“Ginormous” is a word used informally but it’s a real word (look it up). Moreover, it describes the size of China’s real estate market ($90 trillion). Yet, major losses are mounting in the world’s largest property market. Could the second largest (U.S.) be next? Our February Elliott Wave Financial Forecast warns of “contagion”:

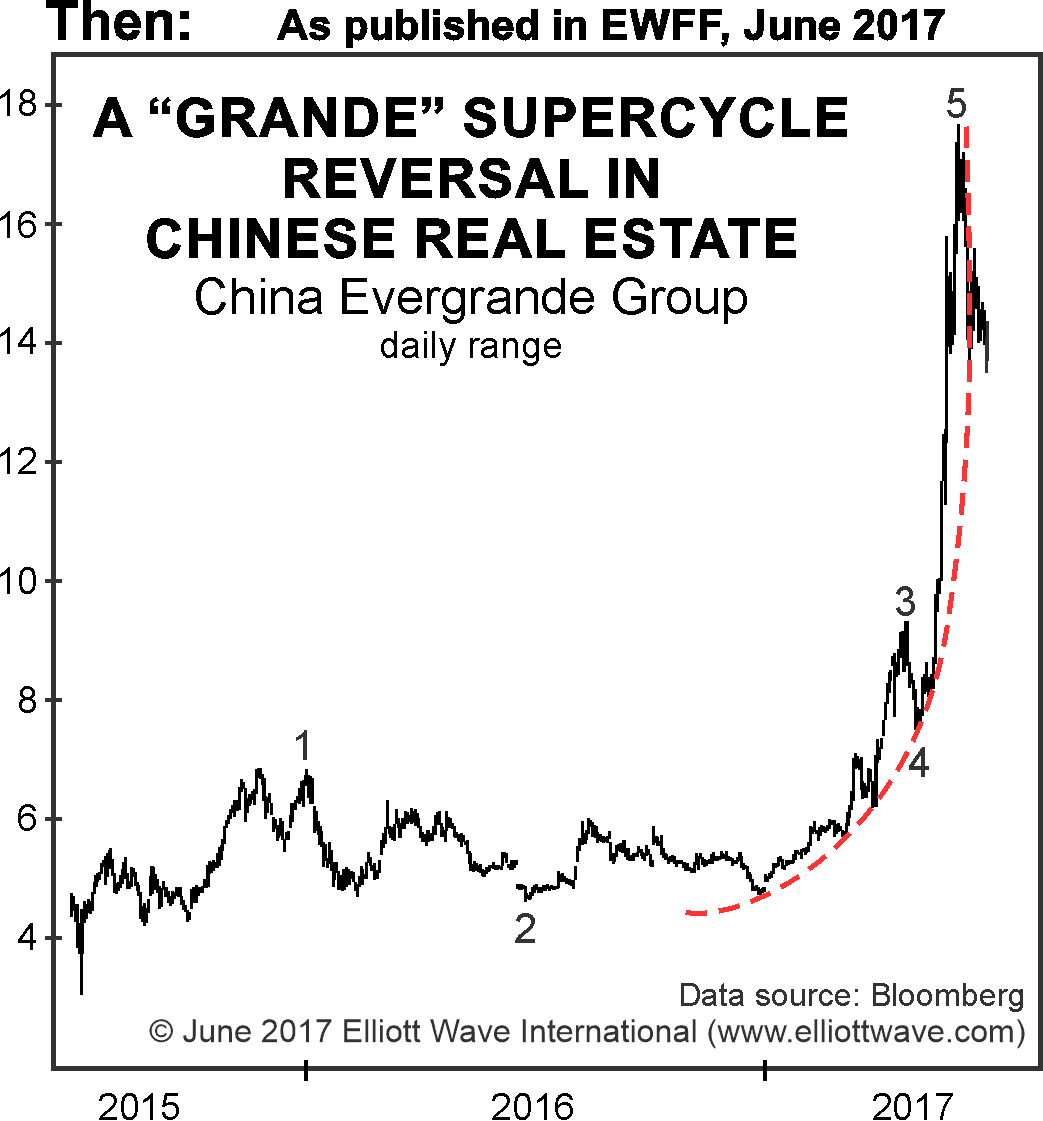

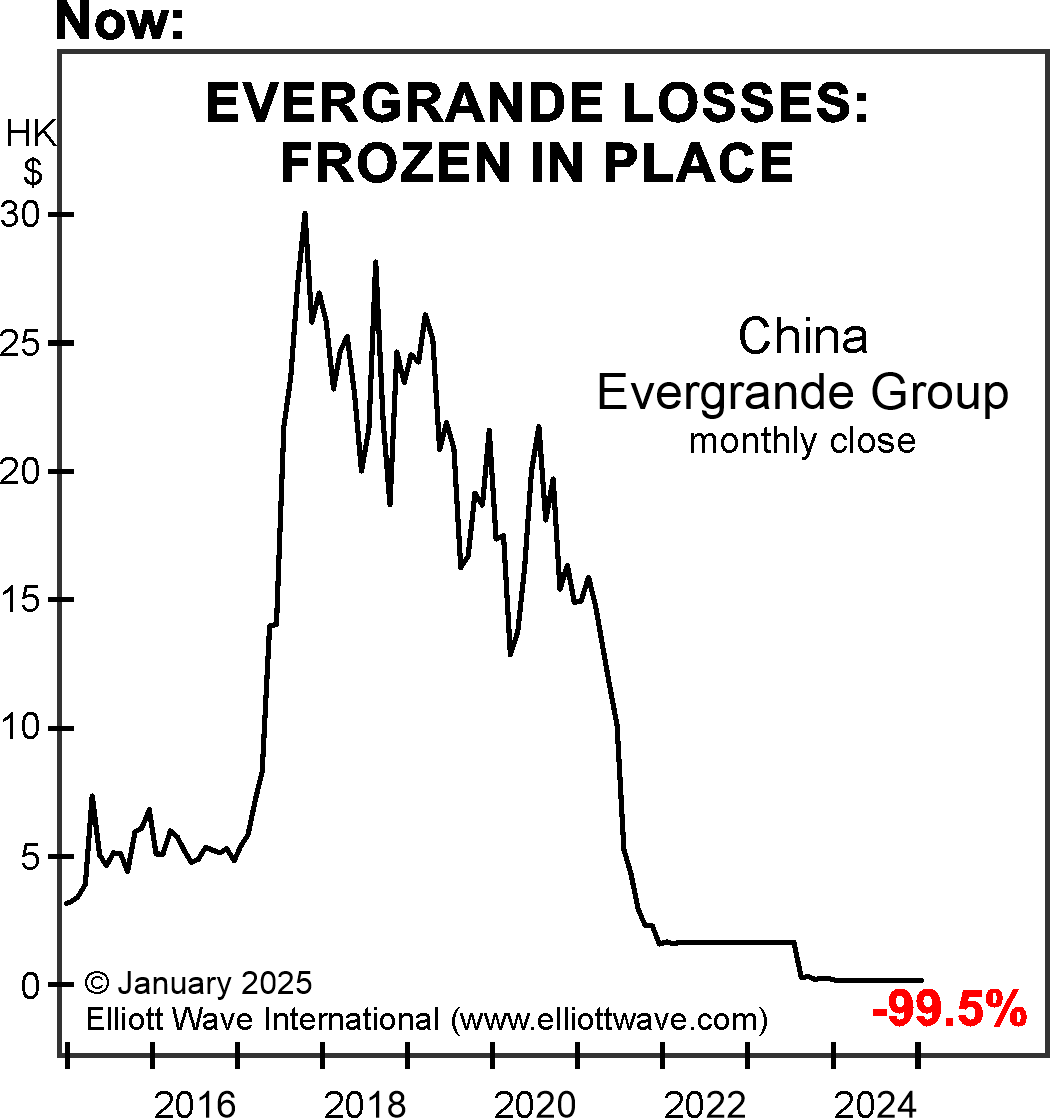

When it comes to describing China’s real estate boom, there is no better symbol than China Evergrande Group, which was once the largest real estate development firm in China. These charts show the end of a story that began in 1996, when China Evergrande was founded:

In July 2017, EWFF spotted Evergrande’s emerging troubles and stated, “China Evergrande, and China real estate in general, are in topping territory.” From its all-time high at $31.55 in October 2017, the stock declined to just $1.65 in March 2022, when trading was halted. It traded again briefly in late 2023. As the chart shows, however, China Evergrande’s shares are once again frozen, this time at a new low of $0.163.

On a year-over-year basis, [Chinese] home prices declined by more than 5% in December, which is in line with the prevailing downtrend.

At this late juncture, there are churning market segments where one can catch a glimpse of the potential for global contagion.

If you’re thinking “deflation” know that we are too. Get our complete analysis via our flagship services by following this link.

You won’t see analysis like this in the financial media news. Get unique insights delivered straight to your inbox – FREE.