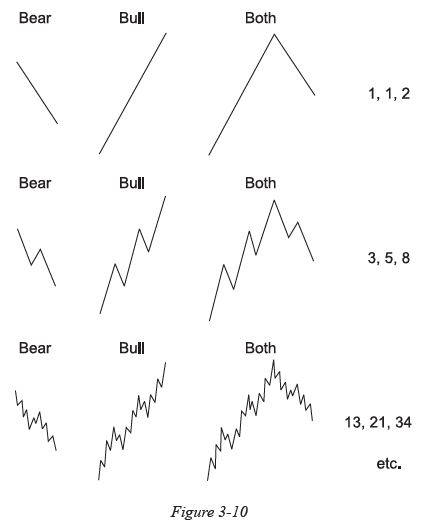

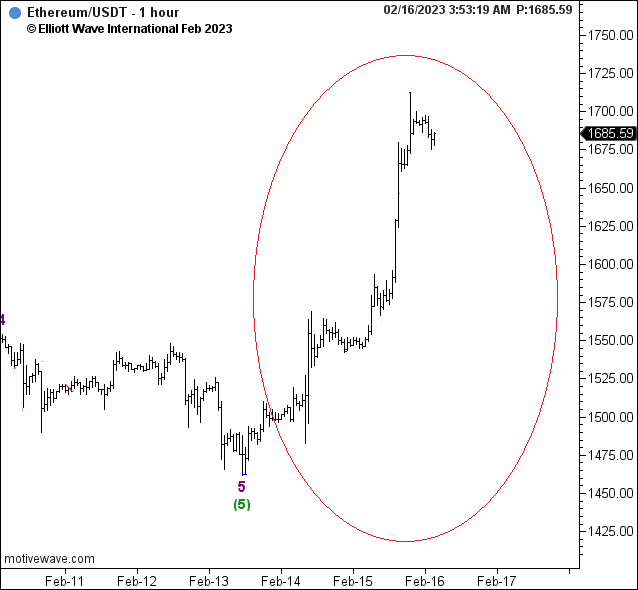

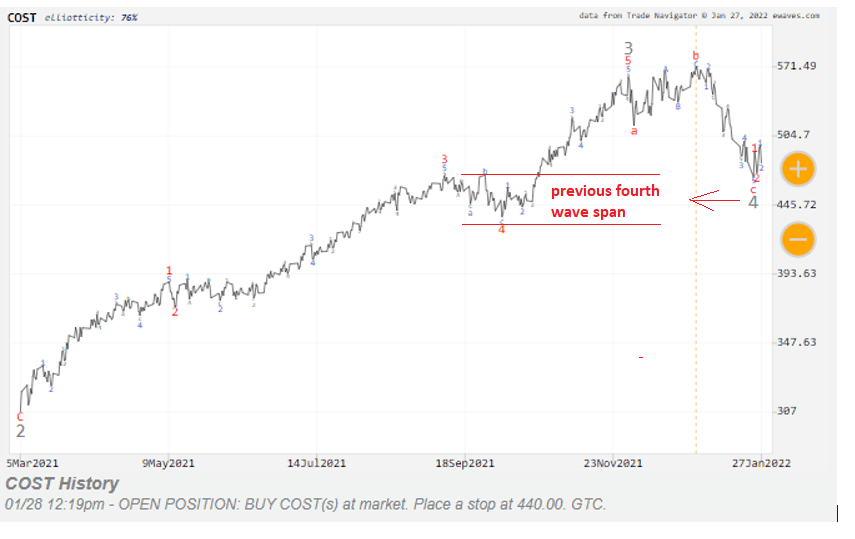

Elliott Wave Principle says this about the depth of corrective waves: “The primary guideline is that corrections, especially when they themselves are fourth waves, tend to register their maximum retracement within the span of travel of the previous fourth wave of one lesser degree.”

Now, check out this chart of Costco (COST) – as posted in our Flash Services. See that large grey-ish wave 4 over to the right? Now train your eye back to the left. See the red 3 and the red 4? (How can you not with the convenient lines we’ve added?) That’s the “span of travel of the previous fourth wave of one lesser degree.” Or, as they say in France, voila!!

And hey, as long as you’re at the store, grab me a few cases of something. I don’t care what; I just love volume discounts!

PS – COST rallied to over $600 by early April. That’s a LOT of paper towels!

Want to learn more about Elliott Waves? Sure you do – Read Elliott Wave Principle FREE