Yes, Congress passed and President Biden signed another last-minute government funding bill, averting a government shutdown crisis. Yet, another potential crisis related to borrowing and spending is brewing – as outlined by a recent Elliott Wave Theorist:

Economists do not look at the same factors we do when assessing stock market risk. An investment banker, citing recent economic numbers, claimed that today the U.S. has “nearly perfect” economic conditions to support a bull market. But economic numbers are not a basis for an investment opinion. They lag the stock market by months. The rising stock market predicted the positive economic numbers. Economic numbers are laggards and do not predict anything. Fed Chairman Powell recently declared, “I don’t see anything in the economy that suggests that likelihood of a downturn is elevated.” That is almost exactly what Fed Chairman Ben Bernanke said in 2007, just before the biggest stock market drop since 1929-1932.

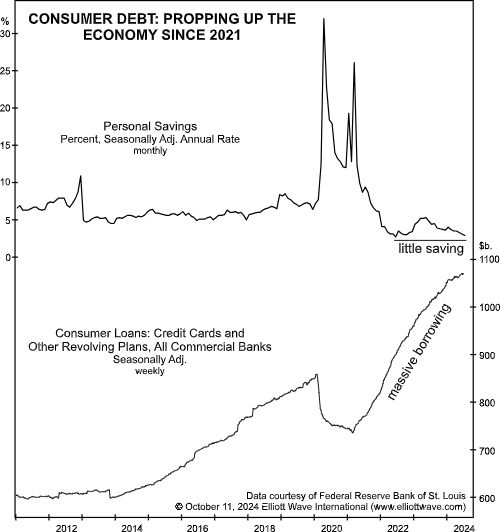

People need to look under the hood of the economy. The engine is not running on premium gasoline in the form of savings but rotting ethanol in the form of debt, as you can see in the chart below. This condition cannot endure. It is a forewarning of crisis:

Get more insights like this, which you most assuredly will not find in the mainstream financial media. Just review our flagship services, which include The Elliott Wave Theorist by following this link.

Not ready to subscribe? Sample us first. Read our FREE highlights issue on stocks.