“We can expect a lot of corporate pain in the next couple of years”

A day of reckoning awaits many U.S. corporations — and that could arrive as soon as 2024.

A little while back, when corporations borrowed money to improve their balance sheets, they did so in record amounts and when interest rates were ultra-low.

Here’s a July 9, 2020 news item from The Financial Times:

The leveraging of America: how companies became addicted to debt

With the corporate sector already owing $10tn, many businesses are doubling down on new loans to survive the pandemic

So, if you’re wondering how a sizeable number of companies are holding up relatively well in an economy which shows signs of weakness, all that basically free money is a big reason why.

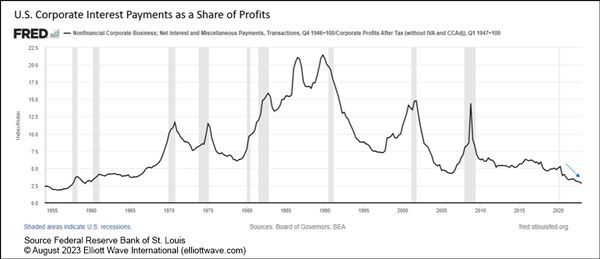

Elliott Wave International’s Senior Global Strategist Murray Gunn, who edits EWI’s new service, Global Rates & Money Flows, showed this chart in the August issue and said:

The chart shows the level of interest payments that U.S. corporates pay on their borrowings as a proportion of their profits. Historically, interest payments as a proportion of profits have risen before economic recessions [shaded areas] as higher rates pressure profit margins. However, since 2020, even though we have seen the fastest rise in bond yields ever and historic tightening of monetary policy by the Fed, U.S. corporates are paying less on their interest payments as a proportion of their profits.

This is undoubtedly a function of the low borrowing rates that were locked in during 2020 and 2021, and it means that corporations are not feeling much pain at all over the surge higher in interest rates. But that can’t last forever. When corporates must refinance, they will be faced with having to borrow at much higher rates and that will see interest payments as a proportion of profits balloon. 2024 and 2025 is when the bulk of the refinancing schedule really kicks in and so we can expect a lot of corporate pain in the next couple of years.

As this Aug. 7, 2023 news item from Markets Insider notes:

A $2 trillion corporate debt wall will spark job losses in 2024, Goldman Sachs says

“Companies will need to devote a greater share of their revenue to cover higher interest expense as they refinance their debt at higher rates,” Goldman said.

Recessions tend to be accompanied by a weakening jobs market.

Right now, the demand for labor is quite high.

However, it appears that change is just around the corner. Get more insights as you follow the link below.

Follow the Money — Here’s How

EWI’s newest service is called Global Rates & Money Flows, and it’s edited by Murray Gunn, our Senior Global Strategist.

As Murray notes in the August issue of GRMF:

Waiting for Godot is a play by Samuel Beckett in which two characters, Vladimir and Estragon, engage in a variety of discussions and encounters while awaiting the mysterious Godot. Although sending word of his impending arrival, Godot never shows. Participants in financial markets are increasingly seeming like Vladimir and Estragon, waiting for a U.S. economic recession to arrive. Some are questioning whether it will.

Like Godot, the recession has already sent word of its impending arrival. The most-oft-cited indicator is …

Get all of Murray’s analysis as he covers global fixed income markets, central bank machinations and changes occurring in money and currency markets, including digital currencies.

Murray is a veteran of Standard Life, the Abu Dhabi Investment Authority and HSBC. His new service is designed with institutions in mind, yet individuals may avail themselves of Global Rates & Money Flows too.