junctures in the stock market.

Vaccine Hesitancy Claims More Victims

Amidst the worst measles outbreak since the disease was declared eliminated, social mood explains why many have begun to fear the thing that could save them.

Stock Market Valuations Are Out of This World!

This measure of stock market optimism became so extreme that it was literally nearly “off the chart.” Review one of the coolest market charts ever for a big-picture perspective.

The Dimmest Outlook Ever: Is a Consumer Collapse Imminent?

U.S. consumers are flashing a historic warning. As financial stress mounts, sentiment has plunged to record lows—worse than anything seen since the late 1970s. Spending cutbacks are spreading fast, and the data points to a looming consumer pullback that could trigger the next major economic downturn.

Will Technology Save — or Destroy — Humanity?

Will technology save or destroy humanity? The new May Socionomist has an answer not even chat GPT could conceive of!

Erroneous Assumptions

Myths about how financial markets work are pervasive. Many of these myths are based on the erroneous idea that investors react rationally to news and events. Nothing could be further from the truth, as this excerpt from the book, The Socionomic Theory of Finance, reveals.

EUR/USD: See What a Third-of-a-Third Elliott Wave Setup Looks Like

On February 28, long before “Liberation Day”, Currency Pro Service editor Michael Madden recorded a video for his subscribers with this chart and forecast for EUR/USD.

ESG Investing Sounded Good on Paper

Investing fads come and go. And when they “go,” many investors are caught off guard. Here’s an update on a forecast we made of a widely publicized sector which had been heralded as a “money machine.”

Dollar Index Plummets: See What We Showed Subscribers 5 Months Ago

In this Chart of the Day video, we reveal the exact analysis we shared with subscribers five months ago, accurately forecasting the dramatic drop in the US Dollar Index. See how our early insights helped viewers stay ahead of the market shift.

Here She Comes… Again: Miss 1950s America

Socionomics explains how the growing tradwife movement has a special place at the perfectly set table of social mood.

Identifying “Downside Leaders” Ahead of Time

No profits? No problem! At least, that was the attitude of many speculators. Get our take on a stock market index which appears to be on a fast track – to the bottom.

Chief Market Analyst Steven Hochberg on Kitco News

“On Thursday, April 10, EWI Chief Market Analyst Steven Hochberg sat down with Kitco News Anchor Jeremy Szafron to break down the latest moves in key markets—offering expert insight through the lens of Elliott wave analysis.”

Tariffs, Tumult, and a Trade War: Why Protectionism Thrives in Bear Markets

Trade tensions are exploding — but it’s not just about tariffs. This excerpt from our April 2025 Global Market Perspective reveals how erratic U.S. trade policies are part of a deeper, more dangerous trend driven by shifting social mood. Discover why falling commodity prices and rising protectionism signal a bigger storm ahead for the global economy.

Junk Bond Spread: Decisive Trendline Break

Bond investors are complacent no more! A sharp shift has taken place in these first few months of 2025. See this surefire signal of looming “financial trouble.”

‘Investors always want the most at the END of any advance’

Two days of the Dow’s all-time high, we posted a timely forecast including this excerpt.

Trade War in “Full Swing.” Are You Holding On?

Uncertainty over U.S. trade policy is at a fever pitch. Americans have questions. Socionomics has answers.

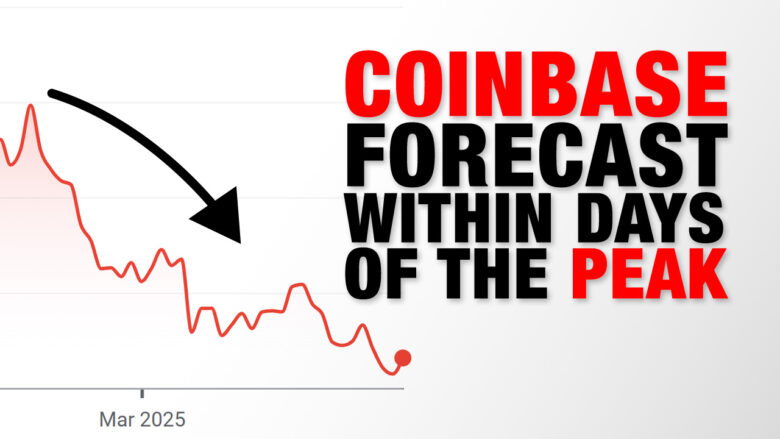

What We Said Before This Crypto Index Fell Fifty Percent

The Coinbase crypto index saw a powerful rally into December 2024. Yet, within days of the price peak, we forecast a reversal at two degrees of trend. See the Elliott pattern for yourself in our brief video.

Stocks Dive: House Prices Next?

The loan portfolio of the Federal Housing Administration (FHA) may be more precarious than it was before the 2008 housing crisis. What?!? Our Elliott Wave Theorist comments on the likely result.

Emerging Markets Up, U.S. Dollar Down

Emerging markets have dramatically outperformed U.S. stocks in 2025 so far. In January, that’s what our Global Market Perspective told subscribers to expect. See the forecast and what may follow the rest of this year.

High Market Drama Ahead!

See the high-yield (junk) bond chart that offers a “clue” hiding in plain sight that investor sentiment has changed profoundly..

Already a club member?

Login Now