Look at this “steep and steady retreat”

No, U.S. business activity has not slumped into an all-out contraction (at least, not yet), but it is growing at a slower rate.

As a July 24 Reuters news item noted:

U.S. business activity slowed to a five-month low in July, dragged down by decelerating service-sector growth…

S&P Global said its flash U.S. Composite PMI index, which tracks manufacturing and service sectors, fell to a reading of 52 in July from 53.2 in June. [emphasis added]

Keep in mind that a reading below 50 indicates contraction.

We may be closer to that drop below 50 than many economic observers expect.

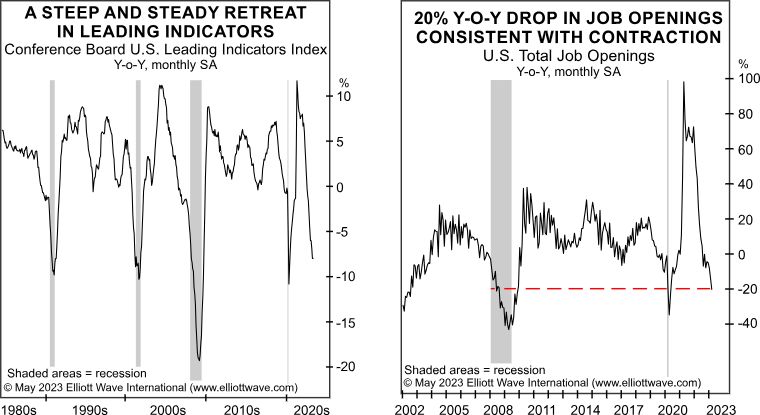

Here’s what our June Elliott Wave Financial Forecast noted via these charts and commentary:

The closer the economy gets to an outright contraction, the more sanguine economists seem to become. In January, EWFF observed that many economists expected a recession at some point in 2023. EWFF added that economists were bearish “but only by the slightest of margins.” …

This is somewhat surprising because many classic indicators of a recession are exactly where they were at the beginning of past recessions. In fact, the year-over-year change in the Conference Board’s Leading Indicators Index, which includes 10 different measures, is at -8%. As the first chart shows, similar readings came near the outset, or in, each of the last four recessions. In April, just three out of ten indicators were positive… A 4% decline in the LEI index signals a recession, according to the Conference Board… In February, one of the reasons we said a bullish economic stance would turn out to be a mistake was early signs of weakness in the labor market, which we discussed in December. The next chart shows another important labor market datapoint, the year-over-year change in the total number of job openings. At -20%, the latest figure is equivalent to declines within the recessions of 2008 and 2020.

Indeed, more than a month after the June Elliott Wave Financial Forecast published, CNBC had this headline (July 6):

Job openings fall by half a million

Our Elliott Wave Financial Forecast will continue to keep you ahead of trends in the economy, as well as provide you with Elliott wave analysis of stocks, bonds, gold, silver, the U.S. dollar and more.

Follow the link below to learn more.

See What Our Subscribers See:

High-Confidence Junctures in U.S. Financial Markets

These markets include the U.S. dollar, gold, silver, bonds — and, yes, the stock market.

If you want to stay ahead of trend changes in all these key markets, these forecasts are worth your immediate attention.

You see, swift price changes are anticipated — so you may want to review our Elliott wave forecasts now.

Learn how to enjoy instant and unlimited access to our main investor package by following the link below.