Category: Articles

-

How the EWAVES Engine Nailed the S&P 500 in 2025

EWAVES has been nailing the S&P 500 this year (2025), calling the Feb top and then the April bottom. Elliott Prechter, creator of EWAVES, explains how the engine was built and how it scans thousands of markets to spot high-confidence Elliott wave patterns.

-

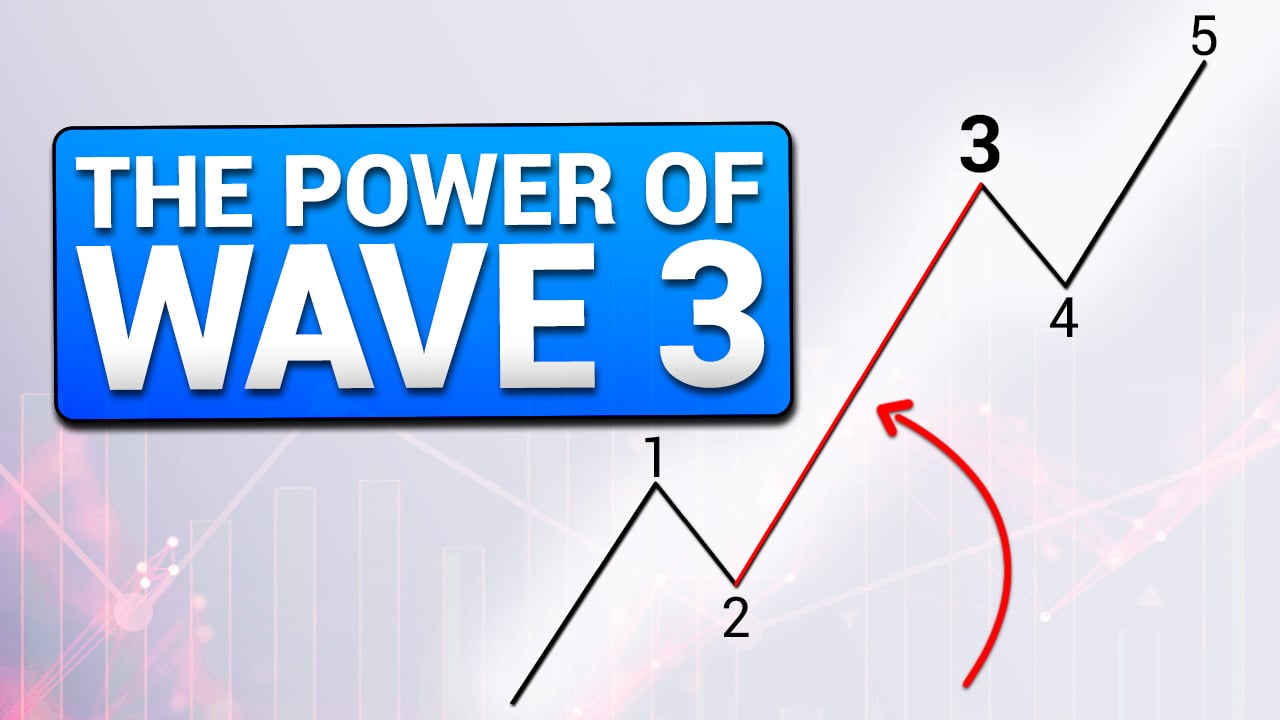

Third Waves Are the Ones You Want to Catch

Of the five waves in an Elliott impulse, the 3rd wave is the one you want to catch. And you definitely don’t want to be on the wrong side of one. Here’s why.

-

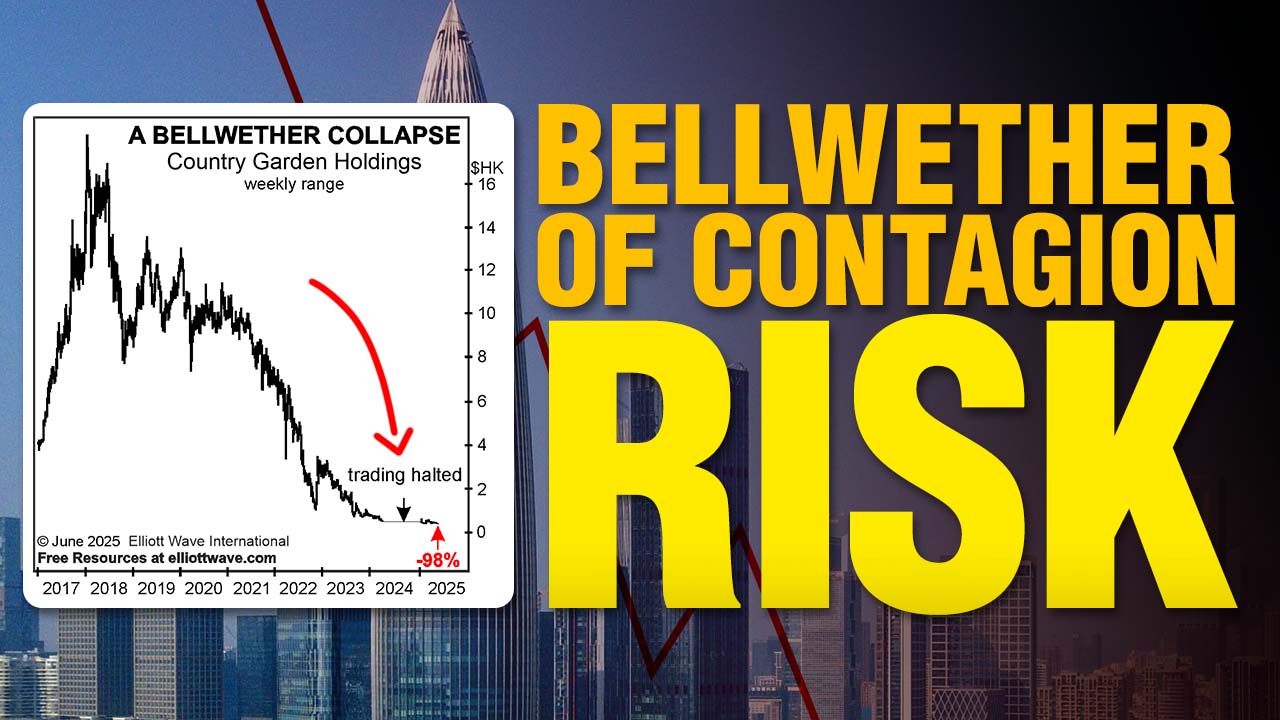

That Can’t Happen Here — Can It?

The world’s second largest economy appears to be on shaky ground. Let’s focus on China’s real estate sector and our analysis of a “bellwether of contagion risk.”

-

Musical (Fed) Chairs

Who will be the new Fed chair? Names are already being floated in the nation’s capital. But does it matter who heads the Fed as far as the trend of interest rates goes? You might be surprised.