You know that prices for U.S. real estate are nowhere near a bottom when a vacant lot in Palm Beach, Fla. just hit the market for $200 million (realtor.com). And this is just days after a similar lot sold for $178 million. When can you expect the “bust” phase to start? Watch the stock market. As Robert Prechter’s book, Last Chance to Conquer the Crash, notes:

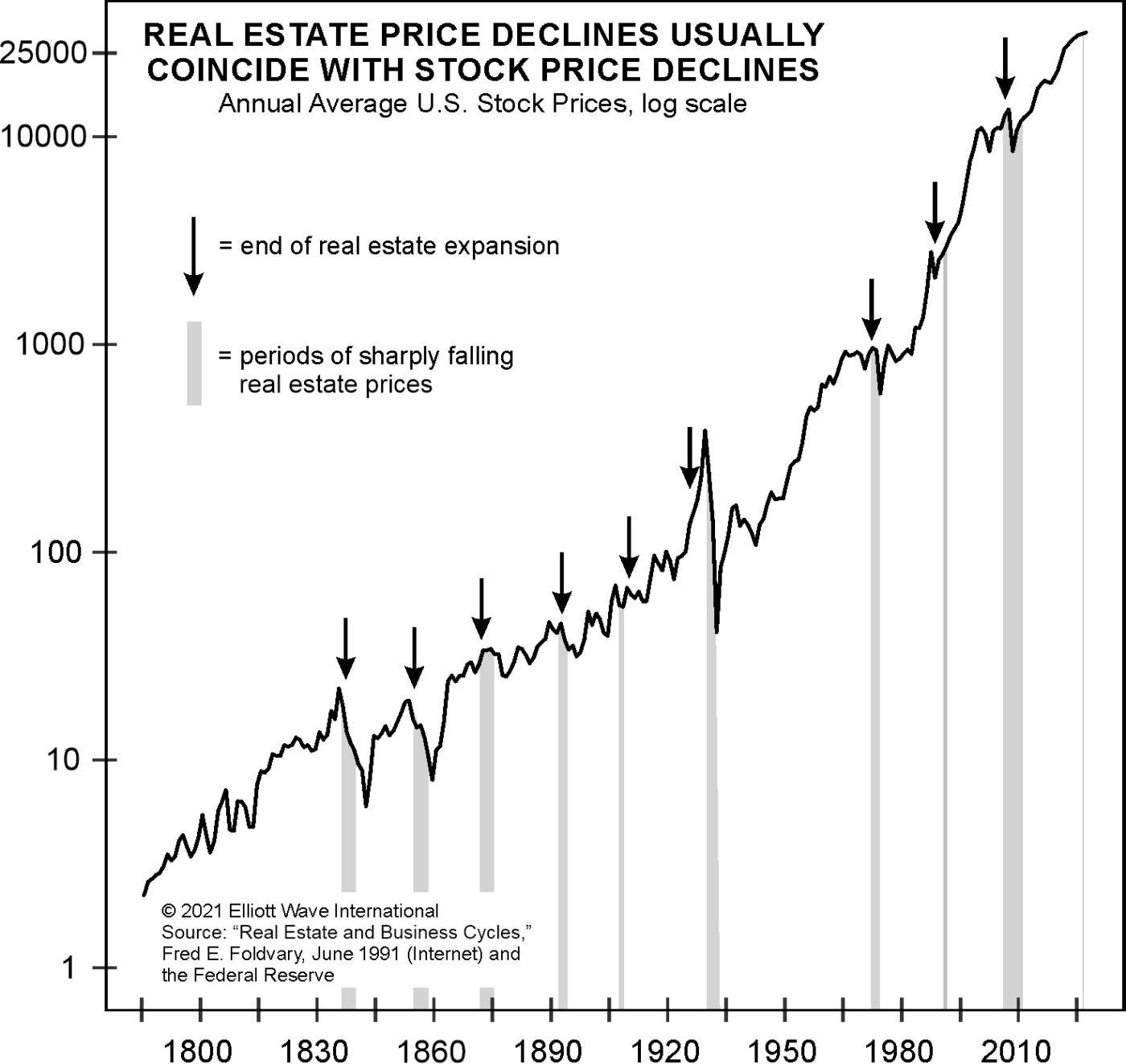

Real estate prices have always fallen hard when stock prices have fallen hard. The chart below displays this reliable relationship:

If you’re wondering how real estate prices soared in the first place, keep in mind that many people – as well as corporations – bought property as investments instead of as a place to live. This makes a big difference, as Prechter explains in The Socionomic Theory of Finance:

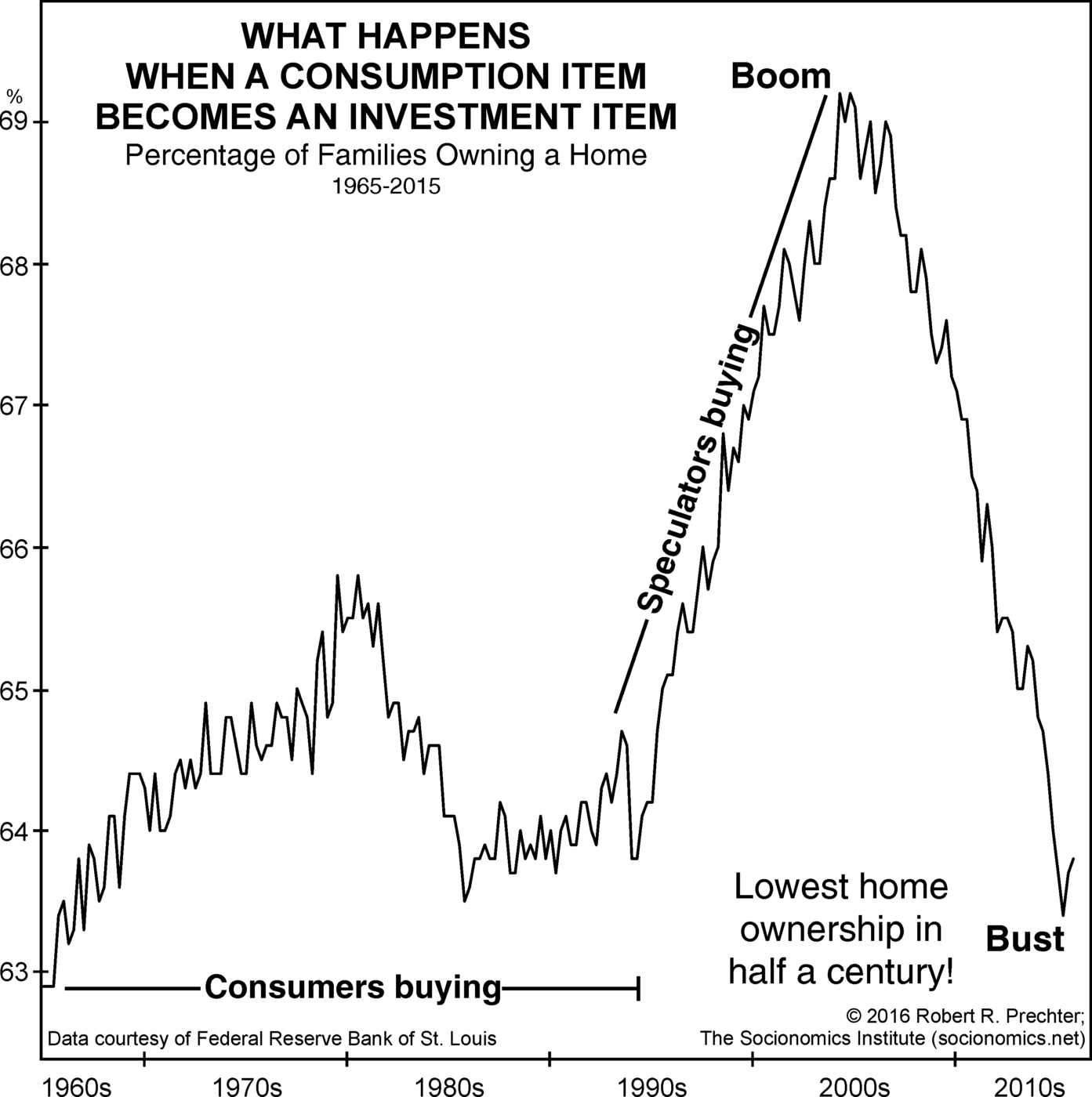

In the marketplace as a whole, a consumer good becomes an investment item when the bulk of market participants changes its orientation from self-regarding to other-regarding, in which case impulsive pricing invades the economic sphere. At times, people have bid up the price of rare coins or baseball cards as collectors’ items and the price of tulip bulbs or houses as investment items. From 1995 to 2006, many speculators built or bought housing and other properties in anticipation of higher prices, thereby treating formerly economic items as financial items. Market participants’ shift in mental orientation from a producing or consuming mindset to a speculative mindset changed their behavior, resulting in a classic boom and bust. See the chart below:

Elliott Wave International is distinguished by its years of in-depth research into how financial markets really work. This research has yielded many valuable insights, which we share with subscribers, making them among the savviest traders and investors on the planet. You can join them by getting analysis and forecasts from our flagship services – just follow this link.

If you’re not ready to subscribe, get myth-busting market research by reading Chapters 1 & 2 of the landmark book, The Socionomic Theory of Finance – FREE.