Stoxx Europe 600: What Signs of Investor Exuberance Keep Telling Us

Brian Whitmer was a civil engineer in another life, so he’s got a good sense of how things are constructed. Applying that skill set, he deconstructs today’s sundry financial vehicles, like CDOs, meme stocks, subprime mortgages, SPACs, et al, and contextualizes them for his subscribers in the monthly European Financial Forecast and the European stock section of Global Market Perspective. He’s also got a bit of wanderlust and is currently traveling around the world for a first-hand, boots-on-the-ground feel for what’s really going on.

Every day, you read news stories about the state of the economy and the stock market affecting consumer and investor behavior. The story goes something like this: When the economy and financial markets show signs of improvement, consumers start to spend more, and investors buy stocks.

But if you’re a student of Elliott waves, you understand that this type of thinking is precisely backwards. It’s consumer optimism and the resulting consumer spending that elevates the economic markets; and it’s the investors’ bullish mood that translates into a rising stock market as investors buy stocks.

Social mood, in other words, comes first. Consumer and investor behavior – bullish or bearish – follows.

That’s why social trends can give you clues as to where the financial markets are likely heading next. For example, exuberant investor optimism often appears near major stock market tops, while deep pessimism accompanies major lows.

Let’s look at a key European market as an example. Back in March, the pan-European Stoxx Europe 600 index extended its rally to seven consecutive weeks. Most investors probably saw the strength as a reason to load up on European stocks. Readers of our European Financial Forecast, on the other hand, saw warning signs of exuberance flashing throughout society.

First, Lamborghini’s 2023 sales results showed an all-time record 10,112 cars sold last year. Lamborghini’s electric V12 Revuelto is sold out until late 2026 – a three-year wait!. Luxury goods tend to be popular at extremes in positive social mood, as the stock market and economic prosperity approach major peaks. They tend to go out of favor when these trends reverse.

Second, a March 10 Bloomberg headline said, “One of the Most Infamous Trades on Wall Street Is Roaring Back.” The trade in question was the so-called short volatility trade, where traders sell products that track stock volatility. “Investors are sinking vast sums into strategies whose performance hinges on enduring equity calm.” According to data from Global X ETFs, short volatility bets nearly quadrupled in two years.

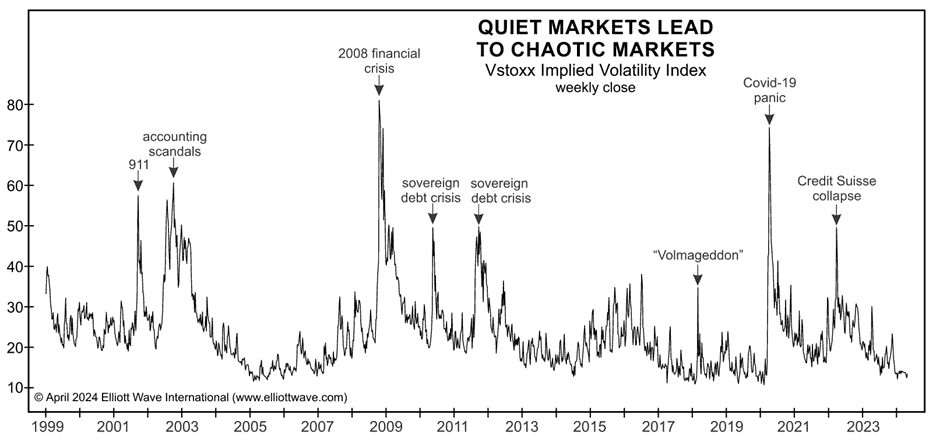

“Enduring equity calm” attitude among investors rang a bell. We had been here before. An earlier iteration of the same trade famously blew up on February 5, 2018, when the CBOE Volatility Index (VIX) suddenly spiked 20 points and destroyed vast numbers of professional and retail portfolios. The spike coincided with a global stock market sell-off and a two-and-a-half-year period of volatility that left the S&P 500 where it started. In Europe, the Stoxx 600 had peaked three years before the S&P, so the stretch of zero returns lasted nearly six years. This chart of Europe’s VIX equivalent, the VStoxx Implied Volatility Index, illustrates a few of the infamous volatility spikes over the past quarter century.

In our view, the re-emergence of the short-volatility casino is a much larger version of 2018. Five years ago, traders were gambling with a little more than $2 billion within a small handful of funds. Today, a mind-blowing $64 billion is being bet using “ETFs that sell options on stocks or indexes in order to juice returns” (Bloomberg, 3/10/24). Whether they know it or not, these traders are relying on smoothly functioning markets that behave the same way today and tomorrow as they did yesterday or the day before.

The warning signs we see in investor and consumer behavior are worth heeding. To predict the next move in European markets, I’ll continue to monitor social trends for clues. But more importantly, I’ll compare the Elliott wave price structures in stock market indexes to previous major junctures in those indexes. Tune in to The European Financial Forecast for my ongoing analysis, or sign up for our free newsletter below, and I’ll send you occasional updates like this.

Learn the Key to Market Behavior

Join 100,000 traders and investors who read the free EWI newsletter. It takes 5 minutes to learn how to time your market moves and make smarter financial decisions.