See why Solana’s record-setting October-November rally was ON the Elliott wave charts from the beginning. This story speaks for itself.

In case you’ve been living under a rock, artificial intelligence is everywhere, or should I say everywhA.I.re!?

On September 22, CroissantEth, a crypto developer, debuted a brand-new meme altcoin from the brilliant robot minds of ChatGPT and DALL-E. The robots originally named their token “FluffyUnicorn Coin” but later landed on “AstroPepeX.”

I couldn’t make this stuff up if I tried.

The trend has caught fire. On November 14, Finbold.com reported that investors are “increasingly turning to ChatGPT for financial insights and even predictions regarding specific assets.” Including the “optimistic” and “sceptical” 1-, 5-, 9-, and 27-year price outlooks for one of 2023’s best-performing cryptos, Solana. From the article:

“According to ChatGPT, Solana boasts robust fundamentals, positioning itself as a high-performance and scalable blockchain characterized by minimal transaction fees.”

Solana has been a standout, rallying from the mid-teens to $67 in less than two months before hitting an 18-month high on November 16.

A.I. can be a huge asset in some areas of problem solving. But, these Chatbots are using the same “fundamentals” to predict price trends as mainstream analysts. That’s not solving a problem. It’s perpetuating one, because “fundamentals” don’t drive price trends; investor pscyhology, which unfolds as Elliott wave patterns on charts, does.

Case in point, on November 17, Motley Fool drew a line from Solana’s rally to the conclusion of the trial against disgraced crypto giant Sam Bankman-Fried. From Motley Fool:

“The moment of truth came when Bankman-Fried finally took the stand and testified in his own defense on Oct. 27. As can be seen in the chart, the conclusion of the trial in early November coincided with a new, much steeper upward trajectory for Solana.

“So, long story short, a huge overhanging cloud seems to have been removed from Solana, and the outlook for this crypto suddenly looks much improved.”

But like most “fundamental” analysis, this logic is off a few tilts. The “overhanging cloud” was removed from Solana before the Oct. 27 testimony of B-Fried. In fact, the “moment of truth” for Solana’s upside return occurred on September 29.

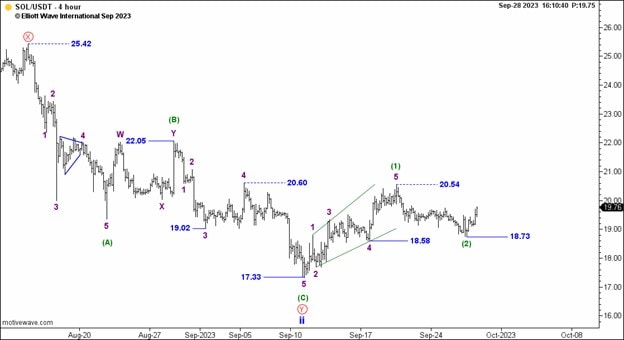

That day, after months of sideways price action, our Crypto Pro Service showed this chart of Solana. A trend-changing event had taken place; the conclusion of the wave 2 pullback, with a wave 3 rally — a HUGE rally — due next.

From September 29 Crypto Pro Service:

“SOL has advanced a bit further from 18.73, which ideally serves as the wave (2) low [at 17.33]. Breaking above 20.54 decisively would bolster the idea wave (3) is getting underway.”

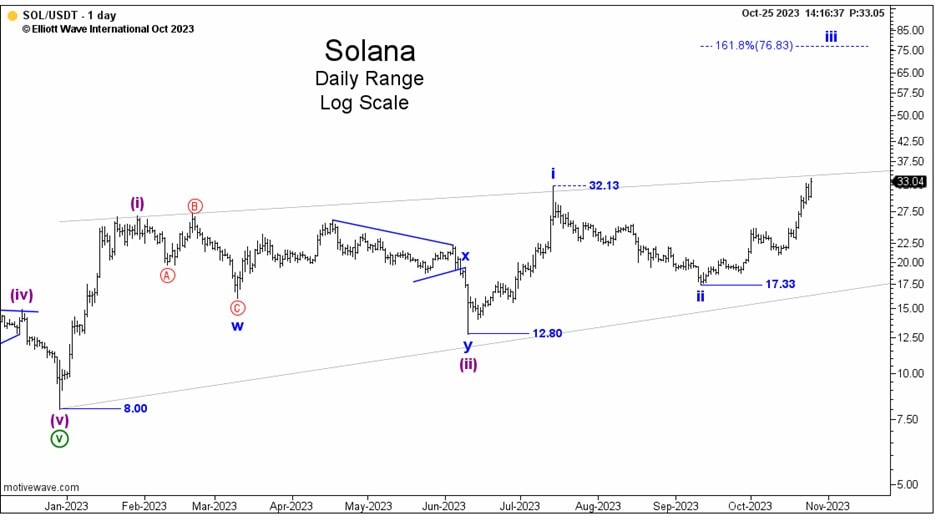

From there, SOL began its upward ascent. Our October 25 Crypto Pro Service widened the lens of Solana’s uptrend, showing prices rising as high as the $65-$75 area in November.

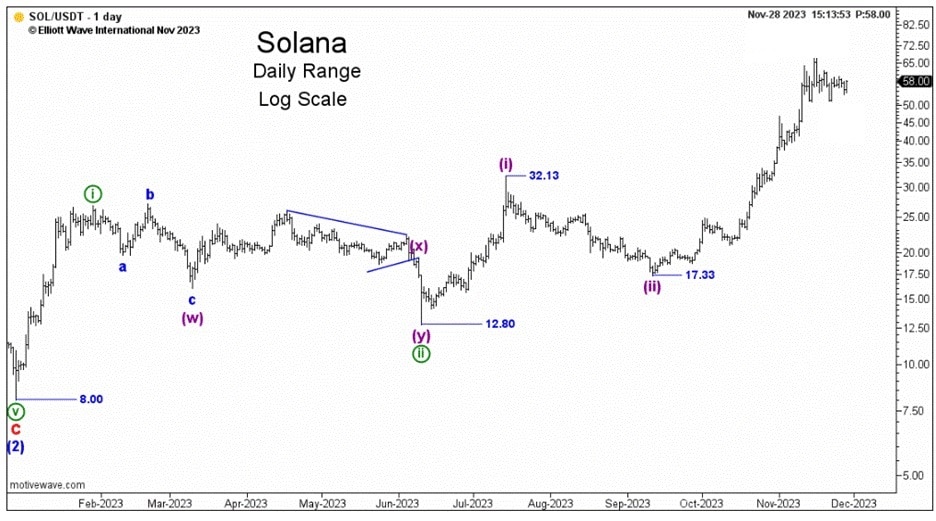

And this next chart shows the powerful rally that followed:

A.I. no doubt has a place in facilitating decisions big and small. But helping to predict market trends may not be one of them if “fundamentals” are the data of choice.

For that, a human being examining the Elliott wave patterns unfolding on price charts is still preferable. Is Elliott wave analysis perfect? Not at all. But every human interpretation of price action includes critical price levels to help manage risk for even the most volatile markets like cryptos.

Clear Waves = Clear Setups

Right now, the crypto waves are clear — and point to another year filled with opportunity.

Let us help you catch and ride the NEXT BIG wave in cryptos.

I’m an Investor

I need big-picture forecasts for cryptos each month.

Our Global Market Perspective now includes crypto coverage! Each month, Chief Crypto Guide Tony Carrion provides his detailed video analysis of the best crypto opportunities on his radar — including Bitcoin, Litecoin and Ethereum. Plus, you get Elliott wave forecasts for traditional markets like stocks, bonds, metals, currencies and more — more than 40 global markets in total.

$77

I’m an Active Trader

I need intensive crypto coverage throughout the day.

Cryptos are one of the most exciting markets on the planet, offering HUGE opportunities. And our guides have a lot of experience forecasting them. In fact, in 2017 we added this asset to our Pro Services intensive (intraday) coverage. Since then, our Crypto Pro Service analysts are on record with multiple calls that helped subscribers catch major moves. Join them now.