This sentiment index combines seven indicators into one useful trend measure

Elliott Wave International’s research reveals that the overall mindset of investors tends to follow a similar path each time around.

That is – market participants generally go from feeling deeply pessimistic all the way to feeling highly optimistic – and then back again.

These swings in investor psychology tend to produce similar circumstances at corresponding points in the Elliott wave structure of the main stock market indexes.

Let’s now consider the opposing mindsets of fear and greed and see what they reveal at this juncture in the S&P 500’s price pattern.

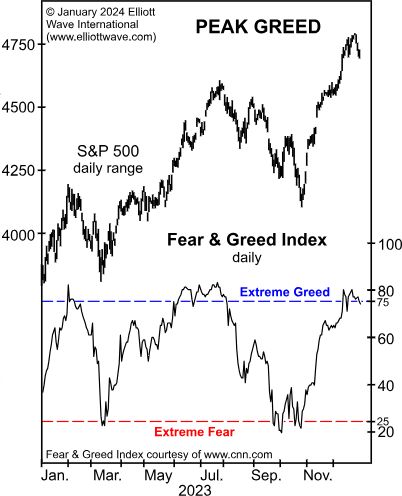

This chart and commentary are from the January Elliott Wave Financial Forecast:

The Fear and Greed Index (CNN.com) … combines seven different indicators into a sentiment measure. As shown, levels of Extreme Greed have occurred at or shortly before highs in the S&P 500 over the past year.

And this headline from Jan. 12 shows that even those at the top of the investment food chain are exhibiting no caution whatsoever – nor are they encouraging others to do so (Moneywise):

‘I’m more optimistic than ever’: Billionaire [CEO of Major Investment Firm] says investors should be 100% in equities if they can handle it

A year or two from now the current sentiment of this CEO and other optimistic investors may turn out to have been spot on.

Presently, the S&P 500 does hover near its record high. Yet, yet you may want to check out what the Elliott wave model reveals. In our view, it’s very much worth your immediate attention.

Get insights now by following the link below.

What’s Old Has Become Very Relevant … Now

Here’s a quote from our January Elliott Wave Financial Forecast:

Dow Theory is the oldest market indicator in the Dow averages’ history, and its conclusions often compliment the Wave Principle.

This observation doesn’t stand alone – we include a highly-relevant chart plus commentary that are worth your immediate attention.

Plus you’ll get our analysis of bonds, gold, silver, the U.S. Dollar, the U.S. economy and more by following the link below.