Since the depths of the prior housing bust in 2007-2011, U.S. housing prices – both rents and the price of homes – have steadily climbed.

As a February 27, 2024 Fox Business headline said:

Home prices hit a new all-time high in December

We all know that the pandemic-era shift towards working from home pushed a lot of people to look for more space and drove up the demand for single-family homes. But another major reason houses have gotten so expensive – and this one goes back more than a decade — is that they’ve have been treated more like “investment” items versus “consumption” items.

As Robert Prechter notes in his landmark book, The Socionomic Theory of Finance:

When the bulk of participants in the market are consumers who think of houses as shelter, prices are stable. When a significant portion of participants in the market are speculators who think of houses as investment items, prices soar and crash.

And a lot of the “investing” in the housing market has been done by corporations, which began buying single homes in bulk, often a dozen or two at a time, near the bottom in real estate prices back in 2011-2013. And lately, this buying spree has been raising a lot of concerns:

- Corporate Home Buyers Restrict Widespread Homeownership (The Regulatory Review, July 27, 2023)

- Buying a home is tough: Corporate buyers make it even harder (90.5, WESA, Aug. 28, 2023)

- Investors account for 30 per cent of home buying in Canada (The Globe and Mail, Sept. 10, 2023)

- New Legislation Proposes to Take Wall Street Out of the Housing Market (The New York Times, Dec. 6, 2023)

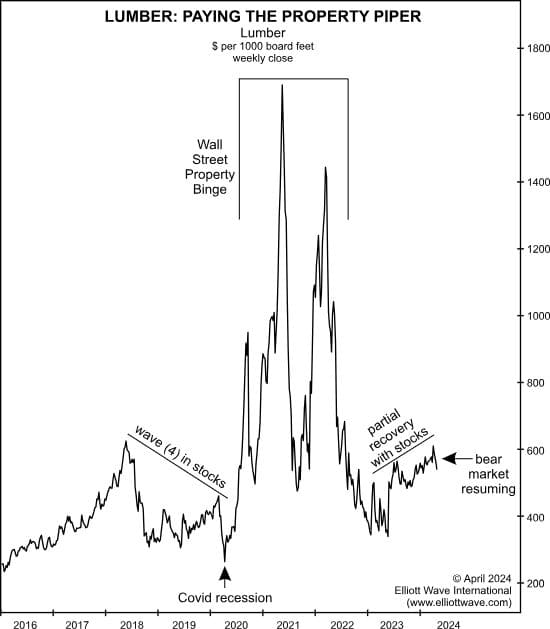

Yes, corporations have bought entire neighborhoods and many thousands of homes in communities across the country. Yet, there’s at least one sign that the upward trend in home prices may be set to reverse. Here’s a chart and commentary from our April Elliott Wave Theorist:

Lumber prices tend to fluctuate with the demand for new housing. [The chart] shows some history. Lumber prices were relatively calm until 2020-2022, when Wall Street firms went crazy buying up homes across the country, as if they are some sort of long term investment vehicle. All that investment jacked up home prices and prompted new building.

Lumber prices plunged in 2022, then recovered somewhat into early March of this year. In recent weeks, they have slid persistently, down 10% in a month. I think the bear market in lumber prices is resuming. Residential real estate prices should not be far behind.

The April Elliott Wave Theorist also provides its outlook on other major assets – which you are sure to find highly informative.

Follow the link below to learn how you can prepare for what we anticipate next for major financial markets.

Why Real Estate Prices Soared (and What May Be Next)

“I think the bear market in lumber prices is …”

Why does the housing market sometimes soar and then crash like the stock market? Here’s an explanation. Plus, get our insights into what may be next for home prices.