Category: Articles

-

That Can’t Happen Here — Can It?

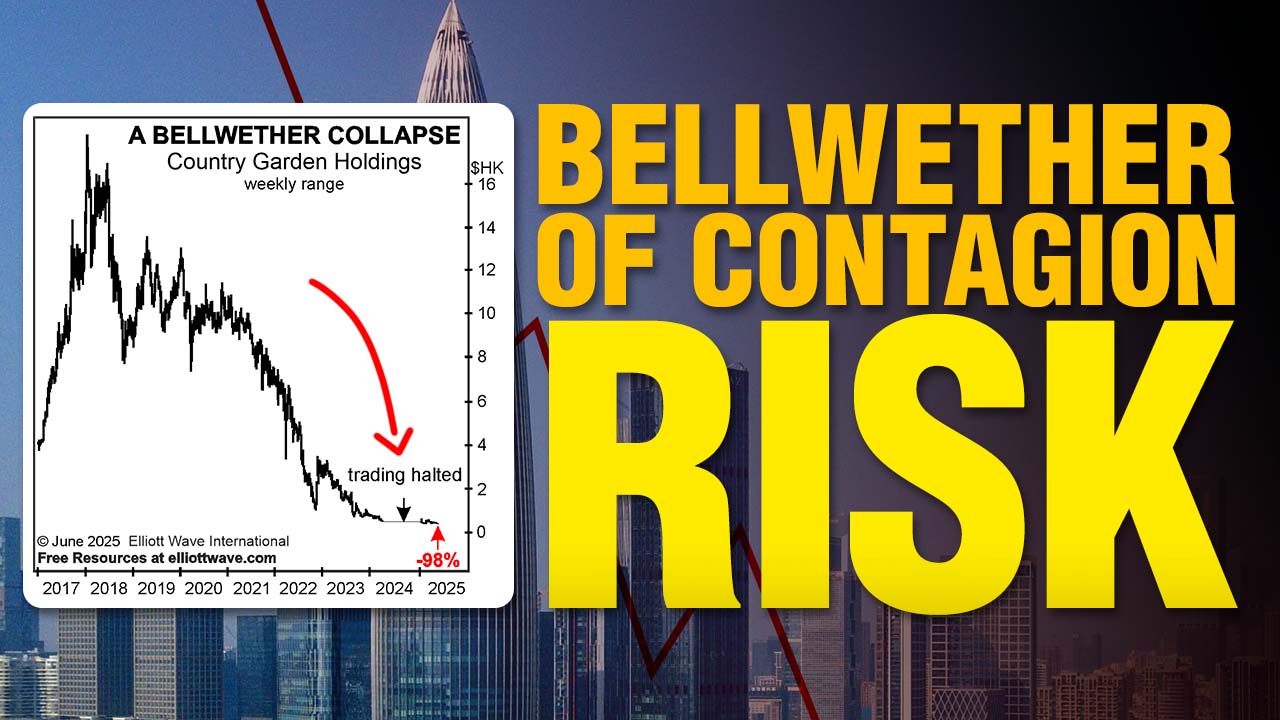

The world’s second largest economy appears to be on shaky ground. Let’s focus on China’s real estate sector and our analysis of a “bellwether of contagion risk.”

-

Musical (Fed) Chairs

Who will be the new Fed chair? Names are already being floated in the nation’s capital. But does it matter who heads the Fed as far as the trend of interest rates goes? You might be surprised.

-

Debt Ceiling Drama

Borrowing and more borrowing. That’s the story of the U.S. government. And, now, Congress wants to raise the “debt ceiling” – again. Here’s what you need to know.