Update on astonishingly speculative mindset

The persistence of financial optimism since the broad U.S. stock market topped in January 2022 has been remarkable.

And in Elliott Wave International’s view, this should serve as a cautionary tale rather than a sign of a new bull market. We could be wrong about that. However, if you review a free report just released by Elliott Wave International which shares some key investor insights from our Global Market Perspective, you may reach the same conclusion as us. You can download a copy by following the link below.

Right now, let me share with you just one of the many indications that financial optimism may be nearing a peak.

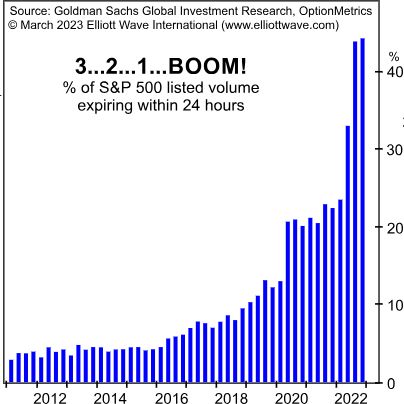

Back in March, our monthly Global Market Perspective mentioned that a segment of traders have been using the market to make casino-style bets. Here’s a chart and commentary:

More than 40% of the S&P 500’s total options volume occurs in what is known as “zero-day-to-expiry” options, or 0DTE. These are options that expire within 24 hours, making them highly sensitive to changes in price because of the lack of time premium. In 2022, the CBOE and CME expanded existing options so that there are now S&P options that expire each day of the week, allowing investors to speculate using these ultra-short-term instruments.

By Sept. 14, Reuters had this headline:

New ETF looks to tap hot market for zero-day options

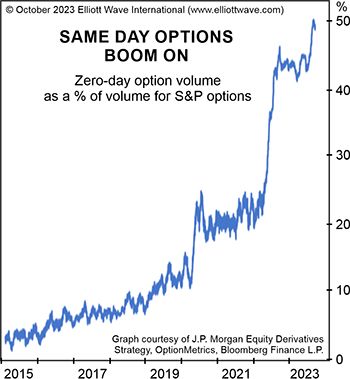

Indeed, since our March analysis, the “casino” action has ramped up several notches. Here’s an update from our November Global Market Perspective:

Back in March, readers will recall that [we] showed that 0DTE options surpassed 40% of the total U.S. options market. By early May, there was no mistaking the importance of this trend as the little guy was piling in. The Economist called 0DTE options the “latest fad” among retail investors and noted that they were “Losing Billions” in the process… This chart from the Financial Times on September 25 shows the boom rolling higher.

Now, here’s the latest headline (Bloomberg, Nov. 21):

Zero-Day Mania Expands With Cross Asset Flare

Remember, you can download EWI’s new report “Essential Investor Insights from the November Global Market Perspective” for free by following the link below.

Free Report

Get Key Insights from our Latest Global Market Perspective

It wasn’t easy for us to distill 100+ pages full of charts and forecasts for 50-plus+ global markets into a handful of “essential insights.”

But we gave it a shot. We picked out 4 which deserve your attention now.

Our new, FREE report “Essential Investor Insights from the November Global Market Perspective” gives you 3 excerpts from the new, November issue of our flagship global forecasting service, PLUS 1 insight from the October issue.