Here’s how remarkably skewed stock market leadership has been

You may find it hard to believe, but just seven stocks have been holding the stock market up – at least, mainly.

You may have heard their names a time or two: They are Meta (Facebook), Apple, Amazon, Alphabet (Google), Microsoft, Nvidia and Tesla – now known as the “Magnificent Seven.”

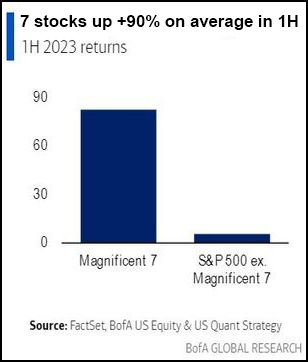

We’ve been keeping an eye on them for a while. Just to give you a progression of our coverage, let’s start with this chart and commentary from our July 2023 Elliott Wave Theorist:

[The chart] shows how skewed the leadership has been. Just 7 stocks account for nearly the entire gain of the S&P Composite index of 500 stocks for 2023, never mind how much they dominated the NASDAQ indexes.

Our October Elliott Wave Financial Forecast offered this updated perspective:

Just seven tech-focused stocks … known as the Magnificent Seven, are responsible for nearly the entire year-to-date change in the capitalization-weighted S&P 500. The “other” 493 stocks in the index have contributed less than 1% to the S&P’s change this year.

The persistent enthusiasm for those well-known big-cap tech names is captured in this September headline (Marketwatch, Sept. 16):

Here’s an Easy Way to Make a More Concentrated Play on the ‘Magnificent Seven’ Stocks

This is also a perfect example of crowd behavior.

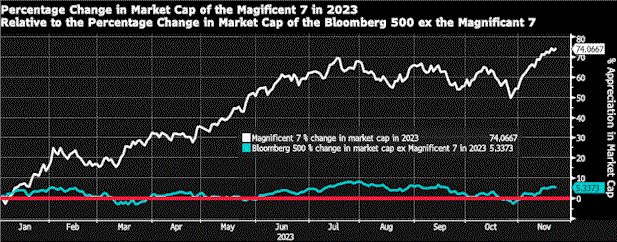

Our coverage of these seven stocks continued with this update from our Nov. 22 U.S. Short Term Update:

The top line on this chart from Bloomberg shows the percentage change in 2023 in the market cap of the Magnificent Seven: Apple, Microsoft, Alphabet (Google), Amazon, Meta (Facebook), Tesla and Nvidia. The bottom line on the chart shows the percentage change in the market cap of the Bloomberg 500, an index similar to the S&P 500, excluding the market cap of the Magnificent Seven. Were it not for seven stocks, the market cap increase in the Bloomberg 500 would be less than the return on short term U.S. T-bills. … There has never been such a high weighting in the S&P in such a few number of companies.

When investors finally turn sour on these seven stocks, expect the S&P to plunge.

When might that happen, and how do you know the signs to look for?

Just know that Elliott waves directly reflect the repetitive patterns of crowd behavior, and these recognizable patterns can help you anticipate major market turns.

Get our Elliott wave analysis of the major U.S. stock market indexes by following the link below.

Enjoy Instant-Access to Near- and Long-Term

Elliott Wave Analysis of Major U.S. Financial Markets

You can get it via our Financial Forecast Service, which includes the Elliott Wave Theorist (published monthly since 1979), the monthly Elliott Wave Financial Forecast and the U.S. Short Term Update (near-term forecasts, thrice weekly.)

Subscribers enjoy instant access to actionable analysis of the main U.S. stock indexes, bonds, gold, silver, the U.S. Dollar index, the U.S. economy and much more.

See this actionable analysis for yourself by following the link below.