In one read, Global Market Perspective (GMP) will show you the Elliott wave patterns and trends for the world’s most traded markets. This includes stock indexes, forex, cryptos, interest rates, metals and energy. Each issue puts the world of finance and economics within your grasp, in ways no other source can.

Here’s just three of the many examples you can have on your screen within minutes:

The Rise of Protectionism: Anticipating a coming negative mood trend?

Protectionist policies got a big boost in May when U.S. Treasury Secretary Janet Yellen urged the EU to clamp down on Chinese exports. She warned that an export glut “could threaten the survival of factories across the world.” We know that trade restrictions prohibit the free flow of capital to the detriment of businesses everywhere. But instead of lifting the restrictions, Yellen believes she alone can decide the right price of Chinese goods. Worse, she’s so sure about her protectionist policy that she’s willing to punish American, European and Chinese companies that seek to trade those goods in an open market. Europe has pushed back … so far. Yet in the June GMP, our European analyst Brian Whitmer asks and answers this question: Will “Europe’s softer stance on Chinese trade outlast a major negative mood trend?”

China, the U.S., and Taiwan: Does the Cold War past predict today’s Cold War future?

In 2022, Russia-Ukraine became the first proxy battle in the current cold war, much like the Korean War (1950-1953) was the first proxy battle in the earlier Cold War. The Russia-Ukraine war could follow that precedent by ending in a stalemate sooner than most observers imagine. Then, even as the developing bull market in world ex-U.S. stocks contributes to years of relative peace, China could become much stronger militarily. In turn, the next proxy battle in the cold war rivalry—perhaps a China-Taiwan war—would be analogous to the Vietnam War when the U.S. dramatically escalated the fighting in 1965 and pulled out eight years later, as the communist government of North Vietnam in turn took over South Vietnam to reunite the country. In the June GMP our Asia-Pacific analyst Mark Galasiewski uses eye-popping charts and history to show a highly credible forecast that you simply cannot see or read elsewhere.

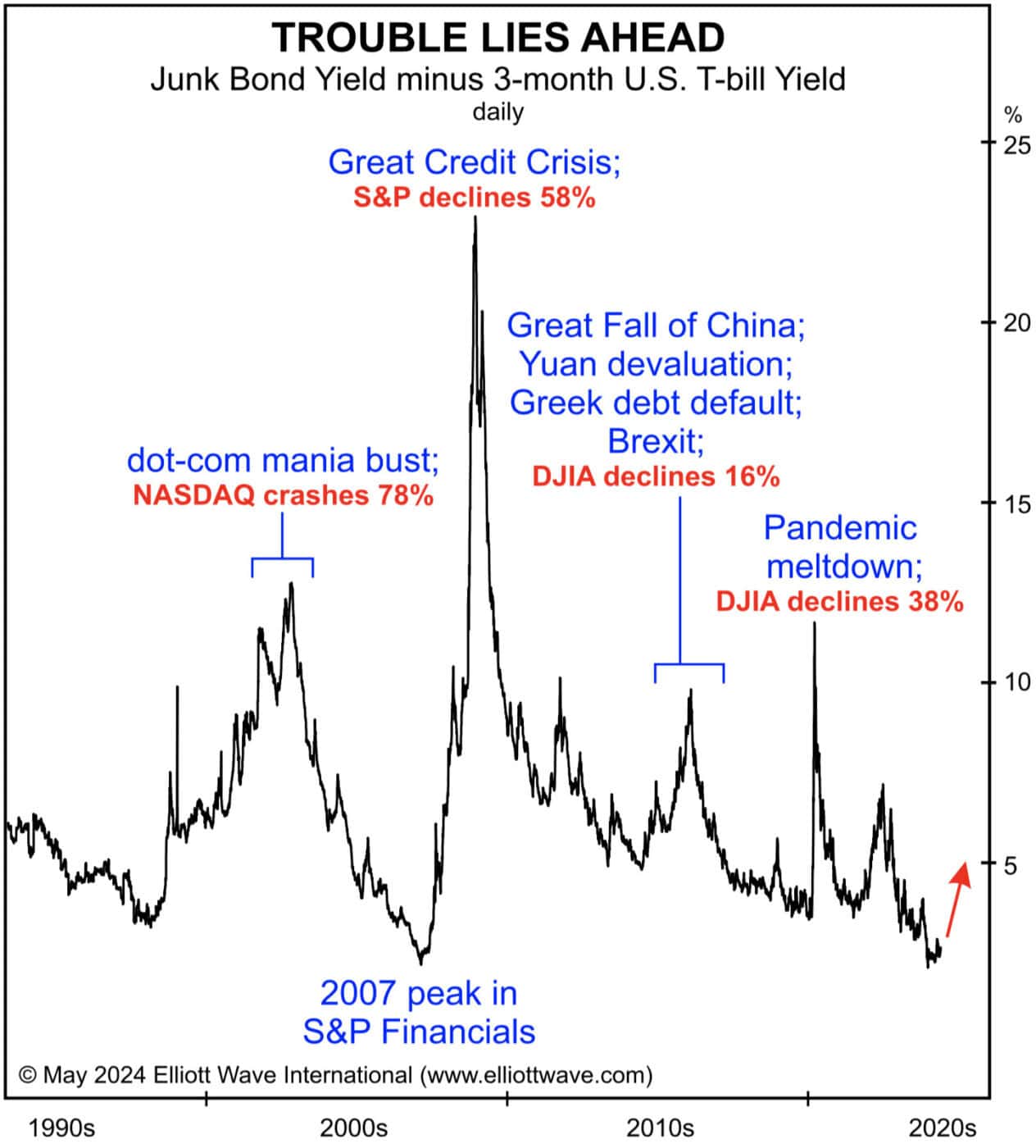

Today’s most overlooked financial news story: The junk bond versus T-bill “yield spread”

Few investors bother to follow the “yield spread” between junk bonds and U.S. T-bills. But today, that spread is almost as narrow as it was at the 2007 stock peak. We humbly suggest that the yield spread in the chart below is indeed worth following. Note especially the two low points in the trendline. Once you read the commentary from analyst Steven Hochberg, you’ll understand why he forecasts that “a significant widening of this spread will start this year, and investors’ historic complacency toward risk will be replaced by anxiety and eventually panic as financial asset values contract.”

These are three examples, yet there’s so much more: 15 dedicated analysts track all the most important financial markets at every degree of trend — from intraday ticks to epic price waves that unfold across decades.

Read and see it all within moments. Keep reading to learn how.

Here is Your Global Opportunity Fast Track

Get Timely Forecasts – and Tools – that Will Help YOU Catch the Next Big Wave

Given the number of market junctures around the world at this very moment, we wanted to bring you what may be our most timely bundle ever.

We want to give you everything you need to prepare for the big waves developing around the globe right now – in one no-nonsense package.

See if this does that.

You Get:

JUST PUBLISHED

Global Market Perspective

15 analysts covering 50+ markets

In one read, you’ll know the Elliott wave patterns and trends in the world’s most traded markets. This includes stock indexes, forex, cryptos, interest rates, metals and energy.

Each issue gives you all the details you need to assess and act on the biggest global risks and opportunities. Only expert Elliott wave analysis can provide this level of insight and confidence.

You get access to the May and just-published June issue – a $198 value.

SPECIAL REPORT

Markets We Like: 3 Below-the-Radar Opportunities

Robert Prechter

EWI CEO Robert Prechter’s special report offers three bullish opportunities that most investors have ignored. The trends are just starting and have plenty left to go. Yet most mainstream media outlets and economist are ignoring them!

You get instant access – a $99 value.