Hey, investors. Mark Galasiewski here.

Indian stocks sold off hard after the results of the 2024 general election were announced on June 4. Conventional observers say that the market was disappointed that the ruling Bharatiya Janata Party failed to win a majority.

But from our perspective, the long-term price action was ripe for a correction after a long impulsive advance. Let me show you how our analysis, published on May 31 (just two trading days before the election results were announced), correctly anticipated the selloff.

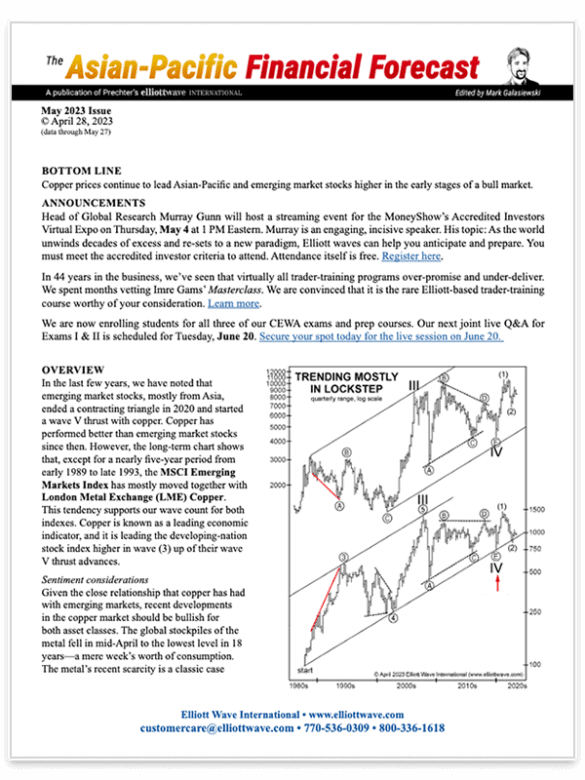

Our analysis highlighted the Nifty Next 50 Index, which is an index of the 50 largest Indian stocks, after those in the Nifty 50 Index. We noted that the junior Index had been soaring in recent months, rising 63% from the October 2023 lows, and had displayed its impulsive pattern more clearly than the Nifty itself.

We also noted that, within that advance, momentum had begun to wane. So we said that investors should be on the lookout for a correction near term. Two trading days later, the market sold off hard once the election results were released.

From our perspective, the market had rallied impulsively right into the election, and the selloff was a classic example of the market buying the rumor and selling the news.

But from an Elliott wave perspective, what degree or size is the correction? And therefore, how long is it likely to last?

To see the answer to that question, read the June 2024 issue of Asian-Pacific Financial Forecast or Global Market Perspective.

Sensex and Nifty 50: Don’t Get Too “Disappointed” (Video)

Mainstream analysts are blaming the recent selloffs in Indian stocks on the surprising result of India’s recent election. While many Indian investors feel disappointed, watch as our Global Market Perspective contributor Mark Galasiewski explain how this was a classic example of “buy the rumor, sell the news.”

It’s easy to look BACK at a market and say, “That was so obvious!”

Everything is “obvious” in retrospect. But in real time, few investors have the tools to confidently sell at a top or buy at a bottom.

Our subscribers have those tools. We use Elliott wave patterns of market psychology, sentiment measures and other supporting technical tools.

And every month, we confidently look ahead in 50+ of the world’s biggest markets in our Global Market Perspective.

Looking for Asian-Pacific market insights only? Then try our Asian-Pacific Financial Forecast. (Focus on India, China, Australia and more.)

Asian-Pacific

Financial Forecast

$37

per month

At the beginning of each month, you get a 30-60 day look ahead at the markets. With insightful charts and text, this publication lays out expected trends and turns in this region.

Coverage includes the Nikkei 225, ASX200, Hang Seng, Shanghai Composite, S&P Nifty, SENSEX, Strait Times Index, MSCI Singapore, MSCI Taiwan, TAIEX, KOSPI and more.

Global Market

Perspective

$77

per month

Gives you clear and actionable analysis and forecasts for the world’s major financial markets.

Get insights for the U.S., European and Asian-Pacific main stock indexes, precious metals, forex pairs, cryptos (including Bitcoin), global interest rates, energy markets, cultural trends and more.