Here’s what happened to the once most valuable U.S. startup

SoftBank, the multinational holding company which is heavily involved in the technology sector, has had a tough go of it.

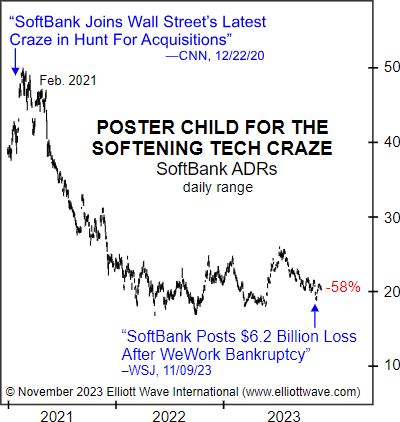

Its stock price has been in a steady decline for the past few years and one has to wonder if this is a preview of what may be ahead for many other firms, especially those in the technology sector.

Our December Global Market Perspective showed this chart and said:

SoftBank’s stock price followed the tech sector higher until February 2021, then reversed and underwent a three-year nosedive of nearly 60%. For investors, the regret phase is now coming on fast. Last month, the Financial Times published an image showing the lifetime performance of 25 SoftBank-funded stocks, including former market darlings like Alibaba, Uber, DoorDash and Fitbit. Just three of the 25 companies showed a positive return since their IPOs, and 12 of them were down more than 50%.

And here’s a headline from Nov. 9 (AP):

Japan’s SoftBank hit with $6.2B quarterly loss as WeWork, other tech investments go sour

Notably, SoftBank’s WeWork – once the most valuable U.S. startup – filed for Chapter 11 bankruptcy protection in early November.

The Financial Times called WeWork “one of the worst venture capital investments in history.”

By contrast, the FANG+ index approximately doubled in value in 2023. However, the group performance of the well-known big cap tech names early in 2024 has been a different story (Markets Insider, Jan. 4):

It’s been a bleak start to 2024 for the Magnificent 7 tech stocks after crushing the market last year

And, as you may be aware, those Magnificent 7 stocks have mainly been holding up the entire market.

In other words, if those big cap tech names crater, the main indexes are likely going to crater too.

At this juncture, you may want to keep a close eye on the stock market’s Elliott wave pattern. You may do so by following the link below.

Read the Just-Published January Global Market Perspective …

… you’ll see and read our latest charts, analysis and forecasts for global stock indexes, bonds, gold, silver, forex, cryptocurrencies, energy, global economies and much more.

Regarding gold, the January GMP says:

A close below [this level] will generate near-term options for the wave pattern.

Learn exactly why that price level is important.

Also, find out why we reference “the oldest market indicator” for the Dow Industrials.

Follow the link below to tap into our latest global financial insights now.