U.S. home sales just hit a 30-year low. In many ways, our analysis foresaw the reversal – here’s how

“Buyer’s strike” — “Deep freeze” — “Inventory famine” — “Seller’s nightmare” — “Full-blown housing crisis” – did I miss one?

In case you’re a turtle and live in a shell, the U.S. housing market is up a river. The above phrases are common parlance for the sector’s current state. In January, the National Association of Realtors dealt a painful blow. From the Associated Press:

“The National Association of Realtors said Friday that existing U.S. home sales totaled 4.09 million last year, an 18.7% decline from 2022. That is the weakest year for home sales since 1995 and the biggest annual decline since 2007, the start of the housing slump of the late 2000s.”

The news made the cover of the BBC:

It’s an epic undoing of an epic housing boom – one that was written on the freshly painted walls two years ago.

Let’s rewind the clock to January 2022. The U.S. housing sector just wrapped up its strongest annual performance in 15 years. From NPR, January 20, 2022:

“Home prices rose faster than ever in 2021. The typical home gained $50,000 in value.”

And, according to most mainstream analysts, the sector’s future growth trajectory was stable. On January 27, PR Newswire wrote:

“Even in the context of a year in which several housing records were topped, the scale of the housing market’s growth in 2021 is eye-popping.

“Strong demand met limited supply in 2021, driving home values up more than ever before — home values grew 19.6% last year, an all-time high in Zillow’s data, which dates back more than 20 years.

“This year is likely to be less competitive for buyers, but it will continue to be a sellers’ market.”

Added Washington Post on Jan. 10:

“All markets are seeing strong conditions, and home sales are the best they have been in 15 years… The housing sector’s success will continue, but I don’t expect [2022’s] performance to exceed [2021’s].”

But these industry heads had a blind spot; namely hope. By contrast in our March 2022 Elliott Wave Financial Forecast, we examined the bare, unbiased facts. And they sent one very clear message:

“The next important move for home prices will be a decline.

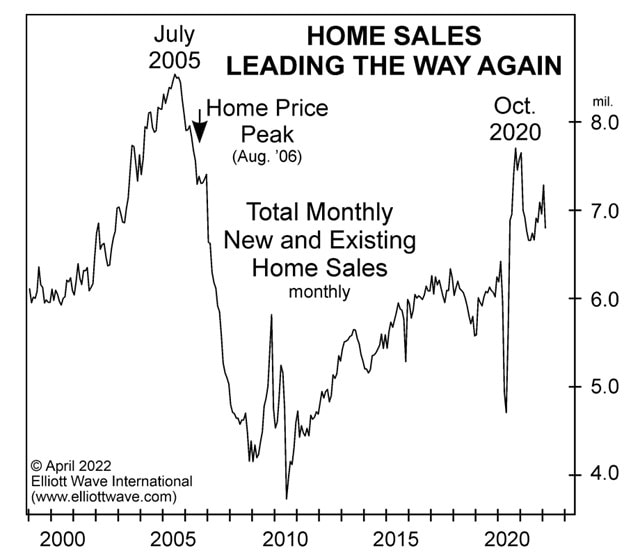

The next month in the April 2022 Elliott Wave Financial Forecast, we went against the bullish consensus (not our first time doing so!) and showed this chart of U.S. home sales.

“Bloomberg goes on to assert, ‘There’s little to indicate the American housing market will slow down soon.’ Of course, there’s not; there never is at a major peak.

“At this point, peak sales in new and existing homes occurred in October 2020, 17 months ago. After rebounding somewhat with the rally in stocks through the end of 2021, home sales fell ‘unexpectedly’ in January and February.

“Of course, the experts are sanguine. In a January 19 release, the NAR’s chief economist stated that ‘existing-home sales likely bottomed out in December’ and predicted ‘brighter days ahead.’ Let’s call it housing déjà vu.

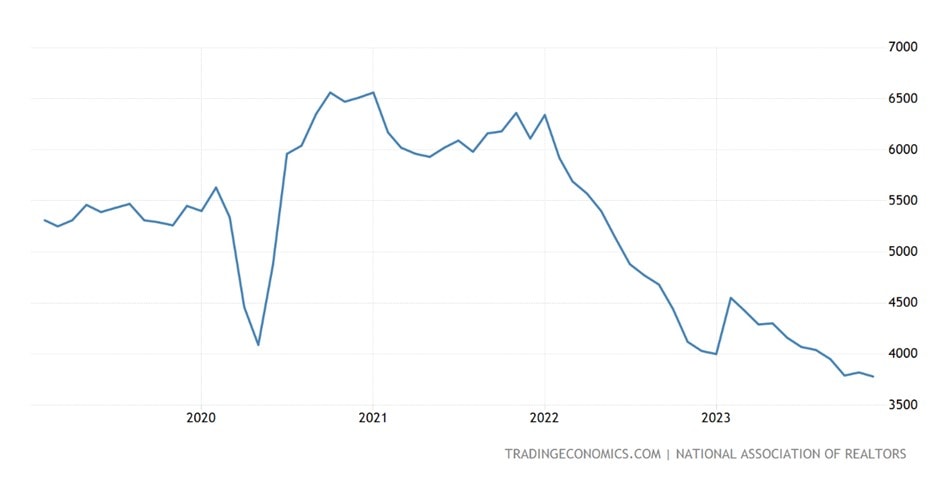

The chart below captures the full extent of the collapse in home sales to the 30-year low recorded in January.

(Source: Trading Economics)

Time and again, the seeming too-big-to-fail pillars of the economy do what few expected them to – that is, fail. Because inevitably, they start to rise again, erasing all memory of the pain that preceded it.

Right now, you have the opportunity to evaluate where the U.S. housing market is likely headed, based on objective measures alone, via our complete Financial Forecast Service.

How Do You Handle Financial Uncertainty?

If you are unsure about how to position your portfolio, put the current financial scene into context.

As Frost & Prechter’s Wall Street classic, Elliott Wave Principle: Key to Market Behavior, notes:

The primary value of the Wave Principle is that it provides a context for market analysis. This context provides both a basis for disciplined thinking and a perspective on the market’s general position and outlook. At times, its accuracy in identifying, and even anticipating, changes in direction is almost unbelievable.

Of course, even putting the behavior of a financial market into context offers no guarantees, yet we see it as a highly useful exercise.

Get our Elliott wave analysis for U.S. stocks, bonds, gold, silver, the U.S. Dollar (and more) by following the link below.