The last time the U.S. experienced a recession was in 2020 and it only lasted a couple of months. Yet, another one may be closer at hand than most observers realize, as our January Elliott Wave Theorist explains:

There has been talk that the Fed lowered its funds rate too far and must raise it now because long-bond yields have been going up. But the Fed does not use long-bond rates to fix its funds rate. It uses T-bill rates, which are smack on their lows of the past year.

Do not expect a change in the Fed funds rate until T-bill rates move. The Fed always jawbones reasons for its chosen funds rate with nonsense about employment inflation and the economy, but there has always been only one basis for the Fed’s rate changes, and that is changes in T-bill rates. For proof, see Chapter 3 of The Socionomic Theory of Finance.

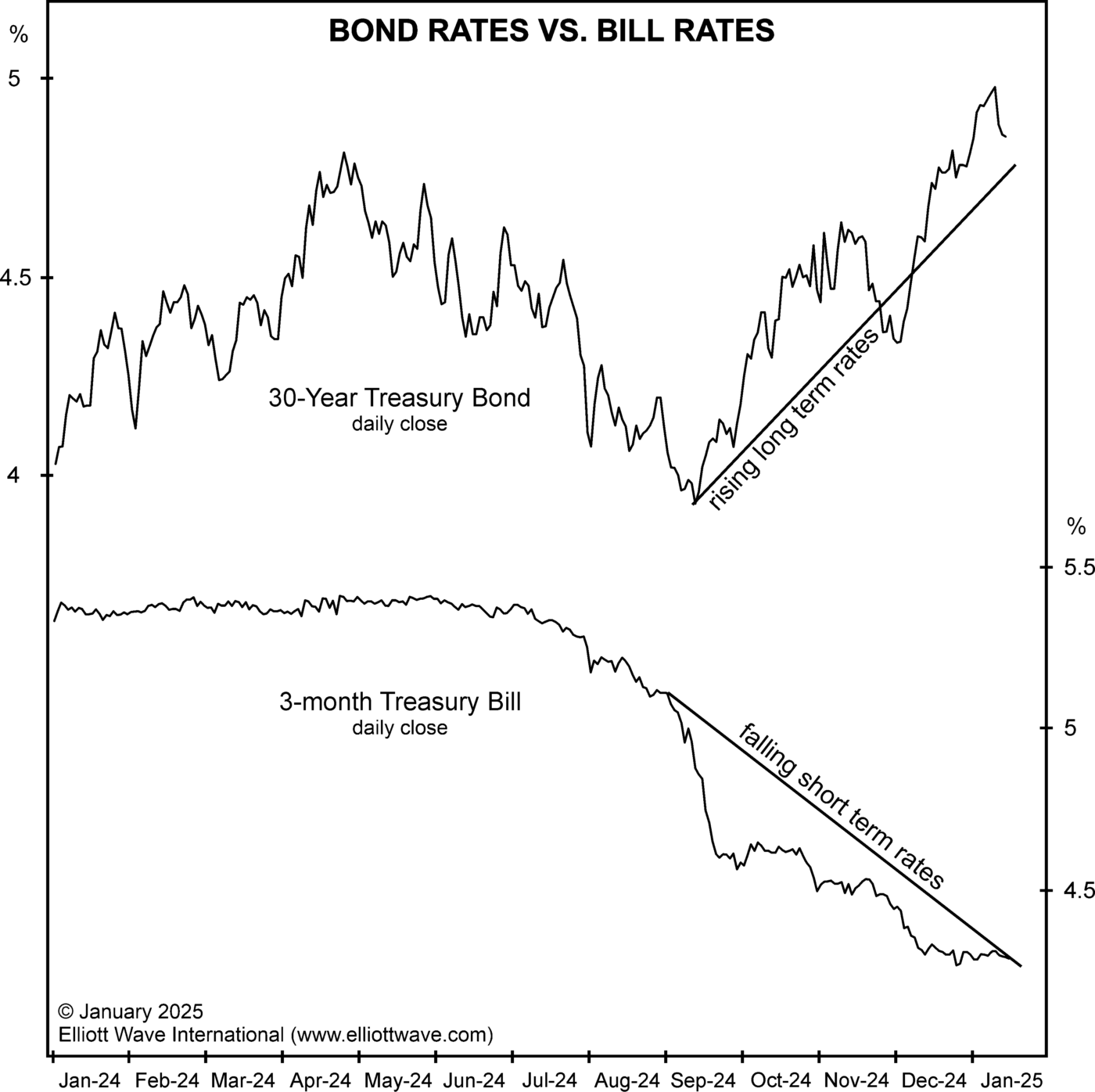

The chart below shows that T-bill rates started falling in July 2024, but T-bond rates started climbing in September. The yield curve is getting back to normal but not in the way investors wanted. The fact that T-bill rates fell and haven’t recovered suggests an economy on the brink of recession:

We [favor] T-bills, FRNs (2-Year Floating Rate Notes) and gold. It’s becoming clear why. Rising bond rates mean falling bond prices, an event that has been causing losses in bond portfolios. That trend is not going to help things in a recession.

The Elliott Wave Theorist is also watching the “High Drama In Gold, Tech Stocks And Real Estate,” which is the title of the recently published February issue. Be sure to get Robert Prechter’s latest analysis by following this link.

Speaking of The Socionomic Theory of Finance, get insights into how financial markets really work by reading chapters 1 & 2 – FREE.