A few headlines chronicle developments:

- China’s consumer prices suffer biggest fall since 2009 … (Reuters, Feb. 7)

- In China, Deflation Tightens Its Grip (Wall Street Journal, Feb. 8)

- China is the only major economy dealing with deflation (Business Insider, March 1)

Yes, in addition to a grim looking real estate sector and an overall economy which has lost some of its vitality, China has been dealing with falling consumer prices for several months.

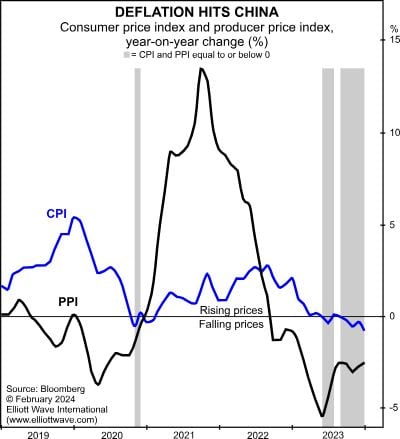

The Elliott Wave Theorist called attention to this back in February with this chart and brief commentary:

The PPI and CPI in China have turned negative as deflation sweeps the country.

By contrast, most of the talk in the U.S. has been about just the opposite. The New York Post summed it up on April 25:

… inflation remains sticky …

So, the farthest thing from the minds of most observers in the U.S. is deflation.

Yet, as Elliott Wave International sees it, it’s quite possible that the U.S. could wind up suffering from the same deflation problem as China.

The March Elliott Wave Theorist said the real estate woes in China could be a sign of what’s ahead for the U.S.:

China is offering a preview of things to come. The country’s stock and real estate markets are more than two years ahead of those in the U.S. Housing prices there have declined month-over-month for 28 out of the past 31 months. That persistent trend offers a clear picture of what is about to hit [in the U.S.].

Elliott Wave International’s global analysts posit that the financial optimism which sent U.S. home and stock market prices to record levels is unsustainable.

High-profile figures in the world of finance have also expressed concern, including the head of the largest bank in the U.S. (CNN Business, April 12):

Jamie Dimon says chance of a bad economy is ‘higher than other people think’

And here’s the view of a well-known investor (CNBC, April 23):

Billionaire investor Leon Cooperman: We’re heading into a financial crisis in this country

Get insights into what the next financial crisis may look like and what steps you may want to take to protect yourself by following the link below.

Real Estate Woes and Price Deflation Hit China: Is the U.S. Next?

China offers a preview of what’s ahead for the U.S.

Are you ready for the next financial crisis? History shows that they take most people by surprise. One big clue for what may be ahead for the U.S. is unfolding in China right now. Here’s what I’m talking about.