Yes, there’s been a recent pickup in stock market volatility, but overall, bullish sentiment remains very much alive and well.

Indeed, here’s a Feb. 18 Yahoo! Finance headline:

A Bull Market is Here.

On April 9, a Fox Business headline reflects the views of a well-known investment manager:

Fed doesn’t matter in this bull market

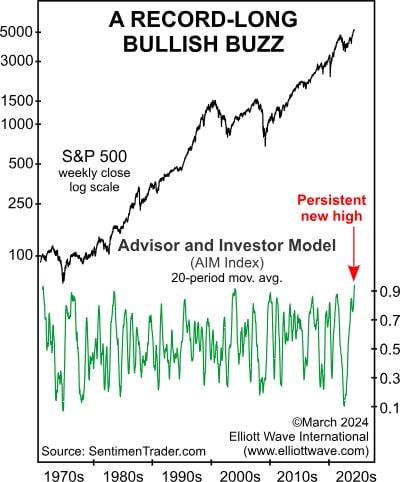

An extreme in bullish sentiment also shows up in the Advisor and Investor Model, which is a very broad measure of market sentiment compiled by SentimenTrader.com. The model is also known as the AIM Index.

This chart and commentary from our April Elliott Wave Financial Forecast provide insight:

The AIM Index constantly fluctuates between extremes; what’s unparalleled about it now is how long it’s been pinned to the top of its range. After hitting its highest possible reading of 1.0 on December 19, it stayed above .90 for the entirety of the first quarter for all but one week. This relentless bullish buzz is represented here by the index’s 20-week average. At 0.93, the April 2 reading is the highest in 53 years.

Yes, it’s possible that this dogged bullish sentiment could persist even longer. Yet, as you might imagine, Elliott Wave International considers extremes in market sentiment to be major red flags.

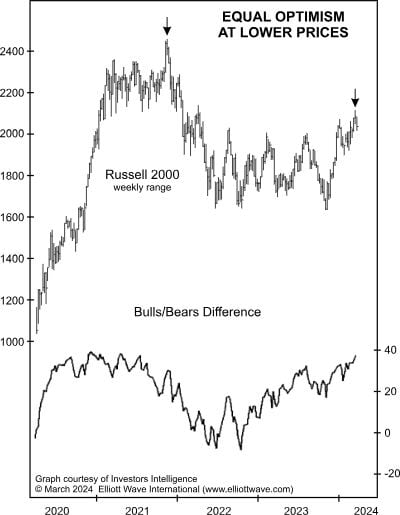

The April Elliott Wave Theorist reveals another cautionary sign via this chart and commentary:

As many pundits are saying, the market is not beyond the valuation of 2021, so what’s the problem? But that was the year of the most overvalued U.S. stock market of all time, from which broad indexes such as the Russell 2000 have not recovered. That optimism has returned to an equivalent level is a big deal. …

Now is the time to learn the important specifics of our U.S. stock market forecast.

You can get the details by following the link below.

This “Bullish Buzz” Reaches Highest Level in 53 Years

Learn what the AIM Index reveals

The word to describe today’s bullish market sentiment is “relentless.” Indeed, this sentiment measure recently reached its highest level in more than a half-century! Here are the details.