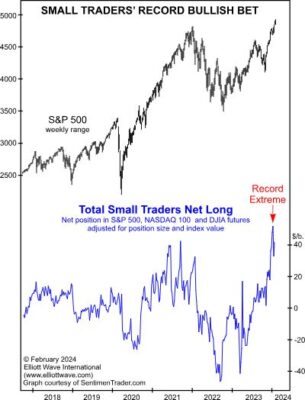

“The total easily exceeds the prior net long extreme”

When most everyone agrees on the future trend of a market, it’s almost guaranteed that the market will go in the other direction – sooner rather than later.

The reason why is that there is no one left to convince, hence, the market in question will likely have difficulty going in the predicted direction.

As Robert Prechter notes in a classic Elliott Wave Theorist:

The more convincing the arguments seem, the surer one can be that a consensus is signaling a turn in the other direction.

With that in mind, consider this chart and commentary from our February Elliott Wave Financial Forecast:

[A] new record was recently reached in the net long position of Small Traders as published weekly in the Commitment of Traders Report. The combined net long futures position of Small Traders in the S&P 500, NASDAQ 100 and DJIA soared to an all-time high of $51.59 billion on January 9. The total easily exceeds the prior net long extreme of $42.06 billion in September 2021.

As you may recall, that prior peak reading in investor sentiment occurred just weeks before the November 2021 top in the NASDAQ indexes.

That doesn’t mean that the exact same scenario will play out again.

However, keep in mind that the patterns of investor psychology tend to be similar each time around – as markets go from an uptrend to a downtrend and then back again.

And these patterns don’t just apply to the typical retail or Main Street investor, they also apply to money managers who may oversee portfolios in the tens of billions of dollars. Here’s a quote from another classic Theorist:

Small traders are typically on the wrong side of the market at the turns. You might think that large traders, because they have a lot more money, are right a lot, but they are likewise usually wrong at the turns.

Get more details on how we use the repetitive patterns of investor psychology to arrive at our forecasts for major U.S. financial mar