Elliott Wave International just launched the Global Opportunity Fast Track. You can read more about what’s included below.

But I wanted to go ahead and remind you of the first phase of the retail investors’ revolution which occurred during the first months of 2021 – when the little guy was out to beat Wall Street.

During that time, the meme stock craze saw GameStop (GME) shares soar a whopping 2311% in just 10 trading days – only to crash and burn in short order. Other stock favorites were also promoted on social media platforms.

You may have seen the 2023 movie “Dumb Money,” which told the story about the social media posts which launched the GameStop frenzy and its aftermath.

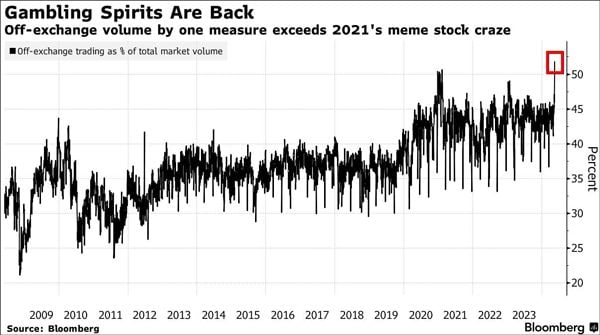

Here in 2024, the gambling spirits have returned. Here’s a chart and commentary from our just-published June Global Market Perspective:

This chart shows one measure of the retail revival. Off-exchange volume registered on platforms that match orders from brokerages is a good proxy for retail trading activity. Total off-exchange volume as a percentage of overall market volume hit a record high of 52% in mid-May, exceeding the extreme of 50% registered during the 2021 meme craze.

Along the same lines, we have this June 1 news item from The Financial Times:

Boom in US penny stock trading prompts warnings of frothy markets

Volumes for some sub-$1 shares are above those of Tesla and Apple as retail investors target cheap but volatile names

In Elliott Wave International’s view, this renewed zeal among retail investors to make a quick buck in cheap names should serve as a warning.

And so should this extreme bullishness directed toward the blue chips, as reflected by these headlines:

- Dow 2.8 million? It’s Not Even a Stretch—For Your Grandchildren (Marketwatch, May 23)

- Wall Street Strategist: Dow Could Hit 60k by 2030 (Fox Business News, May 20)

- Dow Hits 40,000: On the Road to 1,000,000 (Forbes, May 17)

Our latest Global Market Perspective mentions why all this financial optimism should serve as a red flag:

The crowd is never bearish at a high or bullish at a low.

It’s high time that investors look at the stock market’s price pattern, which repeats at all degrees of trend – not only in the U.S., but in other nations around the globe.

Prepare for what most investors are not prepared for by participating in our Global Opportunity Fast Track special offer now – learn more by following the link below.

This Stock Market Indicator Exceeds Level of Meme Stocks Frenzy (Video)

Look at this good proxy for retail trading activity

The gambling spirit among retail investors is back in a big way – even exceeding the meme stock craze of 2021. Animal spirits are also directed toward the blue chips with one headline mentioning “Dow 2.8 million.” Yet, investors should keep in mind this key insight regarding the crowd.

Global Opportunity Fast Track

You’ll be quickly up to speed on which chart trends stand on the verge of turning, according to our research and Elliott wave analysis.

Yes, we’re talking about global stock indexes, individual stocks, cryptocurrencies, forex, bonds, metals, energy and more.

Click on the link below to learn all that you get with our Global Opportunity Fast Track special offer now.