You know the old saying – “Fool me once, shame on you. Fool me twice, shame on me.”

Maybe some lenders need a less-than-gentle reminder so they don’t get suckered. Read this recent Elliott Wave Theorist excerpt:

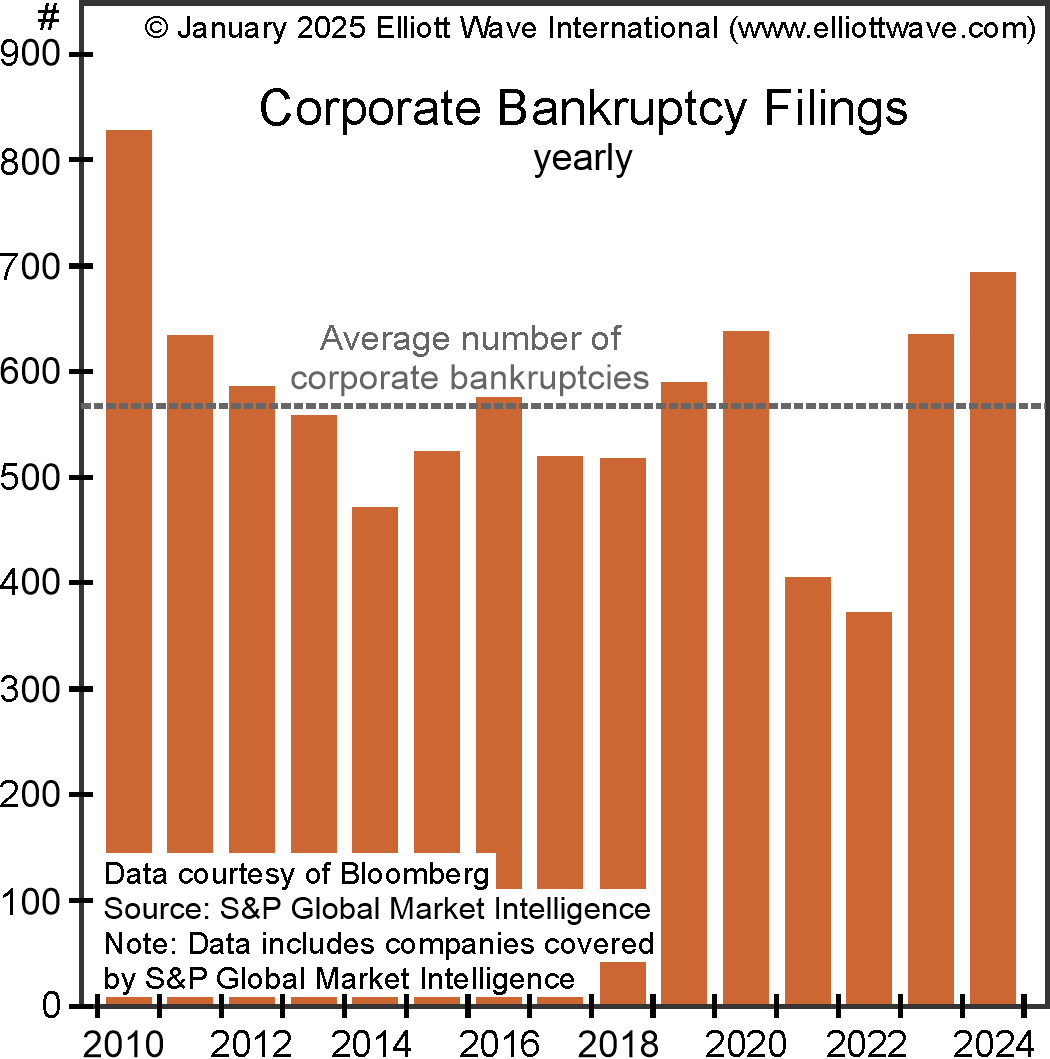

In 2024, even as stocks climbed persistently higher, corporate bankruptcies rose to their highest level since 2010. “Repeat bankruptcies” are also on the rise. These are companies that went bankrupt, returned to operation after debt restructuring, and then went bankrupt again. Bloomberg explained, “Over the past two years, more than 60 companies have filed for bankruptcy for a second or even a third time, according to BankruptcyData. That’s the most over a comparable period since 2020, when pandemic lockdowns shut down vast swaths of the US economy. All told, US corporate bankruptcy filings hit a 14-year high in 2024.” This happened in a boom year.:

Unprecedented financial optimism and the soaring stock market have made lenders believe they are safe. That psychological and financial support is about to disappear.

The era of indiscriminate borrowing by entities at all levels — individual, government and corporate — is coming to a close. Be prepared for credit-card defaults, pension cuts, corporate-debt defaults and municipal-government defaults. The size of the credit implosion will be massive. The deflation currently raging through China is giving us a sneak preview of what is about to happen here.

Indeed, a U.S. economic downturn may be much closer than many people realize. Remember the last slowdown? How’d your portfolio do? “Fool me twice…” Get wiser – follow this link.

Want more economic and financial insights like this? Sign up to get them sent straight to your inbox – FREE.