Here’s one way to tell if a stock index is a relative “bargain”: Compare its book value to its market value. Our November Global Market Perspective looks at Germany’s DAX and provides these insights:

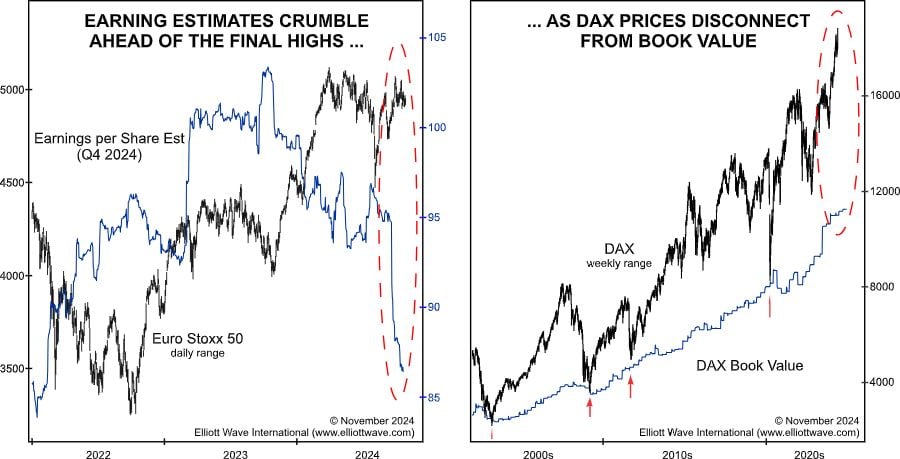

Over the course of 2024, additional divergences have developed among stock prices, earnings and valuations. While the Euro Stoxx 50 trades within 12% of its all-time high (can you believe the top came back in the year 2000?), company earnings have melted away faster than springtime snow. The chart on the left below shows that Q4 earnings-per-share (EPS) estimates peaked more than a year ago and just plunged to a two-and-a-half-year low. Meanwhile, the 40 companies that make up the DAX collectively trade at 1.8 times book value, which is historically extreme:

Book value is a good way to gauge valuation, because it shows where the DAX would trade if its constituent companies were to be liquidated. Historically, the DAX has been a major buying opportunity when prices trade close to their underlying book value, as they did in March 2003, March 2009, September 2011 and March 2020 (red arrows). In 2003 and 2009, the DAX even briefly touched its book value. Investors continue to bid stocks higher because social mood continues to wax positive, but the fundamental overvaluation that will burden markets over the next decade has quietly taken shape. The gulf that has opened up among prices and earnings and valuations will narrow dramatically in the coming bear market years.

The new December Global Market Perspective (publishes Dec. 6) provides you with updated insights into European markets, as well as the Asian-Pacific and the U.S. Tap into our latest analysis now by following this link.

Not ready to subscribe? Review our Highlights Issue on Global Markets – FREE. Check it out now.