Observers of the economy have neglected to consult the data

In his eye-opening book, the Socionomic Theory of Finance, Robert Prechter discusses 13 market myths which can be detrimental to investors’ portfolios.

Many investors accept these claims as true, but they fool investors into making decisions which they wind up regretting. You can read them all for free by following the link below.

Let me go ahead and show you one of these myths, which has to do with trade deficits, the economy and stocks.

Many market observers believe that an expanding trade deficit is a big negative for a nation’s economy and hence, an indicator that stocks are headed lower. Thus, headlines like these are common:

Chief investment officer says rising trade deficit expected to stall economic recovery and derail stock market rally

Or –

Well-known money manager raises forecast for S&P 500 on better-than-expected trade performance

Granted, it does seem like an expanding trade deficit would be bearish and a shrinking trade deficit would be bullish.

Yet, here’s what Robert Prechter notes in the Socionomic Theory of Finance:

… had economists reversed their statements and expressed relief whenever the trade deficit began to expand and concern whenever it began to shrink, they would have quite accurately negotiated the ups and downs of the stock market and the economy over the past 40 years. The relationship, if there is one, is precisely the opposite of the one they believe is there.

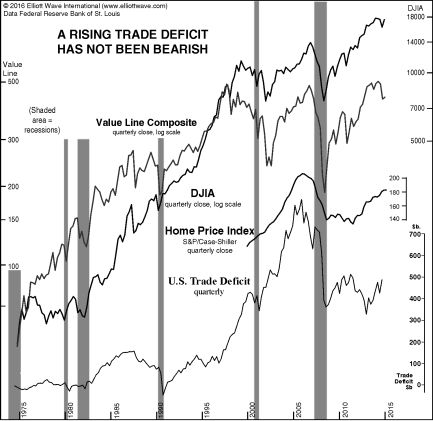

Those are astounding statements, yet they’re backed up by this chart from the book, along with additional comments:

Over the span of these data, there has been a consistently positive—not negative—correlation among the stock market, the economy and the trade deficit. So, the trade deficit’s widely presumed effect is 100% wrong. Once again, economists have made claims that are inconsistent with the data, and they have neglected to consult the data to see if their claims are accurate.

The bottom line is that the stock market is not governed by news like expanding or shrinking trade deficits, or even by how the entire economy is performing.

Get more knowledge as we debunk more claims which are widely presumed to be true but are not — in Chapters 1 and 2 of the Socionomic Theory of Finance, which you can access for free by following the link below.

13 Market Myths That Mislead Investors

Learn What They Are in The Socionomic Theory of Finance

- Positive corporate earnings “cause” the stock market to rally.

- Higher bond yields “cause” stocks to drop.

- Inflation “causes” gold and silver prices to rise.

Many investors hear these claims so often that …

… They assume them to be irrefutably true. So, instead of challenging the claims and assumptions, they instead invest untold mountains of money.

But please know this: Robert Prechter has performed extensive research. For example:

“Over the past four decades, hundreds of articles have quoted economists’ expressions of worry whenever the U.S. trade deficit expands and expressions of relief when it contracts. All their assessments were wrong, sometimes remarkably so.”

In his groundbreaking text, The Socionomic Theory of Finance, Prechter digs into financial history to expose the most popular cause-and-effect market myths touted by economists, news outlets and brokers.

Read the first two chapters now for free and discover 13 dangerous investor myths.