People approach shopping in stores objectively. For example, the latest news about Dollar General is that sales have been rising because even the affluent are seeking bargains. However, many of these same shoppers will buy stocks which are way overvalued. Why? Because they approach investments subjectively. Robert Prechter discusses this dynamic in his book, The Socionomic Theory of Finance:

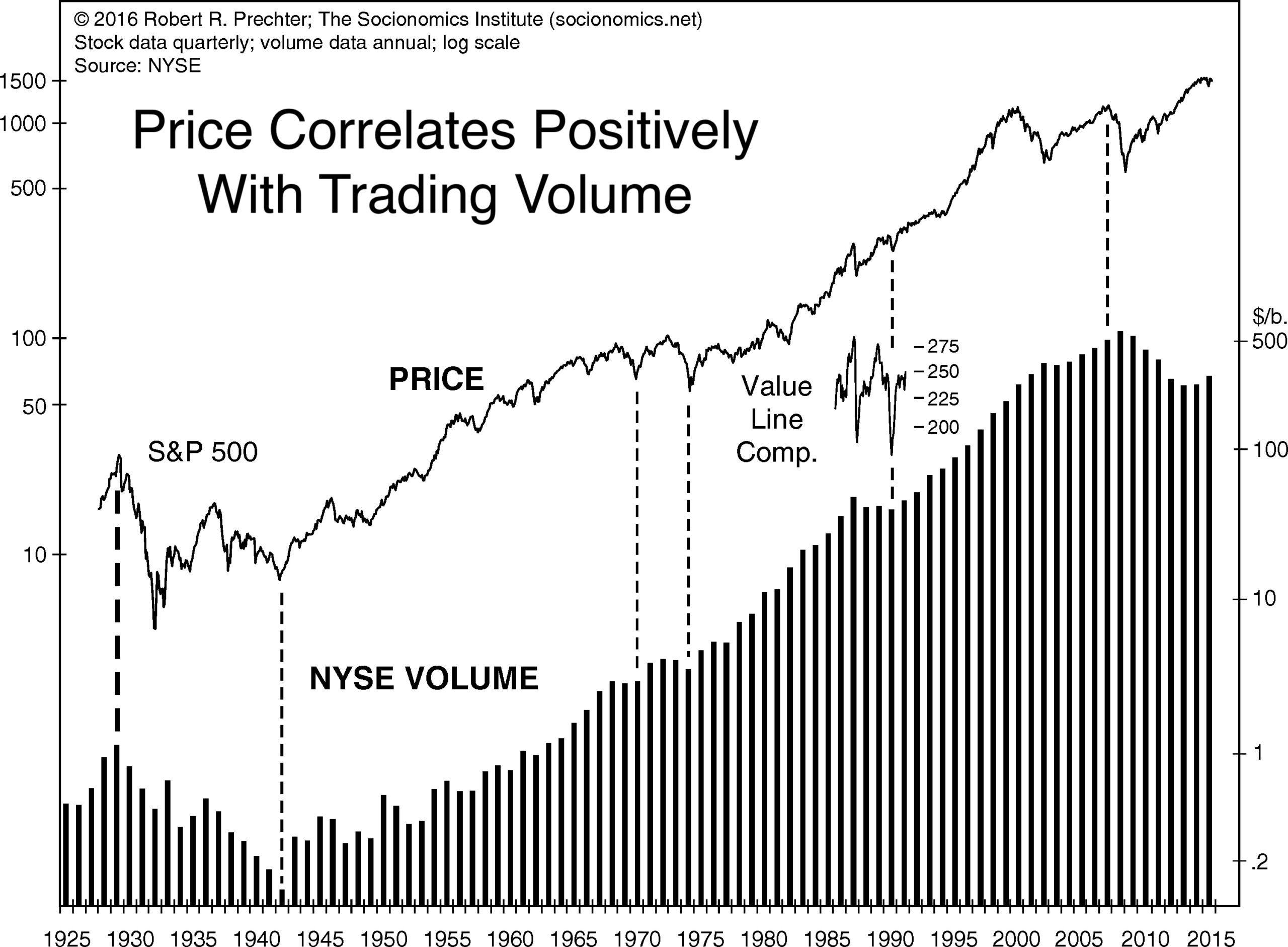

In the marketplace for goods and services, the volume of transactions almost always moves inversely to prices. High prices prompt consumers to reduce the volume of transactions, and a “liquidation sale” prompts consumers to increase the volume of transactions. The transaction volume in the marketplace for investment items, however, tends to fluctuate in the same direction as price. As prices rise, volume tends to rise, and as prices fall, volume tends to fall. Speculators do not shun high prices and rush in to buy bargains but rather tend to transact more as prices rise and stand aside when bargains are available. The chart below shows this tendency over an 80-year period:

When prices for goods are low due to a sale, consumers are excited, whereas when prices for investment items are low, speculators are defensive. Conversely, when prices rise, speculators are excited whereas consumers are defensive.

In these four fundamental ways—the number of owners vs. price, the extent of ownership vs. price, the volume of transactions vs. price and the emotions related to price change—conditions in the financial marketplace are the opposite of those in the economic marketplace. This is a striking fact.

How does all of this relate to the current stock market? Get our insights now by clicking on the button below.

Or, if you’re not ready for a subscription, get more financial insights by reading Chapters 1 & 2 of The Socionomic Theory of Finance. Follow this link for FREE access now!