Learn what’s occurring with the money supply for the first time in at least five decades

First, it’s important to understand that there’s more to inflation than just rising prices and more to deflation than just falling prices.

This is noted because even some economists largely define inflation and deflation in terms of rising and falling prices.

Yet, as Robert Prechter noted in the 2021 edition of Conquer the Crash:

The terms inflation and deflation should refer to things that can be inflated or deflated, namely money and credit. More useful definitions are: Inflation is an increase in the total amount of money and credit, and deflation is a decrease in the total amount of money and credit.

The rising and falling prices of goods are simply effects of inflation and deflation.

We’ve heard plenty of talk about inflation in the past couple of years, yet it’s deflation which appears to be intensifying in Europe.

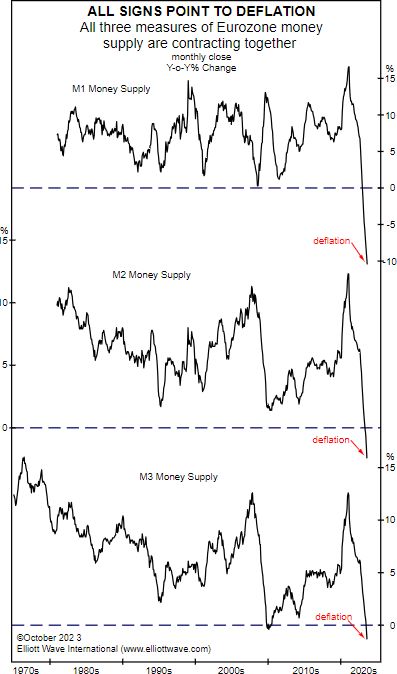

Our recently published November Global Market Perspective showed this chart and said:

In September, M1, which captures circulating coins, banknotes and overnight deposits, contracted at an annual pace of more than 10%. M2, which adds to M1 assets that people can easily convert to cash, dipped below zero in May and contracted at 2.4% in September. Finally, M3, the broadest measure of the money supply, dipped to -1.3% in September. As the arrows show, now is the first time in at least five decades that all three measures of Europe’s money stock have contracted together.

As our latest Global Market Perspective also notes, deflationary forces have intensified because the trend in social mood has flipped from optimism to pessimism.

Eventually, this pessimistic mood trend will show up as falling consumer prices and plummeting stock indexes. Also expect more bankruptcies across the Continent.

Some of these effects of a developing deflation are already occurring. Here are a couple of headlines:

- Business bankruptcy in EU surges to highest levels since 2015 (euronews. Aug. 26)

- German producer prices post biggest decline on record (Reuters, Sept. 20)

If our analysis is correct, expect headlines about European stock indexes in the not-too-distant future — and those headlines may not be pretty.

Get the details so you can prepare for potentially swift financial changes — not only in Europe, but other regions as well, including the U.S.

Learn more by following the link below.

Is Another Deflationary Depression Really Possible?

Note the word “another” in the title: It refers to the two prior U.S. deflationary depressions.

The first was from 1835 to 1843. The second and more famous one lasted from 1929 to 1933.

The 2021 edition of Robert Prechter’s Conquer the Crash mentions the latter:

Depressions are not just an academic matter. In the Great Depression of 1929-1933, many people lost their investments, their homes, their retirement plans, their bank balances, their businesses — in short, their fortunes. Revered financial professionals lost their reputations, and some businessmen and speculators even took their own lives. The next depression will have the same effects. To avoid any such experience, you need to be able to foresee depression.

Our Global Market Perspective will help you to see “around the corner” so you can prepare for what will likely take most people by surprise.

You can have our recently published November issue on your screen in moments as you follow the link below.