If a bull market is extended and valuations frothy, why don’t fund managers get wise and cut back on stock holdings? You’ll find the answer in this excerpt from our January Elliott Wave Financial Forecast, which informs you about the historical and current actions of these deep-pocketed investors:

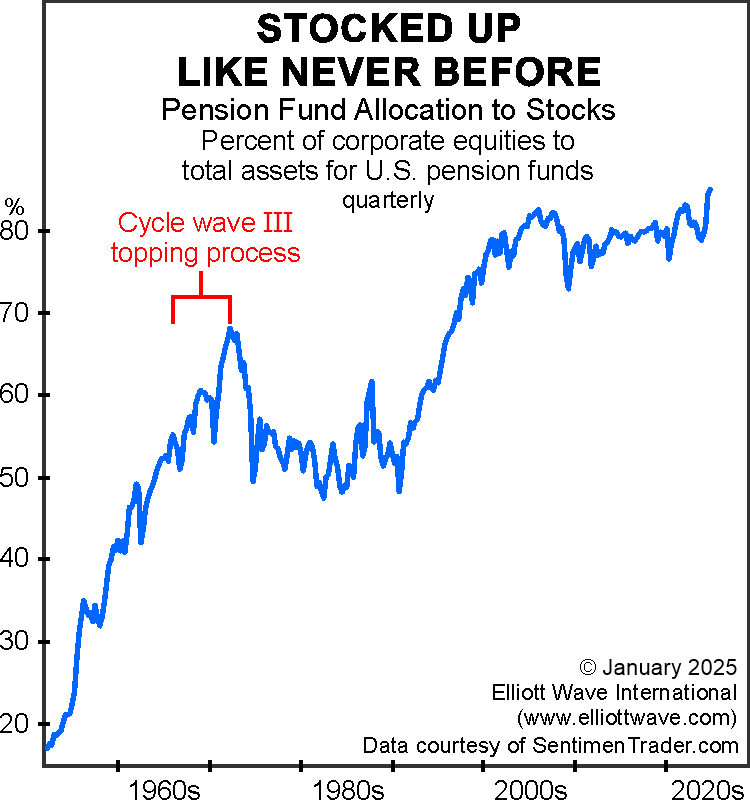

We have discussed “the little guys”’ extraordinary demand for equities. The pros are not far behind. This chart shows the extent to which experienced pension fund managers have committed themselves to stocks:

Pension fund managers were committed to equities through the top of Cycle wave III. Pension managers increased their allocation to equities to 55% in February 1966 and then to a record 68% in the first quarter of 1972 even though the Dow had not made a new high over the intervening period. In January 1973, as the DJIA started the biggest bear market since the Great Depression, stock holdings were still historically high at 67.4%. It was only in the wake of a 47% rout in the Dow that pension managers finally reduced their stock holdings to less than 50%. Why do fund managers not decrease their holdings at stock market tops? Because it’s mathematically impossible. Their heavy commitment to equities is what creates tops.

The chart also shows pension fund managers’ even more aggressive embrace of stocks in Cycle wave V. It was not until 1996, in the middle of Primary wave 3 of Cycle wave V, that the percentage of stocks in pension fund portfolios finally surpassed the extreme reached after the end of Cycle wave III. The percentage peaked briefly near the end of Primary wave 3 in 2000. From there, stock holdings in pension accounts floated even higher for the balance of the bull market. A slight uptick to a new record of 83% in the fourth quarter of 2021 preceded a 28% decline in the S&P 500 over the following ten months. The latest data show that on September 30, pension fund managers’ allocation to stocks spiked to yet another new record high of 84.9%.

Keep in mind that this is just one measure of the current extreme in bullish sentiment. We also delve into another measure, which is a “classic aspect” of major stock market peaks. Get the details via our Financial Forecast Service by following this link.

If you would like to sample us first, read our Stock Market Highlights Issue – FREE.