“More than half of U.S. households have been in the market for a generation”

A lot of people think that it’s perfectly normal to participate in the stock market – you know, like getting a drink of water or – breathing.

We here at Elliott Wave International call this the “equity culture” and it’s been going strong for a good many years now.

It’s difficult for many people to remember that it’s not always been thus.

Yet there’s been significant stretches of time when the populace at large wouldn’t touch stocks with the proverbial ten-foot pole – the years following the historic 1929 crash being a prime example.

Even at the top of the market in 1929, pollster Al Sindlinger estimated that only 20% of U.S. households participated in the stock market – based on interviews conducted in 1939. At the market top in 1987, the percentage of households in the market was 36%.

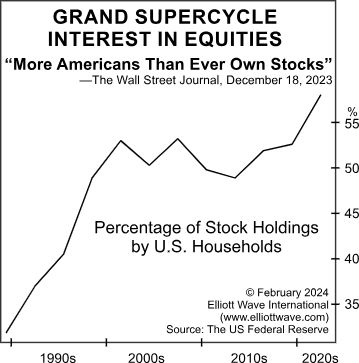

With this perspective, here’s a chart and commentary from our February Elliott Wave Financial Forecast which you may find interesting:

The percentage of stock holdings by U.S. households hit an all-time high of 58% at the end of 2022. The analysis in the Fed’s Survey of Consumer Finances lags by 11 months. Given the market’s recent rally, the 2023 figure is likely to be even higher. … Thanks to the Grand Supercycle degree of the bull market, more than half of U.S. households have been in the market for a generation.

And here in early 2024, the optimistic financial sentiment persists. Indeed, here’s a Jan. 16 Barron’s headline:

Investing In U.S. Stocks Still Makes Sense Despite High Valuations

And, on Jan. 18, the view of the CEO of one of the world’s largest money management firms was reflected in this headline (Seeking Alpha):

“Animal spirits” will stir the markets again in 2024

Only time will tell how the remainder of the year will play out, yet keep in mind that optimistic attitudes toward the stock market are unlikely to go on indefinitely. Another historic shift is all but inevitable.

Our analysis reveals what this shift may very well look like – so you can prepare.

Learn more by following the link below.

Why You Should Read Mainstream Stock Market Forecasts – Carefully

Robert Prechter’s book, Prechter’s Perspective, says:

Read forecasts carefully. If they are unsophisticated, linear extrapolations of a recent trend, it’s probably the best policy to toss them aside and go search for something potentially useful.

Many forecasts that you hear and read in the financial media are simply extrapolations of the current trend.

Anyone can do that.

A useful forecast is one that anticipates when a trend will change.

That’s the province of Elliott wave analysis.

Learn what our Elliott wave analysts are now sharing with subscribers by following the link below.