The Fed finally cut rates last September, but yields across the spectrum have done nothing but rise since then, snubbing their noses at the alleged Fed brain trust. Global Rates & Money Flows has been near-perfect in forecasting rates for the past five years. Read this recent excerpt:

The driver of Elliott wave patterns is crowd psychology and herding behavior. That is the same across all markets. However, bonds, bills and currencies do not act the same way as the perpetual 5-up, 3-down of the stock market. These are what might be referred to as “bounded” markets. The U.S. Treasury 10-year bond yield is not on a perpetually upward or downward trajectory. Bounds exist. Nobody can rule out bond yields spiking to 50% or 100%, but it would be highly unusual and there is no natural trend like there is in the stock market. Up until a few years ago, most people thought that zero was the lower bound for bond yields. That changed when many bonds traded with negative yields. Nevertheless, the point remains that there is not a long-term 5-3 path in bonds.

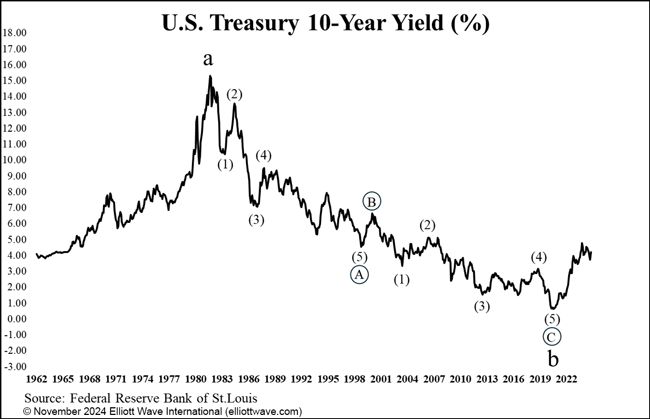

Instead, bond yields and interest rates likely move in high-degree 3-3 patterns. This is not to say that bond yields cannot move to extremes. Far from it as negative yields testify to.

The long-term downtrend in the U.S. Treasury 10-year bond yield from 1981 to 2020 could be labeled as a zigzag Cycle degree wave b. That would mean wave c up in yield is only just getting going:

How high can rates get in wave c? Let’s just say that it rhymes with “beans.”

Global Rates & Money Flows editor Murray Gunn is a 30-year veteran of global bond and money markets. Get institutional-level coverage of worldwide interest rates, debt and money by following this link.

Speaking of Elliott wave patterns, read the definitive text on the topic – FREE. Follow this link to access the online version of Frost & Prechter’s Wall Street bestseller, Elliott Wave Principle: Key to Market Behavior – now.