Here’s an insight into the trend of tightening lending standards

It may seem a bit curious to discuss corporate bankruptcies around the time that the Dow Industrials has hit an all-time high.

But chalk the rise in the number of corporations biting the dust to a combination of too much debt and the rise in interest rates.

Rite Aid Corp. filed for bankruptcy on Oct. 16 because it was unable to fund a debt load of $3 billion. The company was able to secure a $3.45 billion loan to keep operating through the Chapter 11 process, but if our outlook is correct, lenders may not be so generous with other corporations as lending standards tighten.

Our November Global Market Perspective discussed U.S. corporate bankruptcies as it showed this chart and said:

The total number of U.S. corporate bankruptcies hit 516 in the third quarter, almost double 2022’s third quarter total of 263. ….

The percentage of banks tightening lending standards for large and medium size companies rose to 50.8% at the end of the third quarter.

Unsurprisingly, since we published that chart, the number of corporate bankruptcies so far this year has risen. As S&P Global noted on Dec. 8:

Rising interest rates and attendant operational difficulties have fueled the nearly 600 bankruptcy filings since the start of the year.

But the number of corporate bankruptcies is not just a worry in the U.S.

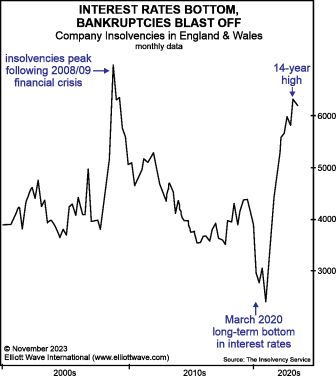

Here’s a chart and commentary from our December Global Market Perspective:

More than 6,200 companies declared bankruptcy in England and Wales between July and September 2023. Not only did insolvencies spike 10% year-over-year, but they also pushed to within 2% of a previous peak set just after the 2008 global financial crisis. As this chart shows, the decade-long downtrend in bankruptcies ended in the first quarter of 2021, closely following a generational reversal in interest rates from down to up.

As you may know, a lot of people have recently been talking about the prospects for lower interest rates. Of course, with all financial markets and conditions, fluctuation is to be expected.

But what about the bigger directional trend of rates?

Our Global Market Perspective provides you with insights that we believe will be highly useful to you.

Tap into those insights now by following the link below.

Your Global Investment Opportunity Roadmap for 2024

That “roadmap” is Elliott Wave International’s monthly Global Market Perspective: You can read the December issue online now.

Many of the 50-plus worldwide financial markets it covers are at pivotal junctures – in other words, their chart patterns show price trends that likely stand at the verge of abrupt and dramatic change.

Get ready to avoid risks and embrace opportunities in 2024.

As you look through the Global Market Perspective’s 40-plus pages, you’ll find in-depth coverage of major financial markets in the U.S., Asian-Pacific, Europe and other geographic regions.

You get our forecasts for global stock markets and economies, currencies, cryptocurrencies, bonds, metals, crude oil and more.

Follow the link below to get started now.